Experts see soft summer for resales

The median price for a resale home in Las Vegas will continue to soften this summer, dragged down by foreclosure properties that are “stuck” in lenders’ inventory, housing analyst Dennis Smith of Home Builders Research said Tuesday.

He showed the existing-home median price at $230,000 for April, about the same as the previous month and down 19.3 percent from the same month a year ago. Since January, the median price has dropped $9,900, or 4.2 percent.

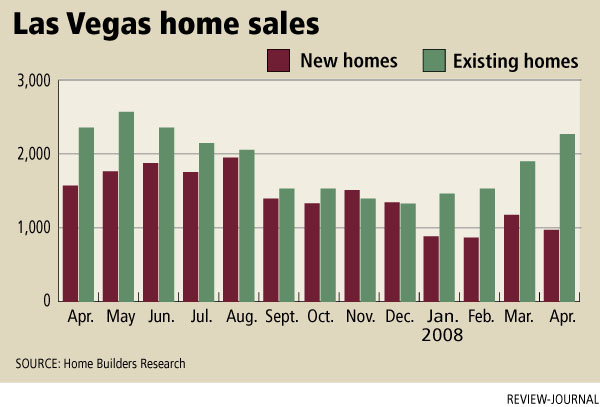

Resale closings topped 2,000 for the first time in seven months at 2,247. But the year-to-date total is down 27.3 percent to 7,163.

Although the number of resales showed improvement, Smith said prices may drop a little more before a “sustainable bottom” is reached.

“There’s these things called short sales,” he said. “Nobody talks much about them. We hear about foreclosures. Short sales are out there by the gazillions. The banks are taking months and months and they’re just sitting out there.”

Smith said Countrywide Mortgage issued a memo saying it would take at least six months to respond to a short sale offer, which is a bank-approved sale for less than the balanced owed on the home.

“What that does to the market is extend the recession,” he said. “I’d rather take the hit and move on.”

Mark McGarry, mortgage consultant for First United Mortgage in Las Vegas, said he has more than 100 first-time home buyers approved and out shopping for homes in foreclosure, but the banks are slow to dispose of their inventory.

Part of the problem is buyers are being misguided in the process and really don’t know how to make the correct offer to a bank, he said.

“The tide has certainly changed,” McGarry said. “The prices that the banks are offering their homes at are competitive, but they are slowly creeping up in price.”

Six months ago, McGarry was sending buyers out to look at $250,000 homes and encouraging them to offer $230,000 and ask the bank to pay 3 percent of the down payment and all closing costs.

“At that time, they were the only offer and nine times out of 10, the offer was accepted,” he said.

Three months ago, competition heated up with banks getting two to five offers on the same bank-owned property, so McGarry suggested offering list price with some assistance on closing costs.

Banks are now getting up to 15 offers on homes in the $250,000 price range.

“We now tell our buyers to offer above list price or even an escalating offer where they will pay $1,000 more than the highest offer,” McGarry said.

The median price of a new home climbed to its highest point of the year in April at $291,080, Las Vegas-based SalesTraq reported. It’s still down 9.3 percent from a year ago. There were 938 new-home closings in April, down 39 percent from last year.

New-home permits totaled 541 in April, the highest monthly number for the year, but down 66.5 percent from the same month a year ago. That follows monthly permit declines of 72.7 percent, 63.2 percent and 64.3 percent.

If this rate continues, Las Vegas will end up with less than half of last year’s 12,836 total permits, SalesTraq President Larry Murphy said. He estimates that new-home inventory is at a two-month supply at current absorption rates.

Murphy counted 2,183 foreclosures, or repossessed homes, in April, more than triple the number from April 2007 and the highest number since he’s been tracking them. So far this year, 6,603 Las Vegas homes have entered foreclosure, compared with 10,324 for all of 2007.

More than 40 percent of existing-home sales were properties repossessed by financial institutions and then resold.

Murphy said it’s important to distinguish between a foreclosure and the sale of a foreclosed property. His figures do not include those homes repossessed by a financial institution. That amounts to nothing more than a transfer of title and is counted as a foreclosure, he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.