Las Vegas home prices down 5.2 percent from last year

Realtor Tim Kelly Kiernan sees a lot of lowball offers on Las Vegas homes, mostly from investors who aren’t convinced the market has hit bottom.

They automatically factor in a 10 percent to 20 percent discount off the list price, he said.

“They’re very calculating in what they want to offer,” Kiernan said. “They’re cash buyers. Unless the buyer really wants the house, they’re offering below list price.”

February’s housing numbers will likely reinforce their mindset.

The median price of an existing home was $115,000, unchanged from the previous month and down 7.3 percent from the same month a year ago, Home Builders Research reported Tuesday. The new-home median price fell to $195,500, a 6.5 percent decrease from a year ago.

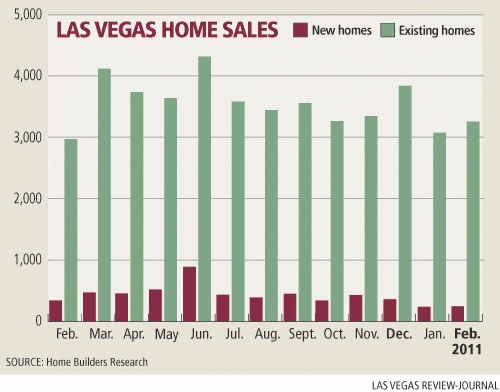

The firm counted 3,241 resales, an 8.6 percent increase from February 2010. New-home sales fell to 237, compared with 322 in the year-ago month.

“Don’t panic. It’ll go up,” said Dennis Smith, president of Home Builders Research. “First of all, there’s not as many new homes to look at and not as many people qualify for them. The biggest reason is because upper-end houses aren’t selling. People can’t move up. They can’t get equity. That’s always been there to move up. Today you can’t say that.”

Las Vegas-based SalesTraq reported 3,616 existing sales at a median price of $110,000, a 20-year low and 5.4 percent decrease from a year ago. The median price for 269 new-home sales was $188,900, the lowest it’s been since 2002.

Perhaps the most damaging statistic is that only one out of every five sales during the month was “nondistressed,” or a regular transaction, housing analyst Larry Murphy of SalesTraq said.

Foreclosures accounted for 45.5 percent of existing-home sales, followed by short sales (21.7 percent) and auction sales (10.3 percent).

“Every day I find more people who are upside down on their home and trying to figure out what to do,” Murphy said. “Upside-down homeowners will continue to feed foreclosures, which will keep prices depressed and until that situation changes, I don’t see things getting any better.”

It would take 30 years for someone who purchased a $275,000 home in 2005 with a $50,000 down payment to gain any equity, Murphy calculated, based on a 30-year fixed-rate mortgage and annual appreciation of 4 percent beginning in 2013.

The house would have lost about $139,000 in value, or negative equity of $89,000, if sold in 2010, and $50,000 if sold in 2020. By 2024, the equity is back to zero, and by 2035, the property value is again $275,000 with $50,000 equity.

SalesTraq reported 372 auction sales at a median price of $86,500; 1,647 real estate-owned, or bank-owned, sales at $106,000; 782 short sales, or lender-approved sales for less than the mortgage balance, at $120,000; and 815 regular sales at $115,000.

Bank repossessions dropped to 943 in February, compared with 1,520 in January. It’s up 5 percent from the same month a year ago.

Murphy said he was surprised that inventory of homes for sale slid nearly 1,000 units from January to 14,401 in February. People may be taking their homes off the market until prices improve, he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.