Bleak reading for the valley

Not since the months following the terrorist attacks in September 2001 has Southern Nevada’s economic picture looked so bleak.

All 10 data series contributed negatively to the Southern Nevada Index of Leading Economic Indicators in January, the first time that’s happened since the index was established in 1990, UNLV economist Keith Schwer said.

In November 2001, every series except gallons of gasoline sold were negative.

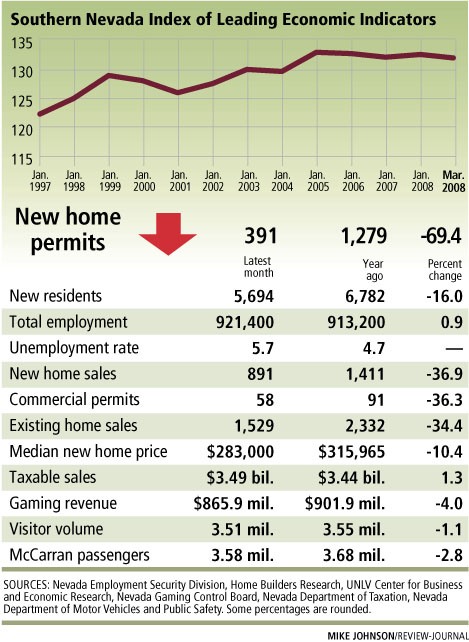

The March index, based on January’s data, showed a sharp decline to 131.94, compared with a record high of 133.93 the previous month. The index stood at 133.17 in March 2007.

"There was always something that would run against the tide, even when it was jumping around," Schwer said of the economic index. "It seems very clear we’re getting a clear signal that the economy is headed toward recession."

Though it’s far from clear when a one-month drop foretells a recession, Schwer thinks the softening in Nevada’s labor market supports his call.

Southern Nevada’s total employment grew 0.9 percent to 921,400 and the unemployment rate increased a full percentage point from a year ago to 5.7 percent.

Schwer said job growth is still a positive for Las Vegas. The index excludes employment data because it’s a "coincidence indicator," he said, peaking and dipping with the general economy.

The index, compiled by the Center for Business and Economic Research at University of Nevada, Las Vegas, is a six-month forecast from the month of the data, based on a net-weighted average of each series after adjustments for seasonal variation.

The accompanying Review-Journal chart includes several of the index’s categories, along with data such as new residents, and employment and housing numbers, updated for the most recent month for which figures are available.

The biggest declines continue to be in construction activity, with new home permits down nearly 70 percent and commercial permits down 36.3 percent. Population growth slowed to 5,694 new residents in February, down 16 percent from the same month a year ago.

Clark County gaming revenue fell 4 percent in February to $865.9 million, visitor volume slipped 1.1 percent to 3.51 million and passengers at McCarran International Airport dipped 2.8 percent to 3.58 million.

Strong construction activity on the Strip has kept the decline in residential construction from pinching off economic expansion for some time now, Schwer said. Difficulties arising from stockpiling of residential building permits in late 2007 and the subsequent shortfall this year have created a small problem interpreting the data, he said.

"Calling turning points in the business cycle is difficult at best," Schwer said. "The early calls of a recession in 2006 and 2007 have not come to pass and were, in the final analysis, hard to separate from shots in the dark."

Tax rebates and other spending upturns should help moderate the downslide, the economist said. However, getting the housing market back on its feet will not come quickly.

"Indeed, it is possible that we may not experience much of a recession or depression, but the subsequent recovery may not be much either," Schwer said.

John Restrepo of Restrepo Consulting Group said he doesn’t think the tax rebate will have much of an effect on the economy because most people will use it to pay down debt.

The other component of job growth is wages, Restrepo said. The average wage in Las Vegas grew from $24,500 in 1992 to $41,400 in 2007, but adjusted for inflation, it’s about $28,000, he said.

Meanwhile, the cost of living in Las Vegas is 10 percent higher than the national average, driven by housing, utilities, transportation and health care, Restrepo said.

"We’re doing better than other places, but we’ve found that we were not immune to the laws of economics and gravity, which we thought we were," he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.