Home sales show signs of life

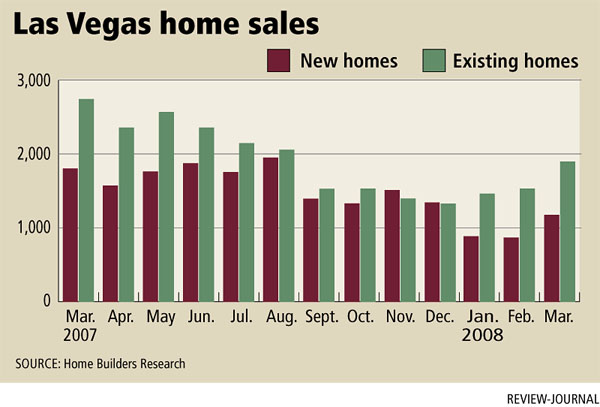

While sales of both new and existing homes in Las Vegas trail last year's numbers, they're picking up momentum, a local housing analyst said Tuesday.

New-home sales increased for the third straight month to 1,146 in March, though the first-quarter total of 2,296 is down 44.1 percent from the same period a year ago, Dennis Smith of Home Builders Research reported.

The total includes 188 high-rise condo units, led by 102 closings at Palms Place at an average price of $668,130.

Median price for all types of new homes sold in March was $278,630, a 9 percent decline from a year ago.

The resale segment continues to improve with 1,899 recorded closings, the fourth straight monthly increase. For the first three months of the year, existing home sales are off 34.4 percent at 4,916.

Nationally, the National Association of Realtors reported Tuesday that sales of existing single-family homes and condominiums dropped by 2 percent in March to a seasonally adjusted annual rate of 4.93 million units.

The median price of a home sold last month in the U.S. was $200,700, a decline of 7.7 percent from a year ago and the seventh consecutive year-over-year price drop. It was also the second biggest decline following a record 8.4 percent drop in February. These records go back to 1999.

"Like I've been saying, it looks like we're close to the bottom," Smith said. "I'm talking about sales. The price is not a reflection of whether the market is turning around. It's a lagging indicator. You have to have better demand."

Resale prices are being dragged down by foreclosures and short sales, he said. The $230,000 median in March is down 19.3 percent from a year ago.

"Even if more than half of the resale total are foreclosures or short sales, so what? The most important thing is to get rid of the excess inventory and that is what's happening, although the lenders could step things up a little bit," Smith said.

"We know of instances where short sales are taking months to get responses from the selling banks. Are they holding offers while waiting for higher offers? Are they understaffed? Whatever the reason, they need to speed up the process."

David Vaughn of Las Vegas said he made an offer for the full amount of $229,900 on a foreclosure home advertised in the Review-Journal by Countrywide Home Mortgage. That was 12 weeks ago.

"I called Countrywide," he said. "All the financing is in place. I can't get them to even talk to me."

Las Vegas-based SalesTraq reported 1,076 new-home closings in March, a 40.3 percent decline from the same month a year ago. The median new-home price has dropped 10.2 percent to $276,292.

Existing home closings were down 62.8 percent in March to 980 and their median price dropped 13.9 percent to $247,000.

SalesTraq President Larry Murphy tallies foreclosure sales separately from existing sales. He showed a record 2,468 foreclosure sales in March, nearly five times more than March 2007. Their median price was only $225,165.

The big news is the price decline, said Debi Averett, founder of Housingdoom.com blog site.

Prices are still falling like a rock, but the drop in home sales isn't as steep as the market shifts from "plummeting" to "stagnating," she said.

"Sadly, lower prices means more foreclosures and more foreclosures means lower prices," Averett said. "Even this isn't bad news for everyone. There's a lot to be said for affordable housing. It's just sad that getting Las Vegas back to that world is such a painful process."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491. The Associated Press contributed to this report.

WORD OF WARNING

NEW HAVEN, Conn. -- An influential economist who long predicted the housing market bubble cautioned Tuesday that the slump in the housing market could cause prices to fall more than they did in the Great Depression and bailouts will be needed so millions don't lose their homes.

Yale University economist Robert Shiller, pioneer of the widely watched Standard & Poor's/Case-Shiller home price index, said there's a good chance housing prices will fall further than the 30 percent drop in the historic depression of the 1930s. Home prices nationwide already have dropped 15 percent since their peak in 2006, he said.

"I think there is a scenario that they could be down substantially more," Shiller said.

"Basically we're in uncharted territory. It seems we have developed a speculative culture about housing that never existed on a national basis before."