Construction jobs bounce back in Las Vegas Valley

Before the economy crashed, local developers would pitch “Cinderella stories” to lenders.

They would talk up the other new buildings poised to come in nearby and the foot traffic they would all generate, Las Vegas developer Rich Worthington said.

“I’m sure bankers would call it something else: a nightmare come true,” he said, as projects were abandoned all over town during the recession and job losses soared.

Las Vegas had one of the biggest construction booms in America during the mid-2000s and one of the most devastating crashes afterward. Today, as the economy improves and population expands, builders have reached their busiest levels in years as they put up apartments, warehouses, housing tracts and other projects.

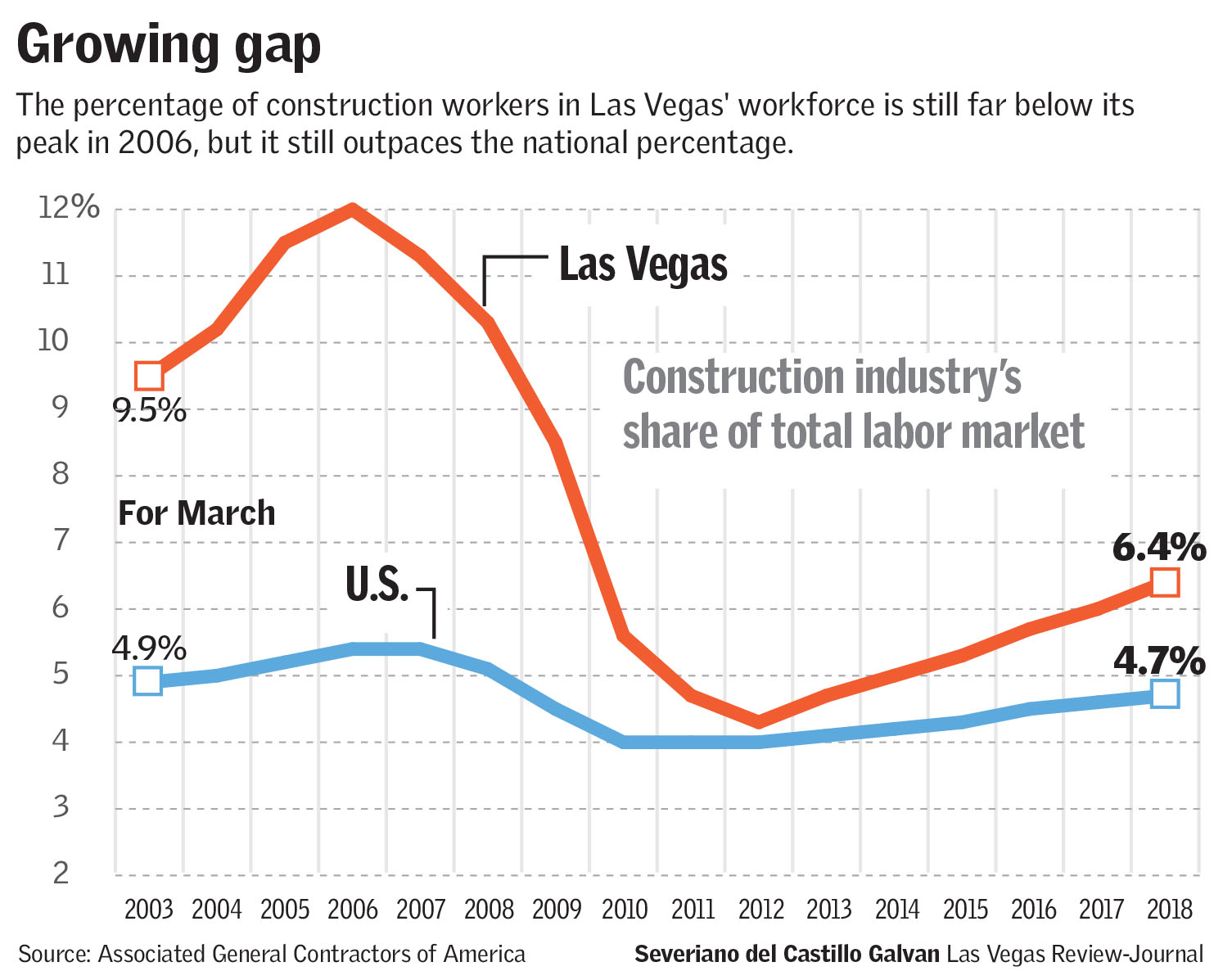

Overall, construction activity — and the local economy’s dependence on it — is far below the peaks of the easy-money bubble years, but Las Vegas still leans more on the industry than the U.S. as a whole.

