Home loan defaults climb

Home foreclosures are expected to top 30,000 in Clark County this year, compared with 11,509 in 2007, a California-based foreclosure investment firm reported.

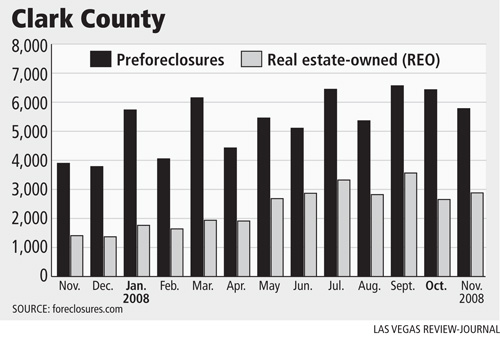

Foreclosures.com counted 2,974 foreclosures in November, bringing the total for the year to 28,133. The monthly number is up from 2,653 in October and more than double the 1,407 Clark County foreclosures in November 2007.

Foreclosures continue to plague the Las Vegas housing market, dragging home values down and competing against traditional home sales. About 60 percent of existing-home sales in October were bank-owned homes, with a median price of $166,000, Las Vegas-based SalesTraq reported.

On a positive note, Clark County preforeclosure filings declined for the second straight month. November’s 5,830 preforeclosures are down from 6,429 in October and 6,565 in September.

“These latest numbers are great news because preforeclosures are early signals of what’s to come,” Foreclosures.com President Alexis McGee said. “The nation’s foreclosure freefall may be subsiding. We still have a long way to go and some of the recent numbers are skewed by lender programs for homeowners that delay rather than eliminate foreclosures.”

Efforts by the government, banks and other entities to work with strapped home-owners to avoid foreclosure are beginning to pay off, McGee said.

SalesTraq reported 2,454 homes repossessed by banks in October, bringing the year-to-date total to 21,025, up 234 percent from a year ago.

“Those things are going to be with us for a while,” SalesTraq founder Larry Murphy said. “The first round of foreclosures was subprime borrowers who had no business buying a house anyway, but the second round is people who had a job and were doing OK.”

Not all preforeclosure filings, which start with a notice of default, end up in foreclosure, McGee noted. Some properties are purchased during preforeclosure, often discounted 20 percent to 40 percent below market value. The owner can walk away with something to show for any equity in the property and avoid a bad credit mark.

Troy Kearns of Gavish Real Estate said lenders seem more willing to deal on foreclosures. He’s selling about 30 percent of his bank-owned inventory every month.

“We’re having no problems moving them at all,” he said. “Banks are being really aggressive with pricing. In terms of a bottom, I’m sure we’re not quite there yet, but we’re hovering around it.”

Kearns’ lowest listing — $37,500 for a house on Euclid Avenue — sold in one day. It was only 600 square feet and needed a little repair, he said.

“You put a renter in there at $500 a month and you’re at 12 percent cash flow,” Kearns said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.