Casino jackpot winners should be prepared for tax consequences

Imagine sitting at your favorite slot machine inside your favorite local casino when the big one hits.

The bells and whistles go off, the lights pulsate and people you don’t even know surround you with congratulatory pats on the back and high-fives.

It must be a fabulous feeling — one I’ve never experienced.

A casino worker is summoned to pay out your jackpot winnings, and it hasn’t even occurred to you that before you walk out the door with your winnings, you’ll need to square up with the Internal Revenue Service.

Before you even set foot in a casino and insert your money into the machines, it’s wise to develop a strategy to keep as much of that money as possible from the IRS.

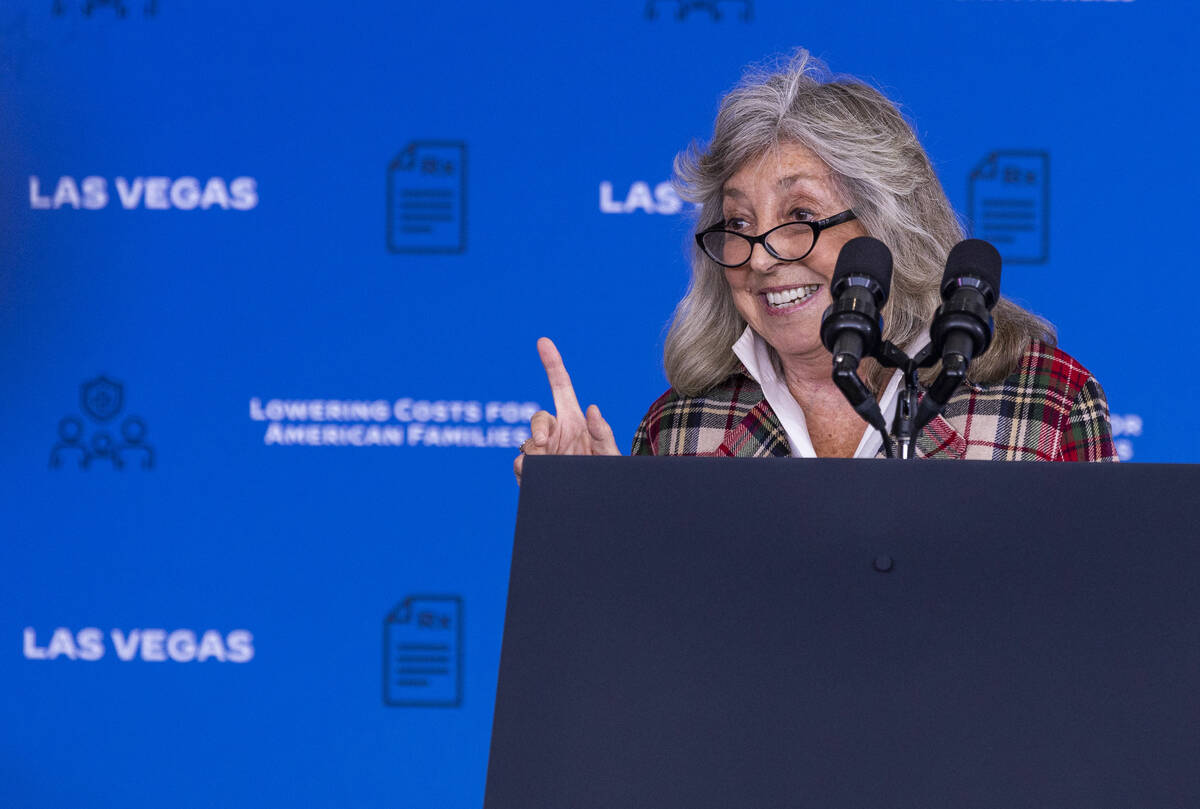

A couple of weeks back, I reported that Rep. Dina Titus, D-Nev., is leading an effort to increase the jackpot threshold from $1,200 to $5,000 as the minimum amount necessary to report winnings to the IRS and receive a W-2G form from the casino. After that column published, I received several emails from readers asking for details on what to do to protect themselves from the tax collector should the big jackpot hit.

