Act aims to stop default onslaught

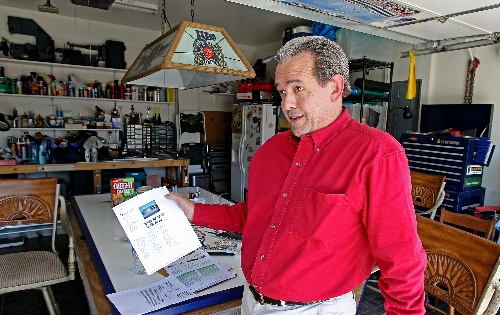

Like so many Las Vegas homeowners trapped “underwater,” Doug Farmer made a strategic decision to stop throwing good money after bad when Bank of America refused to work with him in refinancing his adjustable-rate mortgage.

Realizing he would never be solvent on his $285,000 home in southwest Las Vegas — at least not in the five years he planned to live there — Farmer contacted the bank to arrange a loan modification, only to be told that his debt-to-income ratio wasn’t high enough.

“I asked the gentleman, ‘You mean if I was further in debt, then you would modify my loan?’ How crazy is that? I decided then to just walk away instead of waiting five years and keep paying increasing mortgage payments,” Farmer said. “The government bailed out AIG because they’re too big to fail and I’m too small to save.”

That’s been a common story among Southern Nevada homeowners frustrated with government programs that have not fulfilled promises to help homeowners avoid foreclosure.

Things could change. A group of lawmakers led by Rep. Dennis Cardoza, D-Calif., has proposed legislation to bail out homeowners as well as banks.

House Resolution 363, the Housing Opportunity and Mortgage Equity Act, would allow any homeowner with a mortgage backed by Freddie Mac and Fannie Mae to refinance at current interest rates, regardless of credit rating, home value or income. The legislation is designed to stop the onslaught of foreclosures.

“Under this bill, Nevada homeowners who have a mortgage through Fannie Mae, Freddie Mac or another government-backed enterprise can reduce their monthly interest payments as a result of lower finance rates,” said Shelley Berkley, D-Nev., co-sponsor of the bill. “The savings generated can help Nevada homeowners avoid foreclosure by lowering monthly payments and the amount of debt owed on a residence.”

Lawmakers supporting the HOME Act say it will reduce foreclosures dramatically, reward homeowners who continued to make payments and free up capital needed to reinvigorate the housing market and economy as a whole. It will definitely aid families in Nevada, the state with the nation’s highest foreclosure rate, Berkley said.

Morgan Stanley and JP Morgan Chase estimate the bill would result in an annual reduction in mortgage payments of about $50 billion nationwide.

Potential homebuyers will benefit from the floor in home prices that would come with the prevention of more foreclosures and the availability of credit for new mortgages.

“No solution to date has addressed both foreclosure prevention and the decline of home equity. The reality is the housing crisis has spread far beyond the subprime market, hindering our economic recovery,” said Cardoza, the bill’s author. “None of the administration’s current housing programs have been far-reaching enough to make a dent in the worst foreclosure crisis in U.S. history. Until we see a program that cuts to the heart of the recession, we will continue to see little growth in our economy, families losing their homes and lifetime investments with lost equity.”

Since 2009, Washington has allocated more than $50 billion for housing assistance, though little of it has trickled down to struggling Southern Nevada homeowners.

Foreclosure filings continue to mount in Clark County, including 4,694 notices of default in March and 5,683 notices of trustee sale, an increase of 10.5 percent and 27.1 percent, respectively, from the prior month, Discovery Bay, Calif.-based ForeclosureRadar.com reported.

The Home Affordable Modification Program has largely been criticized as a massive failure as homeowners are forced to undertake a complex loan modification process often to learn they don’t qualify. Banks are unwilling to spend time and money for an uncertain outcome.

Of the 264,000 total loan modifications completed in the first quarter, 210,000 were proprietary modifications, or “in-house” modifications made by private lenders, and 54,000 were made through HAMP, the Washington, D.C.-based Hope Now alliance of mortgage servicers and investors reported in May. Of the proprietary loan modifications, 81 percent included reduced monthly principal and interest payments.

“It’s time for a more sensible, workable program — one the administration and Congress must force upon reluctant lenders — that will help improve housing markets nationwide,” said Dave Satterfield of Sitrick and Co. in San Jose, Calif., a company that represents home investors.

There are some 30 million outstanding mortgages whose losses are guaranteed by the government through Fannie or Freddie. Local Realtors estimate that at least 70 percent of Las Vegas mortgages fall into that category.

Mortgages held by Fannie and Freddie, now under federal conservatorship, are financial liabilities for the government. The HOME Act would reduce that liability over the long term by preventing millions of foreclosures that would otherwise leave taxpayers on the hook. Fees for refinancing would be rolled into the mortgage to eliminate cost to taxpayers. Penalties would be waived.

Millions of American homeowners appear to be prime candidates for refinancing at extremely low mortgage rates, yet many are being shut out of the opportunity, said Mark Zandi, chief economist of Moody’s Analytics.

Lenders withhold their best interest rates from potential refinancers whose credit ratings and home equity have eroded in this tough economy, even if borrowers are current on their mortgages.

Roughly 14 million of the nearly 50 million U.S. homeowners with a first mortgage are underwater, or owe more than their home is worth, and may stop making payments if hit with another financial challenge. The Obama administration should move quickly, Zandi said.

But not everyone thinks the HOME Act is the right move.

Michael Parra of General Realty Group in Las Vegas said there’s a “systematic threat” from underwater homeowners being told they can walk away from their mortgage obligations and rescind the principal balance. Their argument: Show me the original promissory note.

“We have two people in the red,” Parra said. “Which one is more dangerous — the person that does not keep their promise to pay their debt and is trying to live in a property free and clear, or the financial institution that cannot prove they own a note (and) that the defaulter or conniver alleges has unfairly capitalized on the note? If the situation were reversed, the person wouldn’t offer to share equity with the bank.”

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.