Housing haunted by sales statistics

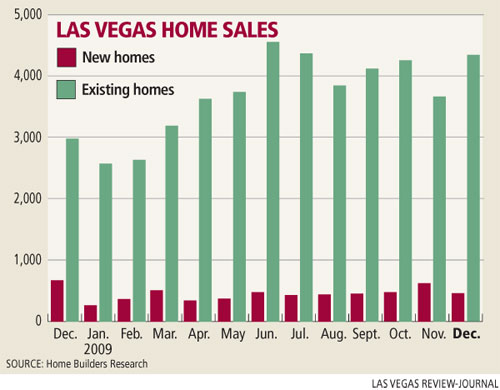

Driven mainly by investors buying foreclosed homes, sales of existing homes in Las Vegas jumped 47.2 percent in 2009 to 44,885 closings, the second-highest number on record, Home Builders Research reported.

On the flip side, new-home sales plummeted to 5,271 in 2009, about half the number from 2008 and an incredible fall from a high of 38,957 four years earlier.

"You’d have to go back to the 1980s to get to 5,000 (new home sales)," Home Builders Research President Dennis Smith said Wednesday. "Now, how soon will it be until we get to 10,000? Let’s just say it’s going to be a while. It’s going to be years."

The Las Vegas housing analyst said he doesn’t know of any possible scenario that would suggest things are going to improve drastically over the next year. There are too many negative factors and not enough positives, he said.

"The only thing that’ll change it is if the banks start lending and that’s not going to happen," Smith said. "For a lot of builders, it goes back to financing. They can’t get financing on projects, at least not the private builders."

Economists at the International Builders Show in Las Vegas predicted a slight increase in U.S. housing starts this year, but they warned that each market is different. Home Builders Research reported 355 new home permits for Las Vegas in December, bringing the total for 2009 to 3,850, a 37.2 percent decline from 2008.

It’s difficult to determine how much of an effect government intervention will have on the housing industry this year, Smith said. The homebuyer tax credit extension ends this spring, which means home sales should climb through the second quarter, he said.

Based on last year’s, when the initial tax credit expired, Smith said he expects a lull in third-quarter sales unless Washington continues or expands the tax credit.

He’s forecasting a slight increase in new-home sales to about 5,750 in 2010 and a drop in resales to 45,000, even though there’s a "preponderance of negative economic and social factors" that could keep consumer spending at a minimum.

"The No. 1 thing that scares me is jobs," Smith said. "If there’s no job growth, how can we expect to see any drastic change in production? These people can analyze all they want, but you have continued unemployment and I think it’s worse than what they’re reporting."

The median resale price was $123,000 in December, down 24.6 percent, or nearly $40,000, from December 2008. However, it has bounced between $122,000 and $126,000 for the past seven months, suggesting some stabilization.

Some analysts predict prices will drop further in Las Vegas when banks release their so-called "shadow inventory" of foreclosures, or homes in default that have yet to go to trustee sale.

Las Vegas Realtor Robin Camacho doesn’t buy into the "double-dip" theory. She expects to see real estate-owned, or bank-owned, home prices remain flat for the next three to four months.

"Las Vegas may see a slight drop in overall prices over the next few months, but this is because the price of short sales and privately held homes are coming more in line with the price of recent REO sales," Camacho said. "Since appraisals are based to a large degree on recent sales and the majority of sales are REOs, this is holding down values."

The median new home price reversed its downward trend, climbing to $216,854 in December, compared with $199,928 in November. It’s down 11.5 percent from a year ago.

Smith said the good news is housing prices in Las Vegas have become affordable. Even without job growth, the affordability factor should be sufficient to push new-home sales to 5,000 to 7,000 units a year, he said.

"We’re still going to sell some new homes. We still have people retiring. Yuppies are retiring and moving here for tax reasons. Being in the Southwest, because of our better weather, there’s always going to be people moving here," Smith said.

Ed Sullivan, chief economist of Portland Cement Association, said homebuilders are unlikely to accelerate construction activity until two critical conditions are met — low inventory levels of unsold new homes and stable or rising home prices.

"With housing prices fluctuating and new foreclosures coming on the market every month, homebuilders have no guarantee of a adequate return on investment," Sullivan said Tuesday at the International Builders Show in Las Vegas. "And there is little to suggest that this will change in the near future."

Smith said he’s lost a number of private homebuilder clients and the ones that survived are running "lean and mean." He started two new files in his office — one for bankruptcy documents from lawyers representing builders and contractors trying to reorganize their debt, another for lenders who are now defunct and have been taken over by the FDIC.

There is some good news, he said: Woodside Homes, one of the top private builders in Las Vegas for many years, is emerging from bankruptcy, and Rhodes Homes may be coming out soon.

Storybook Homes has been revitalized as one of the smaller builders. Harmony Homes, an offshoot of Rhodes Homes, has bought some of the distressed lots from other builders and could have up to 14 active subdivisions by the middle of the year.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.