Analyst calls housing atmosphere ‘horrific, humbling’

If falling home prices and rising foreclosures aren't enough to show how distressed the Las Vegas housing market has become, take a look at November's residential permit total.

Home Builders Research reported a dismal 180 new home building permits issued in Las Vegas, Henderson, North Las Vegas and Clark County, the lowest monthly number since the firm started tracking the local housing market in 1988.

Permit count through November totals 5,961, down 58 percent from a year ago.

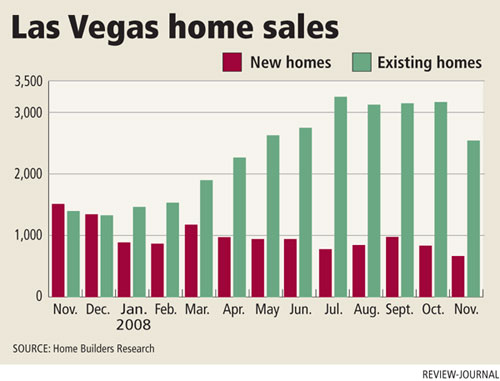

New-home sales also hit a 20-year low at 643 in November, compared with 1,521 sales in the same month a year ago. For the year, new home sales dropped 47 percent to 9,730.

December's numbers won't be any better, Home Builders Research President Dennis Smith predicted, so the 2008 sum will be slightly more than 10,000.

"There is no way anyone can try and sugarcoat what is going on in the housing industry," Smith said Wednesday. "What started as a bubble a couple of years ago has evolved into a horrific, humbling and scary atmosphere that has grown into a national economic crisis."

The median price of a new home fell 8.2 percent, or $22,288, from a year ago to $247,990 in November. It's down 1 percent from the previous month.

Larry Murphy of housing research firm SalesTraq found prices of just $75 a square foot for new homes in the master-planned Providence community in northwest Las Vegas. That's less than the average of $99 a square foot for some 2,000 foreclosures sold in November, he said.

"Why would anyone pay more money for a repossessed bank home than they would for a brand new home?" Murphy asked.

Nearly every home builder in Las Vegas makes Murphy's "Under $100 Club," from Richmond American's price of $72.26 a square foot to Kimball Hill's $99.96 a square foot.

Sales of existing homes declined to 2,518 in November, down 622 closings from the previous month. However, the annual total of 27,503 is up 17 percent from a year ago.

The month-to-month decline in resales is most likely related to the credit market, Smith said. Other factors, such as job uncertainty and tougher qualification standards, may also come into play, he said.

"As the cycle moved, several factors entered the picture and none of them were good," the housing analyst said. "Factors like subprime mortgage, now credit and financing. What's next? Jobs."

Smith said he expects the resales to return to about 3,000 a month after the holidays, the pace of the past four months.

Single-family homes sales in November surpassed same-month sales from the previous two years, Rob Jenson of ReMax Central said.

It's been a tough year for luxury real estate, the Realtor said. Sales of homes for more than $1 million dropped to 199 through November, compared with 410 a year ago. The ultraluxury market, or homes costing more than $3 million, fell to 21 from 40 a year ago.

There were 11 million-dollar homes sold in November, including four foreclosures. Average sales price was $1.74 million, a 12 percent decrease from the previous month, Jenson said.

The resale median price in November was $173,900, a decline of $80,000, or 31.5 percent, from a year ago, Home Builders Research reported.

The price has decreased 2.3 percent from five years ago, before the period of "gluttony and greed," Smith said.

How much lower will it go?

"Many of the money people we talk to believe it looks more and more like factors are in place that might push this market barometer another 5 (percent) to 10 percent lower," Smith said. "We believe it will now bottom at roughly $160,000."

Home prices will probably settle in at that level for a period of time and won't show improvement until 2010 or 2011, he said.

Steve Hawks of Platinum Real Estate Professionals said too many homes were built in Las Vegas and Henderson during the boom years. Builders sold homes to thousands of people who never moved into them.

"Couple that with the slowdown in Clark County population growth and let's just say we could probably do without new homes for a couple of years," Hawks said. "The double-edged sword with that is the builders provided thousands of jobs, but if we have an oversupply, unfortunately there is not much to do but stop building and those lost jobs turn into more foreclosures."

The Altos 10-City Composite Price Index showed a decline in asking prices of 0.8 percent in November and 2.4 percent for the past three months.

Asking prices fell at the fastest rate in Las Vegas, down 3.3 percent in November and 6.9 percent over the three-month period. It's the eighth consecutive month that Las Vegas has posted the fastest rate of declining prices among major markets.

"Tight credit, job losses and plunging consumer confidence continued to pressure listing prices in most major markets during November," Michael Simonsen of Altos Research said. "Recent government actions to reduce mortgage rates and slow the pace of foreclosures could finally start to stem the decline, but we don't expect to see major changes until at least mid-2009."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.