Analyst sees stability in LV housing

New-home sales and their median price dropped in February, but the numbers are starting to stabilize from woeful year-ago figures and are expected to rise as the year progresses, a local housing analyst said Friday.

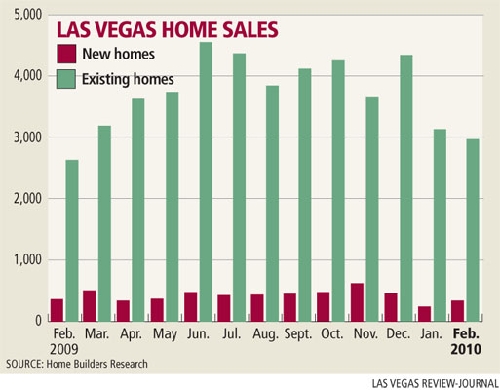

There were 322 recorded new-home sales in February, compared with 375 in the same month a year ago, Home Builders Research reported. The two-month total decreased by 83 sales, or 12.9 percent. The median price was $209,000, down $10,900, or 5 percent, from a year ago.

The resale market, driven by foreclosures and short sales, or homes sold for less than the mortgage owed, continued its strong upward trend with 2,983 recorded transactions in February, a 14.5 percent increase from 2,606 sales a year ago.

The median resale price dropped 14.5 percent to $124,000, but has been fairly flat for the past nine months, bouncing between $122,000 and $126,000.

That’s good news, Home Builders Research President Dennis Smith said. The free-fall that started in 2008 and deepened in 2009 has stopped, he said.

“The numbers are about the same. There’s not much to talk about, except prices are still stable,” Smith said. “They’re not taking off and they’re not dropping off the cliff. They’re flat and stable.”

Government programs are starting to “leak out,” he said, though results have been less than expected. The Obama administration announced a $75 billion foreclosure relief effort Friday to keep people in their homes by reducing the amount struggling borrowers owe.

Bank of America has already announced that it would forgive some of the principal for homeowners who owe more than their homes are worth.

“Bank of America came out with this public relations story about how banks are writing down some mortgages,” Smith said. “I think that’s going to be a big psychological thing. Until those things are put in pace, there’s always a lot of details that seem to cut the program short of what they’re intended to do. The ideas are good and we’re all for it, but they take time. They’ve got to learn the rules, what they can and can’t do.”

Las Vegas-based SalesTraq reported 342 new-home sales in February, down 4.5 percent from 358 in the same month a year ago, and a median price of $206,255, down 5.2 percent. Existing-home sales rose 15.3 percent to 3,229 in February, while the median price dropped 17.5 percent to $118,000.

Larry Murphy of SalesTraq said 46 percent of existing-home sales were bank-owned homes, with a median price of $115,000, while the remaining sales had a median price of $120,000.

He’s also showing 1,349 bank acquisitions in February, about the same as January and down significantly from 2,230 in February 2009. Bank-owned dispositions again outnumbered acquisitions at 1,485 in February. The real estate-owned, or bank-owned, inventory in Las Vegas totaled 10,128, compared with 16,454 a year ago.

Smith said weekly net sales per new-home subdivision in Las Vegas spiked in March, basically doubling from the previous month, largely due to marketing attempts by D.R. Horton to move excess inventory. Those numbers will probably increase as the April 30 deadline for the homebuyer tax credit approaches, he said.

Home Builders Research reported 474 new home permits in February, bringing the total for the first two months to 854 permits. That’s up by 536 permits, or 169 percent, from a year ago.

“It’s been a good long while since that kind of statistic was reported,” Smith said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.