Despite the higher-than-average numbers, a mix of bankers, developers, economists and others are not expressing concern that Las Vegas is getting overextended into real estate like it did last decade or that lenders are pumping too much money into projects again.

“Doesn’t take a genius to figure out after ’08 and ’09 that you don’t want to do a lot of speculative real estate,” said Chris Schlaffman, commercial loan manager at Valley Bank of Nevada.

By the numbers

Some 63,900 people worked in construction in Southern Nevada as of March. Employment has nearly doubled since early 2012 but is still nowhere near its peak of 112,000 in mid-2006, according to figures from the Associated General Contractors of America.

Overall, the industry’s share of the local labor market was 6.4 percent in March, up from a low of 4.3 percent in 2012 but far below its peak of 12.1 percent in 2006.

Nationally, construction made up 4.7 percent of the labor market in March. That’s up from a post-bubble low of 3.9 percent in 2011 but still below its peak of 5.9 percent in 2006, AGC data show.

Southern Nevada’s numbers seem to fit expectations for an expanding Sun Belt city, according to AGC spokesman Brian Turmail, but things are growing at a steadier pace amid more-restrained lending.

“We don’t think we’re going to double the national average” again, said John Restrepo, founder of Las Vegas-based RCG Economics. Today, there is “a lot more care in how projects are built and how they’re approved.”

CLICK TO ENLARGE

‘A slow, gradual climb’

One thing’s for sure: As lenders open their purse strings, investors are building much more than they did after the economy tanked.

Developers completed around 7.3 million square feet of industrial, office and retail space in Southern Nevada last year. That’s up from 297,000 square feet in 2012 but still far below 13.2 million square feet in 2007, according to brokerage Colliers International.

Homebuilders closed 9,400 sales in Clark County last year.

It was the highest tally in almost a decade but still nowhere near the peak of almost 39,000 sales in 2005, according to Home Builders Research.

Nationally, investment in construction projects has increased, but “it’s been a slow, gradual climb,” said Brittany Kleinpaste, vice president for economic policy and research at the American Bankers Association.

Bankers who focus on construction lending are “very careful about who they’re lending to” and are “making sure the borrower is really ready for the project,” she said.

Lenders doling out more

Easy lending for homebuyers and developers alike fueled Las Vegas’ wild growth last decade. Banks that piled heavily into real estate were shut down as the economy cratered, and those that survived drastically cut back on construction loans.

But as the economy picks up, several local lenders have doled out more debt for new projects.

Some 21 percent of First Security Bank of Nevada’s loan portfolio was tied up in construction and development deals at the end of last year, compared with 4 percent in 2012 and 35 percent in 2008, according to Federal Deposit Insurance Corp. figures.

At Town & Country Bank, construction and development loans composed 15 percent of its total portfolio at the end of last year, compared with 5 percent at year-end 2013 and 2014 and 55 percent in 2006, FDIC numbers show.

Banks are lending more for new projects because the economy has improved, developers are more confident and banks are doing better, Valley Bank’s Schlaffman said.

His bank, he noted, has received requests to finance speculative projects, or those planned without users lined up first, “but obviously we won’t look at that.”

Changing times

Las Vegas was among the hardest-hit areas of the country during the recession, with sweeping job losses, widespread foreclosures and soaring vacancy rates.

Construction also evaporated. Laborers’ International Union of North America Local 872 lost about 4,000 members after the crash, and many members lost homes or cars or moved out of state, said Tommy White, the union’s business manager and secretary-treasurer.

“The work just totally dropped off,” he said.

Las Vegas was hit especially hard because of its lack of economic diversity, RCG’s Restrepo said.

“You don’t want to depend too much on construction to drive your economy,” he said, adding it was “never sustainable” for the valley’s construction labor pool to be double the U.S. average.

Southern Nevada had an “unbelievable, unprecedented” fall in construction employment, but there are more diverse projects in the pipeline today, including the new stadium for the NFL’s Raiders and the Interstate 11 connection, according to Stephen Miller, director of the Center for Business and Economic Research at UNLV.

With construction picking up, former union members are moving back or coming out of retirement, White said.

Worthington, president and chief operating officer of the Molasky Group of Cos., said it’s a “natural reaction” that construction has rebounded amid the improved economy. Also, banks are paying closer attention to the loans they’re making.

“I’ve never met as many credit officers as I have in the past few years,” he said.

In the old days, bankers figured that even if a project went sideways, the market overall was still rising so they would end up fine. Not anymore.

“That mentality,” Worthington said, “is gone.”

Contact Bailey Schulz at bschulz@reviewjournal.com or 702-383-0233. Follow @bailey_schulz on Twitter. Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.