LV to seek housing money

The city of Las Vegas’ plan for allocating $20.7 million in housing funds would help get occupants into an estimated 298 foreclosed properties — a number representing a fraction of the thousands of troubled properties in Las Vegas alone.

"The intent is to stabilize neighborhoods," said city spokeswoman Mary Ann Price. "Foreclosure has a negative impact on communities. You have houses that are vacant and abandoned. They become vulnerable."

The Las Vegas City Council is expected today to forward the plan to the federal Department of Housing and Urban Development for approval. The funds would actually be available next March.

The funding is Las Vegas’ share of $3.9 billion allocated nationally for the Neighborhood Stabilization Program to help redevelop and repopulate foreclosed homes.

The program does not include assistance for people facing foreclosure.

"Not only does it not go far, but it really doesn’t address the vital issue of helping people who are going into foreclosure," said Las Vegas Mayor Oscar Goodman, who has called the approach "topsy-turvy" several times.

"It would’ve been better to earmark this money to help keep people from losing their homes."

Las Vegas’ plan breaks the city’s share into three components:

• Homebuyer assistance ($7.4 million): Households that meet the income guidelines could qualify for mortgage buy down or down payment assistance up to $50,000, although it’s expected the average household will need $30,000.

Participants would invest some of their own money, and the assistance would take the form of a deferred loan so that the city still has a stake in the property if the buyer sells it. If a buyer holds onto the property for 15 years, the loan converts to a grant. The goal is to move people into 245 households abandoned or foreclosed homes.

• Lease to own ($5.4 million): This is a program for households with credit problems that prevent them from getting a mortgage. The goal is for the city to purchase 27 foreclosed homes that would be leased to qualifying tenants, who would have four years to improve their finances and buy the home.

For these two programs, participants cannot make more than 120 percent of the area median income, which would be $53,700 for a single-person household and $76,700 for a four-person household.

• Scattered site housing ($5 million): The city would buy about 26 homes within targeted ZIP codes at a price 15 percent below the current appraised values and operate them as low-income rental housing.

The properties would stay in the city’s affordable housing pool for 15 years. Participants in this program cannot make more than 50 percent of the area median income — that is, less than $22,350 for a single-person household, or $31,950 for a family of four.

The balance of the funding is reserved for administration and services such as appraisals and credit counseling.

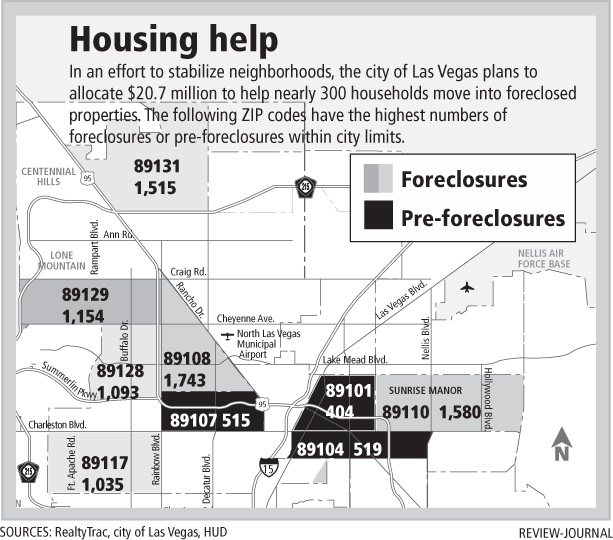

The city’s plan focuses on nine ZIP codes where foreclosures and pre-foreclosures are the highest. Information compiled by the city last month said that there are more than 8,100 foreclosed properties in six of the hardest-hit ZIP codes.

"Would I like more money? Certainly," Goodman said. "Am I going to look a gift horse in the mouth? Certainly not."

Contact reporter Alan Choate at achoate@reviewjournal.com or 702-229-6435.