Will Trump relief orders on payroll taxes, unemployment help you?

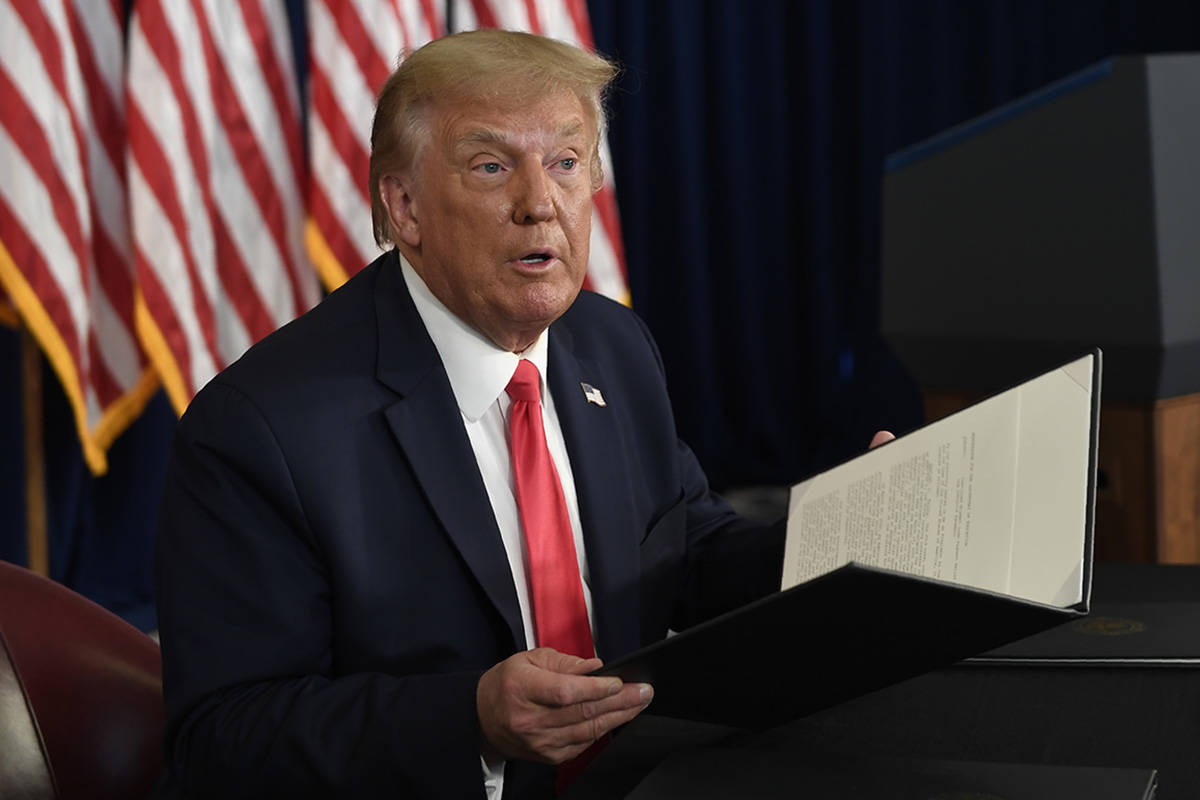

With Congress at a stalemate over the next stimulus bill, President Donald Trump issued four orders over the weekend to provide relief for those who are struggling in the Covid-19 recession.

The orders call for:

— A $400 extra unemployment benefit through Dec. 6.

— Suspending payroll taxes for those who earn less than $104,000 from Sept. 1 through Dec. 31.

— Extending the automatic forbearance given to most federal student loans through Dec. 31.

— Considering whether to pause evictions and potential funding sources for distressed renters and homeowners.

Here’s a breakdown of Trump’s relief orders and what they could mean for you.

Extra $400 weekly unemployment benefit

Trump issued a memo calling for a $400 weekly supplement to state unemployment benefits through Dec. 6. The amount is less generous than the $600 benefit in the CARES Act that expired in July, but more than the $200 Republicans proposed in the HEALS Act.

The order says the federal government would pay $300 a week, while states will have to chip in the other $100. Trump says states that can’t afford the additional $100 would be able to apply for the federal government to pick up the entire bill.

But the additional payment could be difficult to implement for several reasons. Because the funding wasn’t approved by Congress, states would need to set up new systems to distribute the money, which could take months, as CNN explains.

The funds would come from the U.S. Department of Homeland Security’s Disaster Relief Fund, which is typically used for natural disasters like hurricanes and tornadoes. The Washington Post reports that the $44 billion allocated in the order would cover less than five weeks of payments for 30 million people collecting benefits.

