How Summerlin remains a hot spot among master-planned communities

When executives outlined their vision for Summerlin in March of 1988, builders, real estate agents and bankers were eager to get involved with the massive community to be built from scratch in the desert.

Some people also had a hard time with the name.

One homebuilder called Summerlin “kind of a tongue-tumbler,” and at a news conference, project officials kept using the site’s old name and corrected themselves.

More than 30 years later, Summerlin boasts 100,000-plus residents, a network of parks, trails and community centers, and a commercial core with shopping, restaurants, an ice rink, and minor-league baseball. It commands some of the highest home and land prices in Southern Nevada and remains one of the top-selling spots in the nation for homebuilders.

Kent Lay, Las Vegas division president for Woodside Homes, said that he has been building houses in Summerlin since 1994 and that buyer demand has always been stronger there than in other parts of the valley.

“Summerlin has a lifestyle that none of the other (master-planned communities) have been able to create,” he said.

But before builders buy plots of land in Summerlin for new housing tracts, the developer of Las Vegas’ largest master-planned community, The Howard Hughes Corp., spends plenty of time and money getting chunks of desert ready for new residents.

Spanning 22,500 acres along the valley’s western rim, Summerlin still has plenty of room for more construction, too.

By the end of last year, it had 2,864 acres of residential land and 831 acres of commercial land that could still be purchased and a projected sell-out date of 2039, according to a securities filing.

‘A lot of rules’

Hughes Corp. management in Las Vegas outlined Summerlin’s development process in an interview with the Review-Journal. Years before the company starts building roads, it plans how certain areas will look, drawing up parks, roadways, parcel sizes and home offerings, according to Brian Walsh, senior vice president of land sales for Summerlin.

From there, it starts the engineering to create the 20-to-30-acre parcels it ultimately sells to homebuilders, he indicated.

According to Walsh, it can cost $200,000 to $250,000 per acre to develop typical residential land tracts.

Hughes Corp. develops its desert holdings in a “logical manner” so one area connects to the next, according to Kevin Orrock, Las Vegas regional president.

It also doesn’t shop land around to any willing buyer.

Hughes Corp. monitors builders’ inventory of homesites in Summerlin. It floats maybe two or three parcels at a time and asks three or four builders to make an offer, Walsh said, adding the company also outlines what kinds of homes it wants to see built.

Along the north side of Far Hills Avenue, just west of the 215 Beltway, builders’ offerings include townhouses priced from around $385,000 and single-family homes that start at $1.2 million.

Designating different home types for various parcels helps prevent builders from competing head-on with each other, Walsh indicated.

“They have an expectation that if they come out of the ground with a product, it’s not the identical product across the street,” he said.

Design is also “paramount,” including ensuring that houses next to each other don’t have the same paint colors, said Julie Cleaver, senior vice president of commercial and residential planning for Summerlin.

Homebuilders “haven’t been really happy with me in particular at times … but it makes a tremendous difference in our community and in our neighborhoods when you look at that street scene and things aren’t monotonous,” Cleaver said.

Summerlin also has plenty of homeowners association rules that require people to submit proposed exterior changes to their property to a design review committee.

As outlined in the 32-page “design guidelines and standards” packet for the Summerlin West Community Association, approval from a design review committee is required for exterior alterations including landscaping, windows, planters, paint color changes, basketball backboards, patio covers and water features.

Other rules: Exterior window bars are not allowed; a sign with the name of the firm that installed your home-security system can be placed in the front yard, but it can’t be farther than 24 inches from the house; and flagpoles can only have the United States or state of Nevada flags.

Orrock, the regional president, noted that homeowners associations aren’t for everyone but that the rules are designed to sustain “the quality of the development for a long time.”

“There are a lot of rules, but at the end of the day, it protects the value of arguably the largest investment that most people make, and that’s their home,” he said.

Older areas of Summerlin still look nice and well-kept, he added.

“I hate to say it, but Vegas is one community that as neighborhoods age, they tend to deteriorate,” Orrock said. “And I don’t think you can necessarily say that if you’re living in Summerlin.”

Corporate changes

Howard Hughes, the famed aviator, businessman and recluse, acquired the land now known as Summerlin — named after his grandmother Jean Amelia Summerlin — in the 1950s. Before its current name was unveiled in 1988, the spread was called Husite.

The first residential outpost was Sun City Summerlin. The 55-and-older community proved a success, and given that it was first in line, Summerlin management rolled out an advertising campaign to let people know that Summerlin wasn’t strictly for retirees, Orrock recalled.

It quickly became a popular place to live. Summerlin was the top-selling master-planned community in the nation from 1992 to 1995, missed the title in 1996 by just two home sales, and was on top again from 1997 to 2003, Hughes Corp. has said.

It has also gone through a series of corporate bosses. In 1996, Hughes’ heirs sold the Howard Hughes Corp. to Maryland mall developer the Rouse Co. in a $520 million deal, according to news reports at the time.

