Agency governing homeowners groups scrutinized

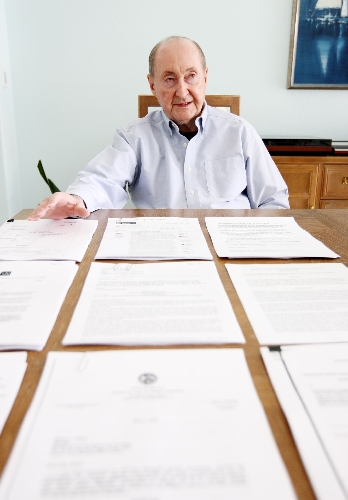

Retired and living the good life in Las Vegas, Robert Hall should be making waves in the lap pool on his back patio overlooking the 15th hole at Highland Falls Golf Club.

Instead, the former military officer and immunotoxicologist is making waves with his community homeowners’ association.

Hall sued the Sun City Summerlin Community Association in July alleging, among other things, that the association unlawfully exceeded its corporate authority and deprived him of civil contract property rights without due process. This tramples on the state constitution, he says.

How can justice be served when board members of Nevada’s Commission for Common-Interest Communities have what many perceive as a conflict of interest? The seven-member commission, created under Nevada Revised Statue Chapter 116 and appointed by the governor, acts in an advisory role for the Nevada Real Estate Division, adopts homeowners’ association regulations and conducts disciplinary hearings.

“It’s all one little ball and you can’t get out of it,” Hall said. “This is the biggest con ever because of the conflict of interest and everybody wearing two or three or four hats. This makes Bernie Madoff look like a pipsqueak.”

Hall cited Michael Buckley, a partner in Las Vegas law firm Jones Vargas. He’s chairman of the commission and his firm lobbies on behalf of RMI Management, a company that manages a number of the 1,000-plus HOAs in the Las Vegas Valley.

Buckley wrote an “ambiguous” advisory opinion on superpriority liens that collection agencies used to counter an opinion from the Financial Institutions Division, said Jonathan Friedrich, a Rancho Bel Air resident and leader of an homeowners advocate group. RMI petitioned the commission to adopt it during the company’s lawsuit against the division.

Superpriority liens are those that get paid first when a home is sold. They’ve become a hot-button issue for investors who buy foreclosure homes that carry delinquent HOA assessments and collection fees totaling thousands of dollars. They say the fees should not be tacked onto superpriority liens.

Buckley said he submitted his opinion on superpriority liens and collections costs last year based on other cases and scholarly text.

“My research led me to conclude that collection fees should be part of the superpriority lien,” he said Monday. “It wasn’t ambiguous. I reached a conclusion.”

Buckley said state law requires commission members to either reside in a common-interest community or be actively engaged in HOA-related business for at least three years. Commission business is conducted in open meetings and policy is shaped by public comment, he said.

The commission tries to be the “voice” for homeowners associations because nobody is lobbying for them in Carson City, Buckley said.

But Friedrich doesn’t see it that way.

“Isn’t it interesting that these law firms go into the collection business? It’s got to be so profitable they can’t walk away from it,” Friedrich said. “Why are law firms involved? Follow the money.”

Commissioner Randolph Watkins is vice president for Del Webb Management, which manages homeowners’ associations in the Sun City communities developed by Pulte Del Webb.

He’s also the boss of state Sen. Allison Copening, D-Las Vegas, who introduced seven HOA-related legislative bills in Carson City that Friedrich sees as detrimental to homeowners. Copening was hired as lifestyle director for Del Webb in September for $40,000 a year, planning community events and writing a newsletter. Before being elected to the state senate, she was spokeswoman for Pulte Homes in Las Vegas.

One of her proposals, Senate Bill 174, seeks to amend superpriority liens. It was passed 4-3 along party lines by the Senate Judiciary Committee on April 15.

SB 174 conflicts with Fannie Mae underwriting guidelines, which allow up to six months of past-due common expense assessments for a dwelling unit to have limited priority over Fannie Mae’s mortgage lien, said Rutt Premsrirut, a broker with Valtus Real Estate in Las Vegas.

