Drops in LV home prices lead the U.S.

NEW YORK — Home prices in many cities, led by sharp declines in Las Vegas and Miami, continued to plunge by record levels in January as sellers cut their asking bids and rising foreclosures took their toll, new data showed Tuesday.

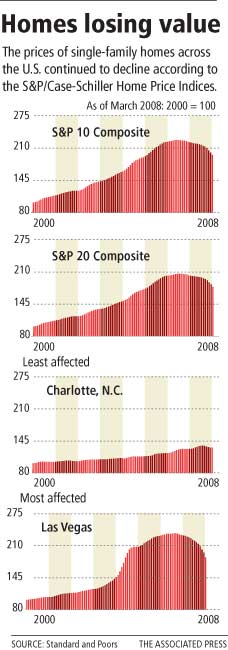

Although the spring selling season usually gives the market a bounce, some analysts say any notable improvement may not come until well into the summer. U.S. home prices fell 10.7 percent in January, and the Standard & Poor’s/Case-Shiller home price index of 20 cities saw the steepest decline in the index’s two-decade history.

Las Vegas and Miami both reported 19.3 percent drops, as the regions are still paying the price for rampant speculation and overbuilding during the boom years. Those cities and 14 others, including Phoenix, San Diego and Detroit, posted record lows.

“I wouldn’t be looking for a pattern of improvement until April, May or June,” said Brian Bethune, Global Insight’s chief U.S. economist.

Only Charlotte, N.C., squeaked by as a gainer in the Case-Shiller index, with a 1.8 percent rise in January compared to a year earlier.

“We are still selling here in Charlotte,” said Dianne McKnight, a broker associate at Re/Max Executive Realty in the city. “If a property is priced right, it sells in a day and you have multiple offers. There are plenty of buyers out there kicking around.”

But the overall downbeat figures come on the heels of data released Monday showing that the median price of existing homes being sold in February fell in the largest year-over-year drop since at least 1999.

“Home prices continue to fall, decelerate and reach record lows across the nation,” said David Blitzer, index committee chairman at S&P. “No markets seem to be completely immune from the housing crisis.”

Blitzer said all 20 cities S&P tracks have seen falling prices for five consecutive months when compared to the prior month. What’s more, the declines are growing in severity, with 13 of the 20 cities reporting their biggest single monthly decline in January.

Las Vegas-based SalesTraq reported a median existing home price of $250,000 in February, down 13.2 percent from the same month a year ago. That followed a 14.1 percent decline in January.

SalesTraq President Larry Murphy said he was doing research on the housing market in Pahrump, about 50 miles southwest of Las Vegas, and found stories from 2004 about how land prices had doubled and developers were selling more lots in three months than they had in the previous 10 years.

“It gave me pause to think here we are four years later and it’s hard to believe the attitude and mind-set of everybody back then, that it would last forever and you’d better get on the bandwagon,” Murphy said. “Four years later it’s doom and gloom and we feel like this is going to last forever. We’re just in these real estate cycles. What’s it going to be like four years from now?”

A narrower survey, released separately Tuesday by the Federal Housing Enterprise Oversight said home prices fell 3 percent in January from the same month last year, and dipped 1.1 percent from December.