Foreclosures in March hit record locally

Lenders opened the floodgates by lifting a moratorium on foreclosures in March, resulting in a record number both in Clark County and nationally, a foreclosure expert said Thursday.

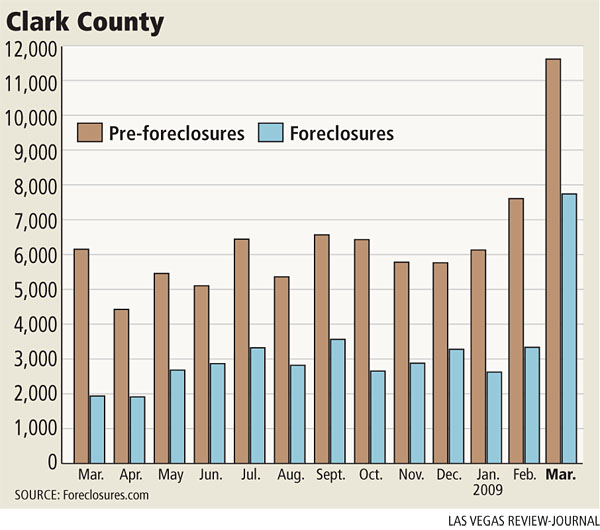

Clark County saw 7,747 homes taken by banks during the month, more than double February’s 3,286 foreclosures and four times the 1,937 in March 2008. The first-quarter total of 13,642 is on pace to shatter last year’s record 31,416 foreclosures in Clark County, Sacramento, Calif.-based Foreclosures.com reported.

The U.S. Foreclosure Index rose 44 percent in March as 175,199 homes were lost to foreclosure, up from 121,756 in February, Foreclosures.com reported.

Clark County pre-foreclosure filings — the foreclosure process that starts with a notice of default — jumped to 11,593 in March, compared with 7,635 the previous month.

Nevada ranks No. 8 in foreclosures nationwide with 26,760 real estate-owned — bank-owned — properties over the past six months. California is first with 130,855 REOs, followed by Florida, 77,542, and Arizona, 53,928.

“Hopefully, this is a short-term surge caused by months of delayed foreclosures,” said Alexis McGee, president of Foreclosures.com. “This is a very troubling turn after seeing some bright spots earlier this year.”

Several banks had agreed to suspend foreclosures while the Obama administration crafted a plan to modify home mortgages for troubled borrowers. They included Citigroup, JPMorgan Chase, Bank of America, Morgan Stanley and Wells Fargo & Co.

Fannie Mae and Freddie Mac, government-controlled mortgage finance companies, suspended all foreclosure sales involving occupied single-family homes and two- to four-unit properties through March 6 to give troubled borrowers more time to negotiate with their loan servicers.

McGee said that a backlog of properties in the system exists and that the backlog is going to take a couple of months to work its way through the process.

With President Barack Obama’s loan modification plan now in effect, the hope is that pre-foreclosure filings will decline, which will help stabilize the housing market, she said.

“I really think at some point that will take hold,” she said. “In the beginning, lenders are having trouble keeping up with demand. If a homeowner was denied (modification) in the past, they need to go back and ask for it again.”

Foreclosures account for roughly 80 percent of homes sales in Las Vegas as investors have returned to the market to snap up deals.

“It’s good for the market that we’re getting rid of them,” Jason Ekus of ReMax Central said. “We had quite a few close (escrow) in March, but we haven’t seen that many since they lifted the moratorium. We won’t see those properties for 60 to 90 days.”

He said most of the real estate agents who specialize in foreclosures experienced a slowdown in new REO assignments, but the banks might be just starting the process now.

Home financing expert Fred Claridge sees both good and bad in “vulture funds” to buy foreclosed homes.

The good news would be professional, for-profit ownership of property that could be sold over the years while being maintained and upgraded, he said. The bad news would be turning housing back to speculators.

“The main difference would be these speculators would not be leveraged, we hope,” Claridge said. “Freddie Mac and Fannie Mae used to have rules that each would not buy more than eight properties for the same borrower.”

Also, he said, Federal Housing Administration financing always had been for owner-occupied, but that slipped while FHA allowed assumptions.

“I believe Freddie and Fannie will pull back on speculators, and FHA should tighten up their underwriting. FHA underwriting criteria are similar to subprime but at near prime rates,” he said.

But Claridge had a warning.

“As an aside, if one were to look at the dark side, should housing decline and the foreclosure rate continue at current levels or increase, FHA could be the next major bailout and could be the mental straw that drives the taxpayer nuts,” he said.

Las Vegas business advisory firm Applied Analysis reported that new foreclosures, or homes that transferred title back to banks, remained elevated at 2,381 in March, a 70.8 percent increase from a year ago. That is about 77 home take-backs every day.

Foreclosure levels reflect the latest market dynamics, Applied Analysis principal Jeremy Aguero said. Pricing in the residential sector has continued to erode, placing an increasing number of homeowners in a situation where they owe more on their mortgage than their home is worth.

“While a portion of foreclosures are the result of borrowers’ inability to make necessary payments due to job loss or other factors, many are facing the psychological dilemma of servicing an obligation with a cavernous disconnect between debt and equity,” Aguero said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.