Bad news mounts in housing

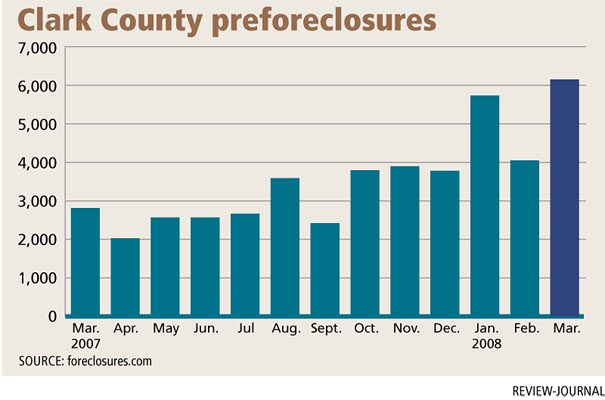

The number of Clark County homes that entered preforeclosure status reached a record 6,152 in March, up 52 percent from February and more than double the 2,813 preforeclosures in the same month a year ago, Sacramento, Calif.-based Foreclosures.com reported.

The county has 15,937 preforeclosures through the first quarter of the year, or 3.11 percent of its 512,253 households, the online foreclosure source reported.

Nevada leads the nation with 2.42 percent of its households, or 18,087 homes, in preforeclosure through March, followed by Arizona (1.96 percent), Florida (1.87 percent) and California (1.05 percent).

Staggering foreclosure numbers are the result of a multitude of factors, including a meltdown in the mortgage lending industry, fraudulent appraisal values and overzealous speculators.

"Consumers got greedy for loans they couldn't afford, mortgage banks got reckless in their guidelines, and Wall Street investors in search of high returns financed the whole shebang," said Gibran Nicholas, chairman of Certified Mortgage Planning Specialist Institute in Ann Arbor, Mich.

Real estate-owned, or bank-owned, homes in the county also rose substantially in March to 1,937, up from 1,640 the previous month and 1,763 in January. The three-month total is three times more than a year ago.

"The world has changed," Foreclosures.com President Alexis McGee said. "Foreclosures are at all-time highs and the markets are in flux. We are now eight quarters into our long-overdue housing correction. Everyone debates when it will end. It's no surprise," McGee said.

Preforeclosures, which start with a notice of default, signal that people are in financial trouble and those numbers are growing rapidly, McGee noted.

If bank-owned properties aren't rising at a matching rate, it means banks are either slowing down the process so homes don't come back onto their balance sheets or they're doing loan modifications, she said.

"Same thing. It slows it down," McGee said. "Preforeclosures really tell you what's going on. People are in trouble and it's escalating. Once preforeclosures start dropping, that's when I see a turnaround."

Jeanette Young said she's now faced with possible foreclosure on her home after losing her job at National Alliance Title, which closed in December.

President Bush's plan to give $600 tax rebates to help homeowners is a "joke," she said.

"I don't know anyone that has a mortgage that is $600, unless they've had the same loan for 10-plus years," she said. "Mine is $2,200 plus all the other bills associated with a home. I do not see any relief in sight for those of us who have lost our jobs, cannot find comparable income and now cannot make our house payments."

John Restrepo, principal of Restrepo Consulting Group, said many people bought more house than they could afford with creative financing options.

"Normally you'd let the market correct itself and those that overbought get hurt and those that didn't overbuy don't get hurt," Restrepo said. "The problem is so deep now with repercussions to the economy that the feds have to get involved. Not only do those people who overbought get hurt, but the whole community gets hurts."

Nicholas of CMPS Institute said the markets hit hardest by foreclosures are those with a high percentage of speculative investors who don't necessarily have as much as incentive as a primary resident to keep the home.

"It's just an investment. They can just walk away from it," he said. "It's going to have to play out in places like Vegas and Florida. You can't bail out speculators. The problem is going to have to correct itself. The No. 1 solution is to figure out a way for government-guaranteed loans for individuals who can afford to repay the loans and will live in it as their primary home."

Wade Henderson, president of Washington, D.C.-based Leadership Conference on Civil Rights, said a key provision in the Foreclosure Prevention Act before Congress will keep some 600,000 families in their homes.

"It is simply unfair -- and politically imprudent -- to continue to punish responsible families who can afford to pay their mortgages, but not their ballooning interest rates," Henderson said in a statement. "Meanwhile our government is bailing out irresponsible lenders and kicking hard-working families to the curb. As the crisis deepens and foreclosures escalate, it is everyone's problem. The industry is taking some voluntary steps to reduce foreclosures and we commend those efforts. But they have done little so far to mitigate the ongoing crisis. It's not enough."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.