Will it bring you relief? Given the difficulty states would face implementing a new benefit system, don’t count on receiving an additional $400 a week anytime soon. Trump’s order is also likely to encounter legal challenges.

Even if Congress reaches an agreement to extend benefits, states will need time to reprogram their systems. It’s unlikely that you could see additional unemployment money beyond your state’s weekly benefit before Labor Day.

Should you take advantage? There’s no additional benefit to take advantage of for now, and you probably can’t afford to wait for extra benefits to come through.

If your state benefits are expiring, apply for an unemployment extension through Pandemic Emergency Unemployment Compensation, or PEUC, funds. It’s federal money, but it’s based on your state benefit. With the average state benefit around $300, it will probably be significantly lower than your previous benefit. In the meantime, focus on landing a bridge job, which is basically any work that can help you survive, even if it’s not in your field.

Payroll tax deferral

Trump directed the U.S. Treasury to stop collecting payroll taxes for people earning less than $4,000 every two weeks, or about $104,000 per year, from Sept. 1 through Dec. 31.

The order could mean bigger paychecks for those who are still employed. Most workers could hang onto the part of their pay that usually goes toward Social Security and Medicare, which amounts to 7.65% of pay for most people.

But while the president can push back the due date for taxes during a declared disaster, he can’t change the tax law without Congress. So unless the next stimulus bill includes a payroll tax cut, those taxes will need to be paid back.

Will it bring you relief? Many tax experts say that employers should continue withholding payroll taxes, so it’s unclear if this order would actually put more cash in your pocket in the short term. Even if your employer stops withholding payroll taxes from your paycheck, though, it’s important to remember that those funds are just a loan for now.

Should you take advantage? Unless Congress actually approves a payroll tax cut, assume you’ll need to pay back any extra money you receive. DO NOT spend this money.

If your employer doesn’t withhold it, your best option is to put it in a high-yield savings account. You can pocket a few extra bucks on interest, and you’ll be prepared to pay it back if and when the bill comes due.

Student loans

Trump’s order suspends payments and interest on most federal student loans through Dec. 31, extending the automatic forbearance provided by the CARES Act for another three months.

However, the order doesn’t extend all of the CARES Act student loan relief measures. For example, the CARES Act temporarily halted collections on delinquent loans. It also told the Department of Education to treat each suspended payment as one of the 120 on-time payments needed for the Public Service Loan Forgiveness program. Trump’s order doesn’t mention either of these provisions.

Will it bring you relief? If your student loan was put in forbearance under the CARES Act, you probably will get an additional three-month hiatus on your payments. Trump does have the authority to direct the Department of Education to defer or cancel student loan payments.

However, it’s important to note that this order only allows you to defer payments and avoid interest through the end of 2020. The president’s order does not forgive any student loan debt.

Should you take advantage? If you need the extra money for bills because you’ve lost income, by all means take advantage. Putting your payment toward credit card debt that’s accruing interest can be a smart move. Or you may want to stash your payments in your emergency fund.

But if you can afford the payments and your finances are in good shape, consider continuing your payments as usual. Your entire payment will go toward the principal balance.

Evictions

Trump’s order on evictions doesn’t offer any specific relief measures.

Instead, it directs the secretary of Health and Human Services and the CDC director to “consider whether any measures temporarily halting residential evictions of any tenants for failure to pay rent are reasonably necessary to prevent the further spread of COVID-19.”

It also says the secretary of the Treasury and secretary of Housing and Urban Development should “identify any and all available Federal funds to provide temporary financial assistance to renters and homeowners who, as a result of the financial hardships caused by COVID-19, are struggling to meet their monthly rental or mortgage obligations.”

Will it bring you relief? Without any specific rules or funds in place, you shouldn’t count on eviction protections. Even the CARES Act eviction moratorium that expired July 25 only covered about one quarter of renters.

Should you take advantage? There’s nothing to take advantage of at this point. However, even if you’re covered by a state or local moratorium or a broader federal moratorium passes, we’d suggest prioritizing your rent above your other bills. Try negotiating with your landlord and applying for emergency assistance if you’re struggling to pay.

Those moratoriums will expire at some point, and you don’t want several months of unpaid rent hanging over you on top of your current bills.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. She writes the Dear Penny personal finance advice column. Send your tricky money questions to DearPenny@thepennyhoarder.com.

This was originally published on The Penny Hoarder, a personal finance website that empowers millions of readers nationwide to make smart decisions with their money through actionable and inspirational advice, and resources about how to make, save and manage money.