I reached out to Dan Randle and his wife, Paula Mills, of Dan Randle and Associates, a Las Vegas-based company that advises people on tax collection issues and IRS audits.

Randle, a former IRS agent in Southern California, has seen things from both the perspective of the player and the tax collector and was kind enough to be interviewed during the extremely busy tax season, with returns due April 18.

Most people understand that while casino winnings are considered personal income and must be reported to the IRS, the total amount of casino losses can be subtracted from winnings to calculate the total tax burden.

So how exactly do you do that?

Get a loyalty card

The first piece of advice from Randle and Mills is to be sure to register for the casino’s loyalty club program and use the card whenever you play.

Sure, you’ll get all the company’s promotional come-ons, and it can be unnerving to know somebody out there knows how much you put into a slot machine on a regular basis. But if you hit the big one, you’ll be grateful for having signed up.

“If players are participating or continuing to participate in one casino or in one of the chain casinos, then they should be registered to a player’s card or notify a pit boss or manager who knows how long they’ve been there,” Randle said.

“If they work with a player’s card, it’s easy to find out what was gambled.”

“That’s the information they should be providing their preparer at the end of the year,” said Mills, a registered agent. “When they put that on their Schedule A or however the preparer documents it, they have a good record of wins and losses. They don’t just make a guess. The IRS is going to look for that documentation.”

Withhold 35 percent to 40 percent

Randle said when a jackpot hits, a casino employee will circle back with paperwork to make sure the IRS gets its rightful share.

“Most casinos will keep a very accurate record because they want to be able to service their customers,” he said. “But they’ll often ask the question: How much do you want to withhold? That’s the wrong question. That’s because at the end of the year, if a person has won $300,000 — or whatever the number — and they do not withhold the proper amount, they’re going to get stuck down the road with a tax bill.”

He said if you ask 10 different advisers, you’ll get 10 different answers on how much to withhold. His recommendation: at least 35 percent of winnings and up to 40 percent.

“It’s going to make a little bite (of the jackpot) to do that initially, but it’ll save a bigger bite down the road,” he said.

Paper trail

When playing table games, Randle suggests turning the card over to a pit boss so that the length and level of play can be monitored. That can come in handy should a player score a big table win.

For sports bets, keeping track of betting transactions is easy because the casino issues a bet slip on every wager. It’s a little more complicated with mobile wagering, but companies are required to keep a record of play. Losing tickets will show the amount wagered and when and where the bet was placed. But Randle cautioned that the IRS is wary of people who collect losing tickets and try to use them to justify gambling losses.

“When I was with the IRS, we would not accept a ticket with a footprint or mustard on it,” Randle said.

If a player wins and hasn’t been using a loyalty card, the IRS will still accept entries in a journal explaining the amount of money wagered, the date, time and place of play and all winnings as well as losses.

Establishing a consistent pattern of play can also be helpful.

Mills said she had a client who routinely withdrew money from an ATM in a casino and kept track of all ATM fees as well as the withdrawals. When it came time to file a tax return, the player, an off-duty casino worker, held all the ATM receipts to justify losses against wins.

“He supplied his bank statements that showed that when he finished work each day, he withdrew a couple of hundred dollars, he paid the fee at the ATM where he worked and we supplied bank statements for 12 months because one year was under scrutiny,” Mills said. “We had his journal. He didn’t have a player’s card, even though he worked at that casino. We were able to show he paid an ATM fee and that it was at an ATM at the premises of where he was playing and a consistent amount for almost an entire year and that was deducted.”

“It helped that he withdrew the same amount from the ATM all the time. We wish we could get a half-dozen more clients like that.”

Randle said he worked with a gambler who liked to bet on horse racing. He said every losing ticket he had was neatly stapled to that day’s racing form, which showed the date and time of the race, the track and the number and names of the competing horses.

Randle and Mills said tax issues involving residents of foreign countries are a little more complicated because not every country has a tax collection agreement with the United States and exchange rates occasionally come into play.

He suggested that international players know their nation’s tax collection status before starting play.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.