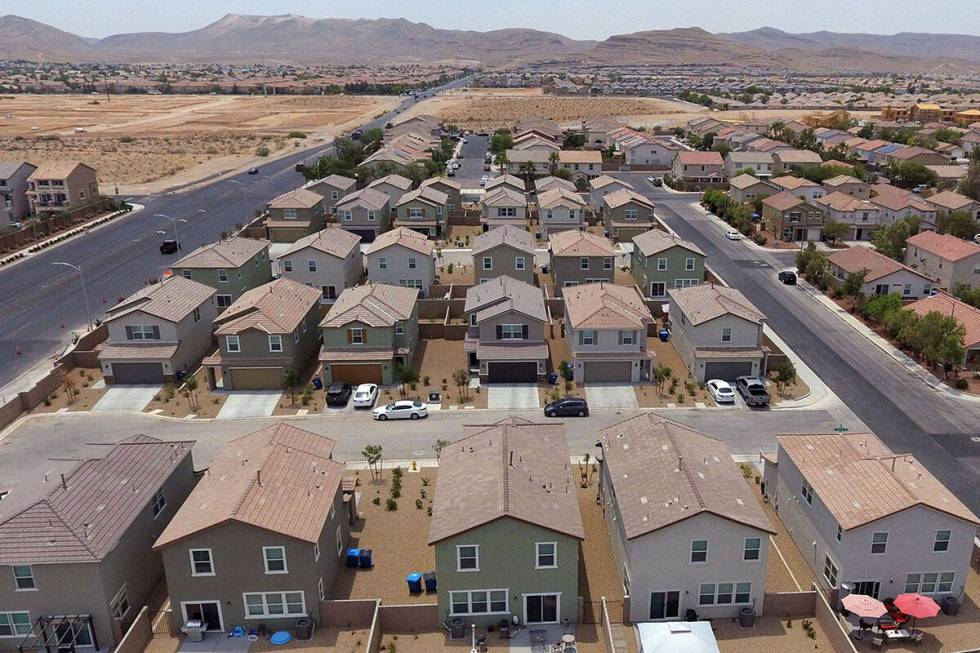

Is Las Vegas a buyer’s or seller’s market for home sales?

The Las Vegas area is in a seller’s market as demand for houses continues to outstrip supply, but the latest peak appears to be over, according to new data from Zillow.

The metro is the 35th strongest seller’s market in the county, with a score of 62.9 out of 100, according to Zillow’s Market Heat Index, which looks at the balance between housing supply and demand. Buffalo, New York, leads the nation (118.1), followed by San Jose, California (111.6), and San Francisco (111.2). The biggest buyer’s market right now is New Orleans at 39.1.

Cities with a score of 70 or more are considered strong seller’s markets. Zillow’s analysis is based on active home listings, share of listings with a price cut and listings that go under contract in 21 days.

George Kypreos, a real estate agent with GK Properties, said we’re definitely in a seller’s market, but it’s a soft one right now and nowhere near the roller coaster ride that housing was on during the pandemic.

“We’ve seen times in the market where rates have dipped and there’s lots of folks who can afford homes and there’s 10 buyers shopping for one home in a neighborhood, and it creates that frenzy and that’s the true definition of a seller’s market,” he said. “On a scale of one to 10, that would be a 10, but today I would say we are more in the seven range, it’s shaded towards a seller’s side. There’s fewer homes for sale than there are shoppers, but sellers still have to negotiate.”

Las Vegas’ strongest seller’s market was back in April 2021, with a score of 86.6, followed by February 2022, with a ranking of 82.2. Las Vegas has technically not been in a buyer’s market since the start of the index in 2018 but was in a neutral market for parts of 2018 to 2019 and from July 2022 to February 2023.

Current market conditions

Kypreos said current market conditions, in which mortgage rates are hovering above 7 percent is definitely dampening sales. Last year was the worst year for sales in the Las Vegas Valley dating all the way to the Great Recession of 2008-09.

“If you’re a buyer trying to find a home for your family, you are kind of caught in the environment you are in. They look at homes and they say for where rates are today and where home prices are, do I see myself comfortable here with this payment, and fortunately a lot of families still believe they can, but you know, it has taken a bit of the wind out of the sales, the higher rates have decreased demand.”

Matt Hennessy, a Las Vegas-based mortgage adviser, said buyer activity has picked up slightly in recent months as it appears some homebuyers are not willing to wait for rates to drop anymore.

“Buyers are becoming more comfortable with mortgage rates given their ability to lock in the price of the home today and having a likely opportunity to refinance to a lower rate in the future,” he said. “With limited inventory the data has shown homes are still appreciating and the cost of waiting may be a disadvantage.”

Hennessy said in terms of the overall U.S. economy and the “data dependent” Federal Reserve, the May jobs report which came in late last week was higher than expected, meaning potential rate cuts are less of a possibility.

“This news was not friendly to mortgage rates as it meant that the Fed is likely to delay its rate cut plans again because a strong job market creates inflationary pressures in the economy. As a result, mortgage rates will trend higher and may stay elevated for longer.”

Orphe Divounguy, a senior economist with Zillow, said the overall outlook regarding the nation’s housing stock is one of demand continuing to outpace supply.

“Buyers are scooping up everything sellers can dish out and then some, leaving fewer total choices on the shelf this year and keeping upward pressure on prices.”

Contact Patrick Blennerhassett at pblennerhassett@reviewjournal.com.