Local existing-home sales surge during May

Sales of existing homes increased for the fourth straight month in May and signs of a price bottom are starting to appear, Las Vegas housing analyst Dennis Smith said Wednesday.

“It could be. Let’s get through the summer before we say anything,” the president of Home Builders Research said. “It’s hard to predict or analyze how to get through the new inventory you hear about of 20,000 foreclosures that haven’t hit the market yet.”

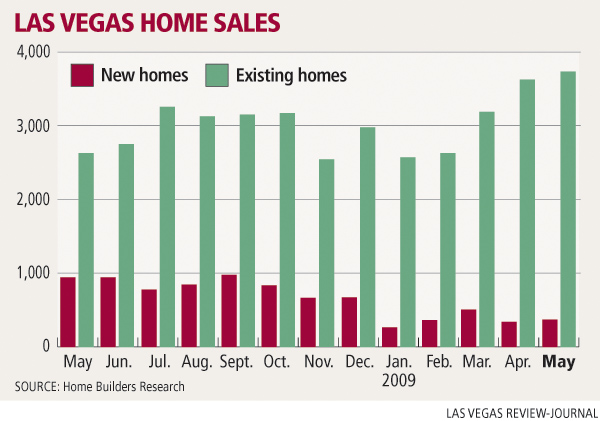

Home Builders Research reported 3,714 resales in May, a 42.5 percent increase from the same month a year ago and up from 3,652 in April.

For the first time in more than a year, the median price was unchanged from the previous month at $130,000. It’s still down 43.5 percent, or about $100,000, from a year ago.

Total resales for the year are up 61 percent to 15,728, an amazing statistic considering all the negative reports bombarding the public almost daily, Smith said.

“Even if the majority of the sales are to investors, we are still selling a lot of inventory,” he said. “During this difficult economic climate, it certainly appears there will be a consistent supply of folks looking for homes to rent.”

New-home sales also rose in May, to 378 recorded closings, compared with 343 in April. They fell 59 percent from 921 in May 2008.

Smith said he doesn’t expect to see the number of traditional, single-family new-home sales increase much this year.

The median price of a new home fell to $212,990 in May, down 23.5 percent, or $65,255, from a year ago. The price has fallen from its peak of $350,615 in early 2006.

Smith counted 308 new home permits in May, bringing the total for the year to 897, a 51 percent decrease from a year ago.

The number of homes for sale on the Multiple Listing Service dipped to 21,181 in May, but it’s going up again when bank-owned properties that haven’t been listed yet come on the market, Smith said.

“They’re going to release them a little at a time, we hope,” he said. “You may see the number of new listings start to increase. Once we get through the summer, we’ll know where we’re at in inventory.”

Las Vegas-based SalesTraq reported 383 new-home sales in May, a 56 percent decrease from a year ago. Existing-home closings increased 66 percent to 4,476, though 64 percent of those sales were bank-owned homes, the research firm reported.

Those homes had a median closing price of $106,000, while homes that were not bank-owned had a median closing price of $140,000. The overall median was $122,000, down 45.8 percent from a year ago.

While President Barack Obama and Congress debate financial regulatory reform, foreclosures continue to mount as embattled housing markets bump along the bottom, said Alexis McGee, president of Sacramento, Calif.-based Foreclosures.com.

Still, some parts of the country are rebounding. Foreclosures are declining, while home sales and average sale prices are increasing, she said.

“We’re in a slow, but definite recovery mode,” McGee said. “While foreclosures persist and unemployment still worsens, there are positives in the market that give a strong indication that housing markets have bottomed.”

In Southern California, home sales rose for the 11th consecutive month in May. A shift toward sales of mid- to high-end homes drove the median price to $249,000, the first increase since July 2007, San Diego-based MDA DataQuick reported.

The company reported that 20,775 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was the most since May 2006.

Smith said homes sales over the summer will depend on how readily financing is available for prospective buyers.

“That’s my point,” he said. “I’ve been saying from the beginning that we’re in the hands of the banks.”

A report from Nevada Title Co. showed 3,277 single-family home sales in May at an average price of $205,213, or $95 a square foot, down 35 percent from a year ago. The average home size was 2,030 square feet.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.