Sales of new homes slipping

New-home sales in Las Vegas are at their lowest level in 23 years, struggling to maintain a pace to reach 3,500 for the year, housing analyst Dennis Smith of Home Builders Research said Monday.

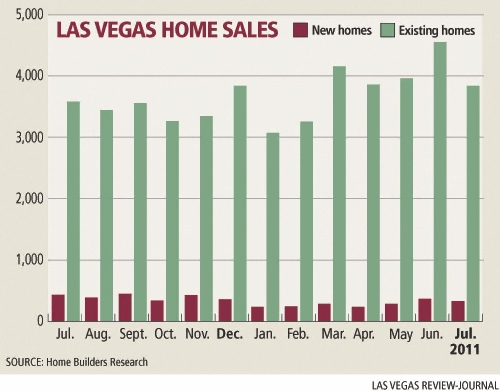

He counted 316 new-home sales in July, bringing the total for the year to 1,990, a decrease of 41.8 percent from the same period a year ago, when the federal homebuyer tax credit was in effect.

The numbers will probably dwindle in the later months of the year, as the summer months are typically the peak home-buying season, Smith said.

Traditional new-home closings — not including high-rise condos and apartment conversions — tumbled from a high of 30,829 in 2005 to 4,761 last year.

Some homebuilders in Las Vegas have turned to purchasing and remodeling existing homes for resale to stay in business.

“These smaller builders — my hat’s off to them,” Smith said. “They could just fold up and go on vacation, and some of them have. Some of them are out there doing stuff, not getting rich doing it, but keeping their doors open and keeping people working.”

The median price of a new home fell to $198,518 in July, down 5.6 percent from a year ago. In June, the price was up 7.4 percent.

Smith said the new-home price keeps bouncing around the $200,000 mark and will probably stay there for many months.

“As much as we would like to feel optimistic for any positive signals that would suggest upward price movement of new homes, it does not appear to be in the cards,” the housing expert said.

Builders pulled 287 new-home permits in July, led by KB Home (42), Richmond American (38) and Pulte (26). Permit activity is down 28.5 percent from a year ago, at 2,311.

There were 3,837 recorded resales in July, down from a robust 4,541 in June. For the year, existing-home sales are up 5.3 percent, to 26,709.

The median price of resale closings was $109,900, down 10.9 percent from a year ago, and the fifth straight month of decline. There’s no way of telling how long the trend will continue, Smith said.

About half the sales are foreclosures and 20 percent are short sales, or lender-approved sales for less than the principal mortgage balance. Investors are taking advantage of the distressed market.

But anyone who thinks the Las Vegas housing market is dead is out of touch with current market conditions, said Amelia Hyden, chief executive officer of Appraisal Management Company of Southern Nevada.

“If you are fortunate enough to be one of those cash buyers, the market is anything but dead,” she said. “The amount of cash buyers in today’s market is phenomenal.”

If there’s any good news, it’s that many of the empty, dilapidated homes that languished on the market for months have been purchased at steeply discounted prices and rehabilitated, Smith said.

“Look around your neighborhood. Is your neighborhood better or worse than a year ago? If I compare my neighborhood, mine looks better,” he said.

One of the topics being discussed in Washington, D.C., is how to rid the economy of foreclosed homes held by Fannie Mae, Freddie Mac and the Federal Housing Authority.

With today’s tight lending policies and lack of good credit among consumers interested in buying a home, it makes sense to turn some of those foreclosures into rentals, Smith said. Nationally, about 800,000 foreclosed homes are owned by banks, including 264,000 by Fannie, Freddie and FHA.

“We know there’s a lot of people still in trouble with their mortgage,” Smith said. “It took two years before the root of the problem was identified, which is to keep people in their houses.”

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.