Las Vegas housing market consistent — in a bad way

The Las Vegas housing market continues to lag other economic improvement as median prices declined in May and new-home sales remained at historically depressed levels, a local housing analyst said Tuesday.

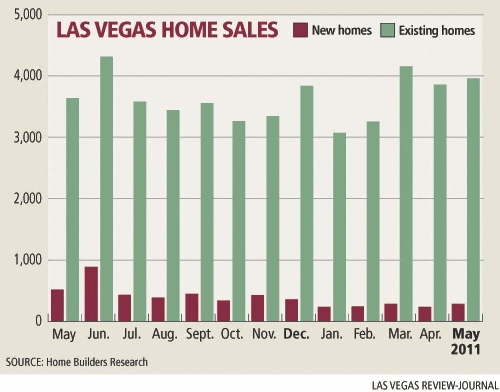

Home Builders Research reported 291 new-home sales in May, compared with 258 in the previous month and 506 in the same month a year ago, when the federal homebuyer tax credit was in effect. The median price dropped 1.8 percent from a year ago to $192,070.

The number of new-home sales has been low throughout the year, averaging 262 a month, and the total for the year is down 36 percent at 1,311.

“We should see the monthly tally rise a little moving forward through June and July,” said Dennis Smith, president of Home Builders Research. They could reach 350 to 400 a month, he said.

His weekly traffic reports are showing net sales per subdivision increasing to about one house every two weeks, up from about one per three or four weeks.

Also, home builders pulled 435 new permits in May, up from 323 in April. Monthly permit counts are a good leading indicator of future new-home absorption, Smith said.

“I’m not saying the recession is over. I’m saying we should see the numbers go up a little bit over the next 30 to 60 days,” he said.

Resale activity is running ahead of last year with 3,956 existing home sales in May, a 9 percent increase from May 2010, according to Home Builders Research. For the year, resales are up 4.8 percent to 18,331.

Smith said he’s ready to bump his 2011 sales projection up to 44,000, not including trustee deeds.

“Yes, prices are down. But the number of recorded transactions is impressive,” he said. “Despite all the negative press, individuals and small and large investors believe it is a good time to purchase real estate in Las Vegas.”

Las Vegas-based SalesTraq reported 298 new-home closings in May, a 42 percent decrease from a year ago. The median price rose 0.3 percent, to $193,843.

Existing-home sales, including trustee sales, jumped 17.4 percent to 4,942 during the month. The median existing home price declined 13.7 percent, to $106,200.

SalesTraq counted 826 short sales, or homes sold for less than the principal mortgage balance, at a median price of $120,000; 746 auction sales at a median of $90,100; 2,005 real estate-owned, or bank-owned, sales at a median of $102,000; and 1,365 nondistressed sales at a median of $120,000.

One of the keys to Las Vegas housing is the real estate-owned element, said Steve Bottfeld, president of Marketing Solutions.

“That has shown virtually no signs of improvement,” he said. “If there is one statistic to watch for Las Vegas’ future, it is the number of potential foreclosures.”

SalesTraq showed 2,233 bank repossessions in May, a 31 percent increase from the same month a year ago and the highest number since October 2009. Smith said an estimated 60,000 foreclosures are sitting in the “silent inventory” that could still be coming onto the market if nothing changes with lender policies.

“It’s not going to take us deeper (into recession), but it’s going to take us longer to get out of it,” he said. “It could be three to five years before we see any noticeable appreciation — and by that I mean 2 percent to 3 percent.”

Local trends mirror a housing market that is slow nationwide. The National Association of Realtors said Tuesday that home sales sank 3.8 percent last month to a seasonally adjusted annual rate of 4.81 million homes. That’s far below the roughly 6 million annual sales rate typical in healthy housing markets.

Since the housing boom went bust in 2006, U.S. sales have fallen in four of the past five years. Analysts say they expect sales to level off at about 5 million a year. That’s not much better than the 4.91 million homes sold last year, the worst showing in 13 years.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491. The Associated Press contributed to this report.