Foreclosures in Las Vegas drop in January

Las Vegas home foreclosures declined 20 percent in January to 2,609 from 3,283 the previous month, online source Foreclosures.com reported Friday.

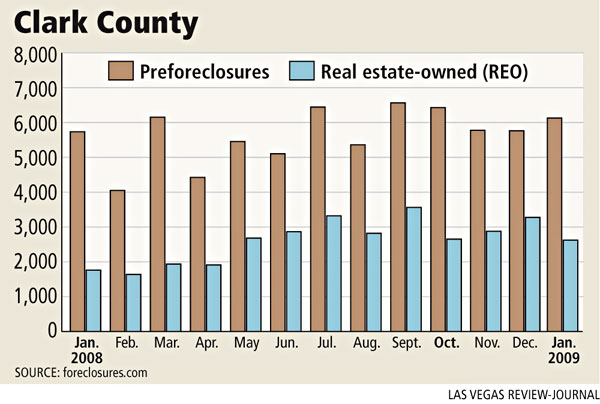

However, the number increased 48 percent from 1,763 in January 2008. Las Vegas had 31,416 real-estate owned, or bank-owned, homes in 2008 and some analysts are projecting as many as 50,000 foreclosures this year.

Clark County preforeclosure filings, or the process that starts with a notice of default, rose slightly in January to 6,050, compared with 5,765 in December and 5,734 in the same month a year ago.

Foreclosure.com’s U.S. Foreclosure Index showed a 25 percent drop nationally as government and lender programs have combined with low interest rates and low housing prices to slow new foreclosures.

Completed foreclosures dropped to 72,694 in January from 97,841 in December, the lowest level since April. Preforeclosures dropped 12 percent to 166,860.

Virtually every state saw a drop in foreclosures, said Alexis McGee, president of Sacramento, Calif.-based Foreclosures.com. California and Florida, two states hit hard by foreclosures, saw January numbers decline 31 percent and 21 percent, respectively. Nevada was down 20.6 percent at 3,207 foreclosures in January.

While others have speculated that foreclosures would continue to rise, McGee stands by her view that the worst is past. The media are still focused on foreclosures, but the story now is the recovery of real estate, she said.

“Investors and first-time home buyers are coming off the sidelines and buying homes,” McGee said. “These market changes and efforts by some lenders to modify loans is changing the dynamic of the real estate market.”

REO specialist Troy Kearns of Gavish Real Estate said he took on 60 new foreclosure listings in the past week and now has 350, up from 250 a month ago. He has two properties in foreclosure at more than $1.5 million.

“What happened is Fannie Mae’s moratorium is over and they flooded the market,” Kearns said. “I know some guys who got slammed who are handling Fannie Mae properties and they hadn’t done anything for two months. Watch February and March take off.”

Las Vegas-based research firm Applied Analysis also reported a drop in lenders taking back homes. January foreclosures totaled 1,124, down from 1,712 in December, but up 16.2 percent from 967 in the same month a year ago.

There were 6,171 active foreclosures, or units in the foreclosure process, but the title has yet to go back to the bank.

“That tells us there’s a significant number likely to be taken back,” Applied Analysis principal Brian Gordon said. “Looking at the data, it would appear foreclosures remain elevated and we haven’t seen a significant correction yet. We’re going to trudge along here for a while, I think.”

The Obama administration announced a $50 billion initiative this week to help strapped homeowners. Some say banks are worsening the foreclosure crisis and undermining the government’s efforts to keep people in their homes.

“I don’t know how that’s going to play out,” Kearns said of Obama’s plan. “If it slows things down, it’s only a bandage on a blown-out tire. At a certain point, you’ve got to let the market correct itself. Things are selling. People are still buying homes.”

Alan Schlottmann, economics professor at the University of Nevada, Las Vegas, said the Fed is concerned about foreclosures creating further downward pressure on home prices. Las Vegas saw a 34 percent decline in median home prices last year to $163,000, according to Home Builders Research.

“They’re concerned we might overshoot on the downside like we did on the upside,” Schlottmann said. “Existing aid programs are triggered once a homeowner falls behind. Let’s have a program to catch them before they go to foreclosure. Let’s identify people who can make it with a little help before they get in arrears and foreclose.”

Las Vegas businessman Robert McKenzie of Macro Global Concepts met Thursday with Sen. Harry Reid, D-Nev., in Washington, D.C., to encourage lawmakers not to give more bailout money to the banks. Lenders have no incentive to dispose of foreclosed properties at a discount or to modify loans for distressed borrowers when they’re getting bailed out by the government, McKenzie said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.