Local home sales stay down

Las Vegas housing analyst Dennis Smith doesn’t think the local market is falling into a "deep crevasse" as some reports around the country may suggest.

The news is bad, but it’s not all bad, he said.

"Yeah, people are out of work, people are going to lose their homes. But it’s going to turn around," the president of Home Builders Research said. "I hope we’ll be talking about this as an educational experience two or three years from now."

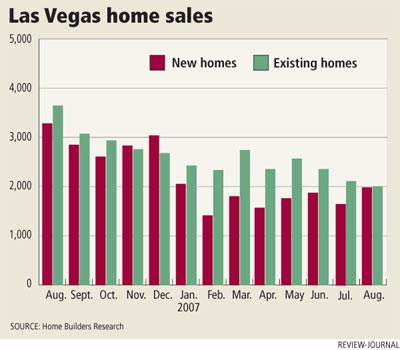

Home Builders Research reported 1,970 new home sales in August, a 39.9 percent decrease from the same month a year ago. Sales are down 43.6 percent for the year.

The median new home price rose 4 percent to $338,560, largely because of mid-rise and high-rise condos. The average price for 486 luxury condo sales in August was $645,353.

The resale segment barely outperformed new homes, with 2,062 recorded escrow closings, down 43.4 percent from August 2006. The median price fell to $275,000 from $289,000 a year ago, or about 5 percent.

"Just to remind these greedy (people) about the price drop, it’s all relative," Smith said. "It’s only dropped from last year and it’s higher than two years ago. It’s not that bad. It’s just bad today. I don’t know anyone that doesn’t think Vegas will come back."

Since 2000, the resale median price increased by $144,000, or 110 percent, he noted. Since 2004, it’s up $25,000, or 10 percent.

Larry Murphy of SalesTraq showed new home median prices gaining 5.8 percent in August to $348,896, while sales fell 39.9 percent to 1,928. Existing home median prices slipped 6.6 percent to $270,000 and sales were off 34.7 percent at 2,390.

The 466 mid-rise and high-rise condo closings in August brought the year-to-date total to 2,073, an increase of more than 1,000 sales from a year ago, SalesTraq reported.

Nevada has led the nation in the rate of foreclosure filings per household, but the Las Vegas housing market experienced the lowest number of foreclosures this year in August, real estate consultant Steve Bottfeld of Marketing Solutions said. The 212 figure was nearly 500 less than July.

"While that is cause for some optimism, it is too early to suggest that the foreclosure rate is slowing," Bottfeld said.

He urged caution in analyzing foreclosure numbers because existing home inventory has reached a record 27,321 and 46 percent of those units are vacant. The Mortgage Bankers Association estimated that investors defaulted on roughly one-third of Las Vegas properties in foreclosure.

"Under normal circumstances, we would suggest that the investor impact on the foreclosure picture is waning," Bottfeld said. "But foreclosure data is not enough. Demand remains weak in the resale sector and appears to be just gathering strength in the new home arena."

Smith of Home Builders Research said the local housing market needs consistency and it has to start in the lending business. Over time, foreclosures should become a nonfactor. But first, lenders have to be willing to discount foreclosed properties more than they have, he said.

Meritage Homes recently lowered prices in some subdivisions by more than $50,000, Smith reported. KB Home is selling a 1,553-square-foot home for $174,990, or $112 a square foot, and a 1,898-square-foot home for $202,990, or $107 a square foot. Rhodes Homes is selling at $125 to $130 a square foot.

These prices seem to be "setting the bottom" of the value ratios for some of the major home builders in Las Vegas, Smith said.

Robin Camacho of Direct Access Lending in Las Vegas said lenders are pulling the plug on stated income loans. It wasn’t such a big deal when it was Bank of America and some of the other conservative lenders who never did much stated income, but now it’s spreading in large part due to Assembly Bill 440 in the Legislature, she said.

"Some people with homes in escrow right now will see their mortgage commitments disappear if they can’t close quickly. This is really going to hit our tip earners in Las Vegas the hardest. Everyone knows their income isn’t easy to verify," Camacho said.