Single-family home sales rise 6.8 percent; prices up

Sales of single-family homes in November rose 6.8 percent from the previous month and the median price climbed 1.4 percent, though year-ago comparisons remain depressed, the Greater Las Vegas Association of Realtors reported Wednesday.

Realtors sold 2,777 homes during the month, an improvement from 2,599 in October, but down 10.9 percent from 3,117 in November 2009. The median price fell 3.6 percent from a year ago to $134,900.

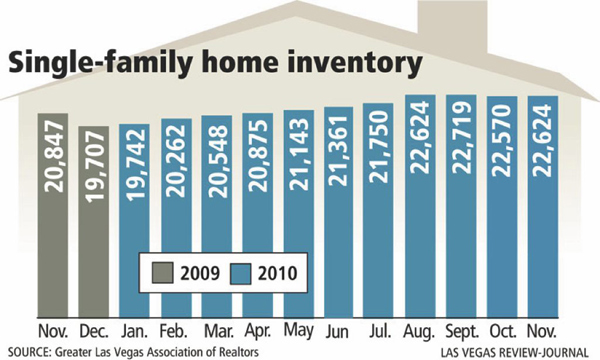

Inventory of homes for sale continued its steady climb to 22,624 in November, increasing 0.2 percent from the previous month and 8.5 percent from a year ago. Roughly 70 percent of the inventory is bank-owned homes and short sales, or homes offered at less than the mortgage owed. The number of units available without offer is 12,581, a 50 percent increase from a year ago.

Overall, the monthly statistics were somewhat encouraging, said Rick Shelton, president of the Realtors association.

Shelton said he was “pleasantly surprised” to see home sales increase from October to November, the first time that’s happened since 2004. They usually decline in November and through the winter months before bouncing back in the spring, he said.

“That’s a very good sign,” Shelton said. “At the worst case, we’ve got a slow start to a typical slowdown in the season. It could be a trend line. We’ll see in December.”

The median price of 733 condominiums and townhomes sold in November was $64,900, down 0.2 percent from $65,000 in October and down 4.6 percent from one year ago.

Home prices in Las Vegas have plummeted to a 14-year low, housing analyst Larry Murphy of SalesTraq reported. The existing median price is $120,000, about what it was in 1996. New-home prices are substantially higher at $205,000, slightly more than they were in 2003.

About 70 percent of home sales this year were “distressed” sales, a combination of bank-owned homes, short sales or auction sales, Murphy said. Unfortunately, those sales have served to drag down the price of nondistressed sales as well, he said.

He showed the median price of a real estate-owned, or bank-owned, sale at $119,000; short sale at $123,000; auction sale at $98,500; and nondistressed sale at $125,000.

A couple of components come into play with the increased housing inventory, Shelton said.

One is the Home Affordable Foreclosure Alternative program implemented in April that gave lenders incentives to approve more short sales, hence more listings.

Second is the homebuyer tax credit that boosted sales by about 12 percent nationwide until it expired in April, the National Association of Realtors estimated. The increase was probably 15 percent to 20 percent in Las Vegas because the city has more people in the age group of first-time buyers and home prices have been reduced by 50 percent, Shelton said.

Calculating a 20 percent reduction in pre-tax credit monthly home sales would bring the number down to the current 3,500 single-family home and condo sales, the Realtors president noted.

“We had a false increase. Sales are static,” Shelton said. “Realistically, without the external factors, inventory has been stable for 24 months. Take the sales numbers … it translates the same way.”

The percentage of local homes purchased with cash continues to rise, accounting for 47.8 percent of all local home sales in November, up from 46.5 percent of all sales in October. Shelton said this percentage of cash buyers is likely a modern-day record for Southern Nevada, and perhaps the highest percentage of cash buyers of any major city in the nation.

Statistics from the Greater Las Vegas Association of Realtors are based on data collected from the Multiple Listing Service and do not necessarily account for sale by owners, homebuilders and transactions not involving a Realtor.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.