If a home is in a jurisdiction that allows for more than six months of assessments to have priority over Fannie Mae’s lien, Fannie will not purchase a mortgage loan secured by that unit.

Ultimately, the debt falls back on the U.S. taxpayer, Premsrirut said.

“SB 174 is nothing but a scheme to raid the U.S. Treasury through the superpriority lien,” the broker said. “The federal government — Fannie Mae, Freddie Mac and HUD (the Department of Housing and Urban Development) — are the parties eating the majority of these egregious collection demands.”

Critics of the Commission for Common-Interest Communities assert that allowing members tied to the industry to regulate homeowners’ association collection fees is equivalent to allowing executives of local power utility NV Energy to sit on the state’s Public Utilities Commission and regulate electricity rates.

“There is an obvious bias when a senator works for an HOA management company and introduces legislation that regulates her industry,” said Troy Kearns, an agent handling real estate-owned properties in Las Vegas. “We vote our appointed senators to protect our interests, not their own.”

Copening said the Legislative Counsel Bureau determined there was no conflict of interest in her taking the job with Del Webb.

“The investors started this smear campaign against me to try to kill both my collections bill that would have capped collection fees and SB 174 because of Section 15, which protects homeowners living in homeowners associations, but which they view to hurt their chances of turning a larger profit when they buy a foreclosed home and later flip it,” Copening told the Las Vegas Review-Journal in an email.

If the superpriority provision is removed, homeowners’ associations will go broke because they have no money to pay collections companies and attorneys, Copening said. Otherwise, the fees are passed on to all homeowners in an association.

“There’s no easy answer because somebody has to pay, but I think if you ask the homeowners that are left in the association, they would rather have the investors pay the fee than them,” Copening said.

She said her bill also stipulates “reasonable” attorney fees based on the work done.

Other members of the Commission for Common-Interest Communities are:

■ Gary Lein, an accountant for homeowners’ associations and management companies.

■ Favil West, retired from homeowners’ association management. West has disclosed that he receives contributions from RMI and Nevada Association Services, a homeowners’ association collection agency, for his charitable foundation.

■ Marilyn Brainard, member of Community Associations Institute, a national lobbying group for the homeowners’ association industry.

■ Robert Schwenk, community manager for Olympia Management (Southern Highlands).

■ Scott Sibley, former state assemblyman and owner of Nevada Legal News. Sibley makes his living publishing foreclosure notices and trustee sales, including homeowners’ association collections. He opted not to vote on the collections regulation because of his conflict.

Brainard and West are designated as homeowner advocates, but Friedrich said they’re among the most “anti-homeowners” members of the board.

Nevada Association Services President David Stone said anyone who says SB 174 conflicts with federal housing guidelines hasn’t read the bill. Section 15 deals with collections and only affects banks and investors who buy foreclosures.

“Freddie (Mac) and Fannie (Mae) are not financing the banks and investors. Some of those (homes) are subject to Freddie and Fannie, but most are not,” Stone said. “If Freddie and Fannie and the banks were opposed to this, they should have said something. Only investors and people who don’t understand the bill are opposed to it.”

What’s confusing for a lot of people is that there are two types of consumers involved in this issue, Buckley said. One is the homeowner delinquent on homeowners’ association assessments; the other is the investor who buys the house at a foreclosure sale.

Section 15 of SB 174 makes it clear that once the foreclosure sale occurs, the association lien goes away and the slate is wiped clean, though it’s still on record, Buckley said.

Michael Lathigee of the Las Vegas Real Estate Club said all 156 members voted in opposition to SB 174 at the investment club’s meeting in March.

“As servants of the public, we hope you will vote with representing the people who elected you and not special-interest groups that are interested to line their own pockets and in some case(s) create more hardship in a recovering real estate market,” Lathigee wrote to the Senate Judiciary Committee before their vote.

“I want to also note that when I testified in front of the CICC commissioners and tried to point out their conflict of interests to the collection industry, I was stopped while I was speaking, yet the applause from the gallery where I was testifying at the Grant Sawyer building was very loud,” he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.