Pluck, purpose help exec pilot title company through slump

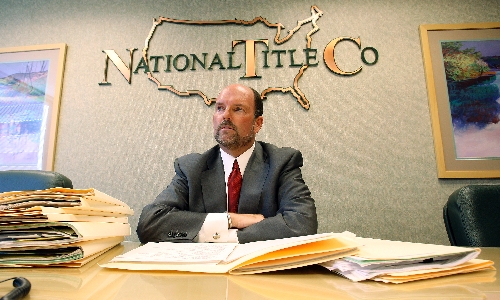

Sifting through thousands of escrow closings a month as president and chief executive officer of National Title Co. gives Tracy Bouchard great insight into the Las Vegas housing market.

The numbers he sees aren’t pretty.

Short sales and REOs, or bank-owned homes, make up more than two-thirds of the closings and the average closing price is down about $7,000 from a year ago. Less volume and lower prices translate to decreased revenue for Bouchard’s business.

National Title, established by Bouchard’s father, Butch, in 1983, had about 130 employees “when the light switch went off,” Bouchard said. Now it’s down to 30.

Things are getting a little better. The company is opening a small office in downtown Las Vegas to serve clients buying homes at auction on the courthouse steps. He’s also opening an 8,000-square-foot office near Sunset Road and the Las Vegas Beltway.

“We’re very fortunate because the community supported local businesses. We needed that more than ever during the recession,” Bouchard said from his third-floor office at the Bank of Nevada building on West Lake Mead Boulevard. “The Herbsts, the Collinses, the Peccoles. Those deep roots have helped us today. While most independent agencies are closing down, we’re still here.”

Bouchard said most of his escrow officers have been with National Title for more than a decade and his controller was with the company when it was Lawyers Title of Las Vegas.

Bouchard, a graduate of Las Vegas High School, started with the family-owned business in 1984 and bought the company in 2003. His father, now 86, remains as a consultant.

Question: What service does National Title provide?

Answer: We’re an escrow and title company. We ensure the owners of a property they have clear title and we’re issuing a lender policy as to the position they requested, when they make the loan in the first position or the second position.

Question: How do you generate revenue?

Answer: Policy and escrow fees. They’re filed with the Department of Insurance and we charge in accordance with fees based on liability of insurance, sales price of the house, the loan amount.

Question: What’s the average fee?

Answer: On an average house of $150,000, the owner’s policy is $850 and the escrow is $430, approximately.

Question: How would you describe the state of the title business?

Answer: I think we’re in a very tough market, a challenging market, and that’s why I feel it’s important for locals to support local business. It’s a sluggish housing market. We used to have a fair amount of refinancing. We have very little right now. We do a lot of business with cash investors down at the auction. People think investors are bad for the market. I think they’re a badly needed component to this market. They create jobs and they fix neighborhoods up. Do you know how many homes would sit vacant and be an eyesore if it weren’t for investors? And they bring HOAs (homeowners association fees) current.

Question: We’ve talked about the foreclosure moratorium and the “robo-signers.” How much have they affected your business?

Answer: If you take foreclosures, with the volume we have, and put it under the microscope, you might find some “t’s” not crossed and some “i’s” not dotted, but at the end of the day, you’ve got to make your payment. Most people are living in their house for a year without making a house payment. Bottom line is it’s personal responsibility. If given the opportunity, I don’t believe many of those folks would want their homes back anyway with the current debt and payment associated with them. For most, the values have dropped more than 50 percent, so it’s more of a strategic decision. Do I wait seven to 10 years for the home to balance out with the current encumbrances? Or do I save the money until the bank forecloses and figure out a way to buy a home at today’s values and get seven to 10 years of appreciation, assuming the values start moving in the right direction? There are exceptions to everything, and for the folks that have lost their jobs, their homes and pretty much everything due to circumstances beyond their control, it’s horrible and hopefully 2011 provides extraordinary opportunities for them.

Question: Have you had any problems with “clouded” titles on homes in foreclosure because of robo-signers? Do you foresee problems down the road?

Answer: No, I don’t. The robo-signing, I think what it’s done is it’s given us a heightened level from underwriters for searching the titles for our properties. The heightened level that was the directive from underwriters is the protocol we were following anyway.

Question: Does your company also handle commercial real estate escrow?

Answer: National Title does a substantial amount of commercial business. We’ve closed some of the largest transactions in Vegas since our inception. Even over the past few years, while the business climate has drastically changed, we’ve continued to be one of the top commercial title companies, closing over $1 billion in commercial transactions.

Question: What are some challenges for your business today?

Answer: Working with less staff … that’s one of the challenges. Obviously, I’m a fortunate guy to own a company and still be in business because I’m dependent on the housing market. I’ve got a group of people who are extremely dedicated to their job. They understand what it takes to be successful in today’s environment. They understand the true team effort. They’ll work seven days a week, 10 to 15 hours a day because home values are reflected in the premiums you make in the title business and it’s down 50 percent.

Question: How do you overcome such challenges?

Answer: We have. How I accomplish that is by the support of the community and having some of the best co-workers in the industry. They understand the challenges and come to work every day and give it 110 percent. They’re not hiding under their desks in survival mode. They’re in thriving mode to help grow the business and extend customer service. The only way we get business is to help our clients further their business. We have a marketing team that’s always looking for innovative ways to gain market share for Realtors.

Question: Have you hired any new employees lately? How many?

Answer: Yes. We hired about three additional marketing reps six months ago. We just hired an escrow officer last week for the new branch at Fourth (Street) and Charleston (Boulevard). We’ll have about 25 people at the Sunset office.

Question: What do you look for in a new employee?

Answer: We look for experience. That’s very important in today’s market, and a tremendous work ethic. A five-day, 8-to-5 job is not going to cut it. You have to be 100 percent committed to the job.

Question: Who taught you the most about this business and what did you learn?

Answer: My father. I worked with my father my entire adult life. He taught me all about the business. He taught me to have a strong work ethic and that the most important asset to the company without exception is the employees. Take care of the employees and create that family camaraderie in the company and they’ll in turn take care of customers. These guys are my family, my extended National Title family. We all have each other’s backs here.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.