Housing experts differ on recession

Las Vegas home builder Tom McCormick, who said the economy is not in a recession, differed Thursday from his two fellow panelists, both bankers, at a housing market seminar presented by Sullivan Group.

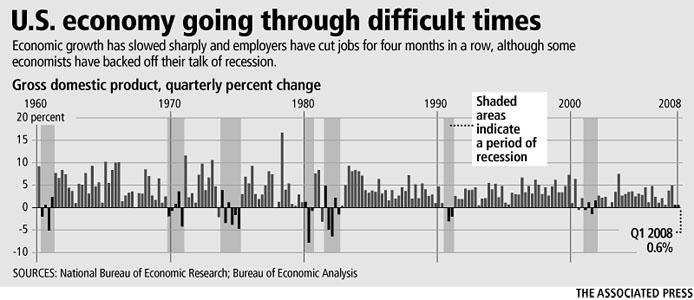

A recession is defined by six months of negative growth in gross domestic product, which we haven't seen, McCormick noted.

"This is as much about psychology as anything," he told a room full of home builders, mortgage lenders, appraisers and other housing industry professionals at Four Seasons. "We see a lot of activity right now. We see an increase in sales. These things are not seen in a recession."

The GDP might not indicate a recession, but job growth has turned negative and consumer confidence is at its lowest level since 1991, when the nation was engaged in the Gulf War and going through a recession, said Tim Sullivan, president of San Diego-based Sullivan Group Real Estate Advisers.

"If it walks like a duck and talks like a duck, some people would say it's a duck," he said. "What's in the mind of consumers? They're frightened. There's pain."

There are some rays of hope in the housing market, Sullivan said.

Interest rates remain near a 40-year low, personal savings are up and the "reset" mind-set is building among both home and land owners.

"Owners are resetting their expectations of values," he said.

The bottom of the market is closer than ever, price cuts are generating interest and sales have increased in the spring, Sullivan said, but it'll probably be next year before "we truly hit bottom."

The housing market has entered a new world, said Ken Perlman, vice president of Sullivan Group. It has already undergone big adjustments and it's likely to continue, he said.

Median prices of new homes in Las Vegas are around $260,000, about where they were in February 2004, Perlman reported. Attached housing has declined 22 percent from a year ago to $214,900, partly due to the slowdown in luxury condo sales.

The good news is builders have pulled back on permits, Perlman said. Annual permit activity is expected to total about 10,000 this year, the lowest number since 1986.

Speculative inventory, or new homes built without a sales contract, is dropping. About 35 percent of the new-home subdivisions Perlman surveyed had no speculative inventory.

News from the "ground" is that sales center traffic has increased, buyers are coming back and they're serious, Perlman said. Nearly 90 percent of subdivisions surveyed are offering buyer incentives valued at about $18,700.

"Certainly it's about demand," said Kev Zoryan, executive director of Morgan Stanley Merchant Banking. "I think what's interesting is the amount of empirical data we collect to see how prices have changed at every end of the spectrum. At the end of the day, it's the sentiment that's driving things right now."

Zoryan said there's reluctance among banks to make loans, "to stick your neck out and make big bold moves." He's seeing a "serious dislocation" of confidence in the credit market that must be re-established.

Terry Jones, vice president of AmTrust Bank, said a key fundamental change in markets such as Las Vegas, Phoenix and Florida is property valuation.

"Our biggest challenge is this unknown value of property. We have to rely on valuation for our ability to advance loans and there's not a lot of confidence in appraisals right now," Jones said.

McCormick, president of Astoria Homes, said he's received offers for some of his lots that are way beyond their value. He's encouraged by land in the Mountain's Edge master-planned community that sold for close to $300,000 an acre.

"I've got public (home) builders calling me and they want to buy lots, but not until they're ready to pour concrete," he said. "We're going to make money by selling lots at a high return."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.