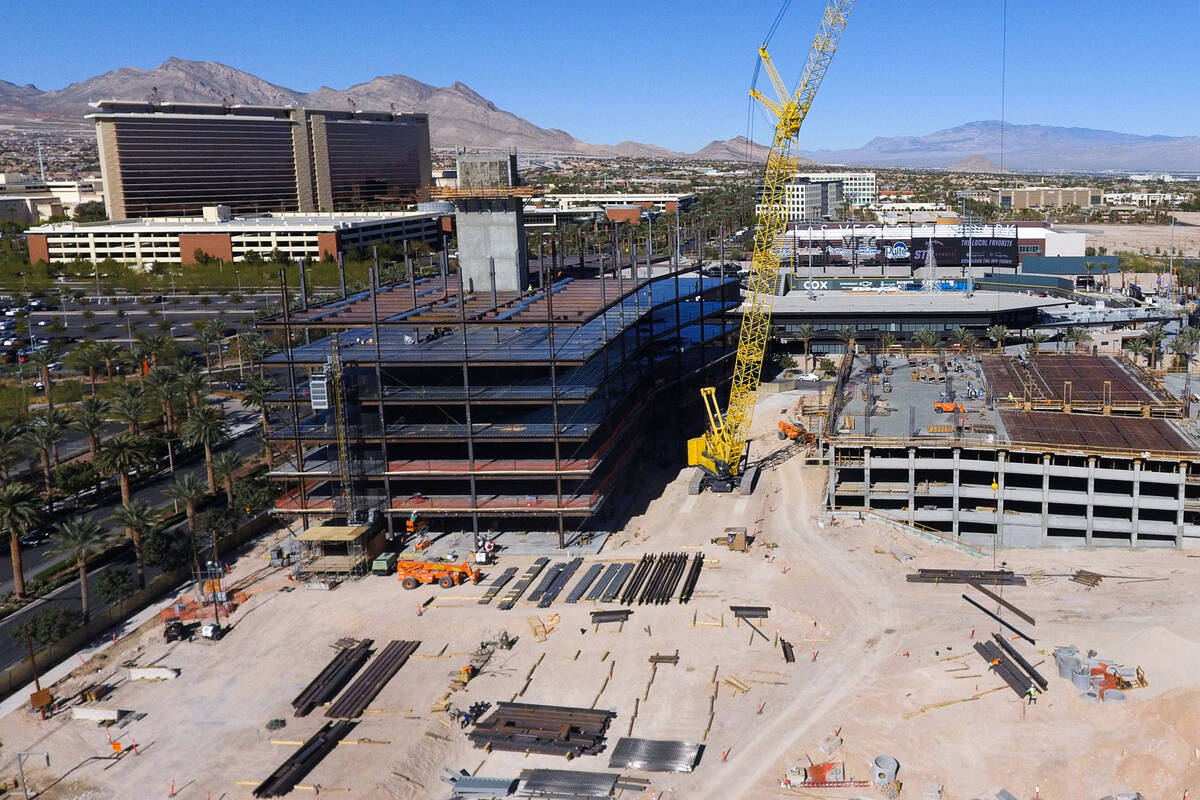

Chicago mall operator General Growth Properties acquired Rouse in a $12.6 billion deal in 2004 as the real estate bubble inflated. But the economy later crashed, and in Las Vegas, General Growth halted construction of the outdoor mall now known as Downtown Summerlin, leaving a steel skeleton off the east side of the 215 Beltway at Sahara Avenue.

General Growth went bankrupt in 2009, and as part of its exit from bankruptcy in 2010, it spun off The Howard Hughes Corp. as a separate company with control over Summerlin and other properties.

Texas-based Hughes Corp. has since developed hundreds of millions of dollars’ worth of projects in Summerlin’s commercial core, bringing retail shops, office buildings, apartments and baseball.

The company owns the Las Vegas Aviators minor-league team and its stadium, Las Vegas Ballpark, which sits across from the company’s 106-acre open-air mall. Neighboring properties include the Golden Knights’ practice rink, City National Arena.

Summerlin also boasts 150-plus miles of trails, numerous parks, and other amenities, including a Fourth of July parade that has drawn tens of thousands of attendees annually.

Last year, Hughes Corp. sold almost 127 acres of residential land in Summerlin for an average price of around $772,000 per acre, the company reported.

Homebuilders also booked just over 960 net sales — newly signed contracts minus cancellations — in Summerlin through the first half of 2021, third highest among U.S. master-planned communities, real estate consulting firm RCLCO reported.

Lay, of Woodside Homes, said that even before the cheap-money-fueled housing craze of the past year or so, his company typically sold houses faster in Summerlin than in other parts of the valley.

As he sees it, Summerlin draws buyers with its sense of community and sense of prestige.

“People want to say they live in Summerlin,” he said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.

Drawing on Summerlin in Arizona community

The Howard Hughes Corp. develops master-planned communities outside Nevada and unveiled plans for its largest one yet last month.

It announced a roughly $600 million acquisition of nearly 37,000 acres west of Phoenix where it plans to develop Douglas Ranch, a community slated to feature 100,000 homes and 55 million square feet of commercial development.

Hughes Corp. CEO David O'Reilly described the community's full build-out as a "50-plus year development pipeline."

O'Reilly said in a statement to the Review-Journal that Hughes Corp. "will seek inspiration from the success of Summerlin and Downtown Summerlin as we look to develop another one of the best-selling communities in the country."

Eli Segall Las Vegas Review-Journal