Mortgage rates dip after reaching 20-year high last week

Mortgage rates dipped this week, giving house hunters in Southern Nevada and around the U.S. a bit of relief after borrowing costs reached their highest level in two decades.

The average rate on a 30-year home loan was 6.95 percent as of Thursday, down from 7.08 percent last week but up from 3.09 percent a year ago, mortgage buyer Freddie Mac reported.

Last week, rates eclipsed 7 percent for the first time since April 2002.

Sam Khater, Freddie Mac’s chief economist, said in a news release that mortgage rates “continue to hover” around 7 percent, as the “dynamics of a once-hot housing market have faded considerably.”

“Unsure buyers navigating an unpredictable landscape keeps demand declining,” he said, adding other would-be buyers “remain sidelined” over affordability issues.

Khater also said that Wednesday’s interest rate hike by the Federal Reserve “will certainly inject additional lead into the heels of the housing market.”

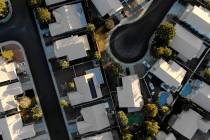

Locally and nationally, homebuyers have been largely pumping the brakes for months, as a sharp jump in mortgage rates wiped out the cheap money that fueled America’s unexpected housing boom after the pandemic hit.

In Southern Nevada, sales totals have dropped sharply from year-ago levels, sellers have increasingly slashed their prices, and builders have offered more incentives to buyers.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.