Fewer homes means prices up

Home prices continue to move upward in Las Vegas as the supply of homes available for sale remains constrained, SalesTraq analyst Brian Gordon said Wednesday.

Current conditions are more reflective of the boom years, as opposed to the hardest-hit market in the country, he said.

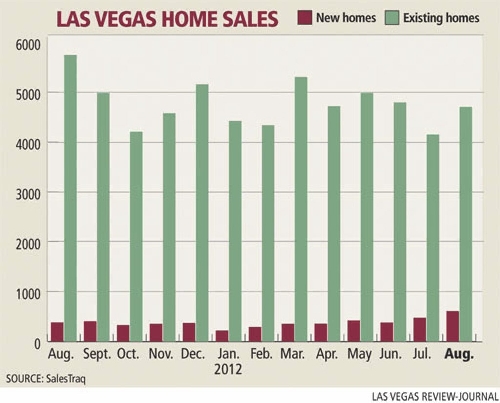

The new-home market recorded 602 closings in August, up nearly 60 percent from the same month a year ago. For the past 12 months, new-home sales are up 15 percent at 4,488, SalesTraq reported.

The new-home median price also has edged up in recent months, climbing to $204,737 in August, a 3.5 percent increase from a year ago.

“We have seen pricing stabilize and begin to push upward for a number of months,” Gordon said. “Most of the increase has been a function of the supply side of the equation. Limited supply has homebuyers competing for fewer homes, and as a result, we have seen pricing jump up.”

Existing home median price jumped 16.5 percent on an annual basis in August to $121,000, while home sales fell 18.2 percent, to 4,697. It’s the highest median price since June 2010, Gordon noted.

Cash buyers account for 53 percent of Las Vegas home sales, and that’s also driving up prices, he said.

“There’s no need for appraisals in those instances, and that allows continued upward pressure on pricing.

“Without traditional appraisals on behalf of the lender, you have cash buyers outbidding some homebuyers with financing,” Gordon said.

1.4-month supply of homes

SalesTraq showed 4,911 available listings of homes for sale in August, a 62.7 percent drop from a year ago. Effective supply is 1.4 months.

With limited supply and increased demand for new homes, builders are pulling more permits. SalesTraq reported 573 permits in August, a 70 percent increase from a year ago. The trailing 12-month total remains elevated from recent lows in the cycle, the analyst said.

“We’re nowhere near the pace that Las Vegas experienced during the boom years, but it appears to have picked up off the floor from the last two years,” he said.

Gordon said that the market appears to have settled into the “here and now,” and that it could be a temporary situation.

“The reality is that Nevada is home to about 75,000 homeowners who are not making good on their mortgage payments, a condition that cannot last forever,” he said.

SalesTraq reported 272 bank repossessions in August, an 82 percent decrease from a year ago. They’re down nearly 62 percent over the past 12 months.

Regulatory intervention, including Nevada’s robo-signing law that went into effect late last year, has been a driving factor in the shift, Gordon said.

Frank Nason, president of Residential Resources, said 85 percent of homes that are under pending or contingent contract are short sales, or lender-approved sales for less than the principal mortgage balance.

It’s evident that the decline in real estate-owned properties, or foreclosures, and the increase in short sales are having a negative effect on the market in terms of closings, he said.

sales up throughout u.S.

Nationwide, sales also were up.

Sales of previously occupied homes rose 7.8 percent in August from July to a seasonally adjusted annual rate of 4.82 million, the National Association of Realtors said Wednesday.

That’s the highest level since May 2010, when sales were aided by a federal home-buying tax credit.

U.S. builders broke ground on 2.3 percent more homes and apartments in August than July. The Commerce Department said the annual rate of construction rose to a seasonally adjusted 750,000. The increase was driven by the best rate of single-family home construction since April 2010.

One challenge for buyers now is the limited number of homes on the market. There were 2.47 million homes available for sale in August, or 18 percent fewer than the same month in 2011.

Homes are selling more quickly than a year ago. The median amount of time that a home spent on the market was 70 days in August, the Realtors’ group said. A year ago, the median time frame was 92 days a year ago.

And the limited supply has helped lift home prices. The median home price in August was $187,400, the Realtors’ group said.

That’s slightly lower than July but 9.5 percent higher than August 2011 – the largest year-over-year price increase since January 2006.

The Associated Press contributed to this report. Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.