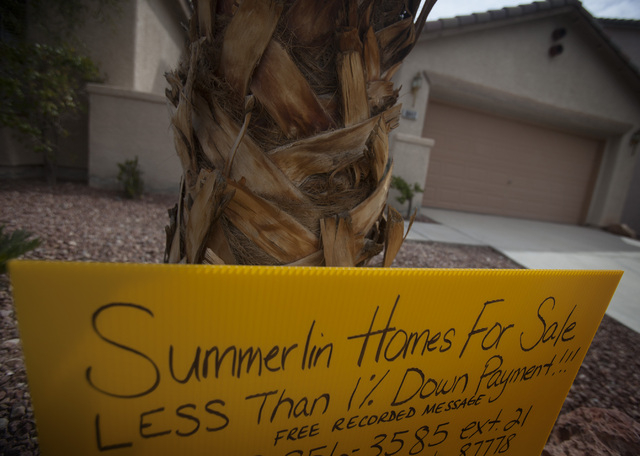

Las Vegas home prices continue winning streak, rise 21.1 percent in March

Local home prices continued their two-year winning streak in March.

The median price of an existing single-family home in the Las Vegas Valley jumped to $195,000 in March, up 21.1 percent from $161,000 in March 2013, according to a Monday report from the Greater Las Vegas Association of Realtors.

Prices also rose month to month, jumping 2.6 percent from $190,000 in February. That was an improvement from the fall and early winter, when month-to-month appreciation stalled.

Condo and town house resale prices advanced 26.1 percent, to $100,953, compared with $80,150 in March 2013.

Heidi Kasama, president of the Realtors’ association, said part of the boost came from a normal, seasonal jump in sales activity that also helped push up prices. Some also traced back to a lingering shortage of for-sale inventory. When buyers can’t find enough homes on the market, prices can spike.

“There was a demand, and people paid for it,” she said.

The association tracked 6,470 available single-family units without offers in March, up nearly 130 percent from a year ago. Available condos and town houses numbered 2,295 units, an 88.3 percent gain. Despite the rising inventory, available units remain below healthy levels for a market this size, Kasama said.

Still, as inventory continues to expand, the city’s housing market should stay stable in coming months, she said.

Distressed and investment home purchases also continued to shed local market share in March. The association’s numbers showed that cash buyers — usually individual investors — made up 43.1 percent of the market, down from 46.8 percent in February and well below a high of 59.5 percent in February 2013.

Also, 12.9 percent of March’s sales were short sales, in which banks approved a sale for less than the home’s mortgage. That share was down from 14 percent in February. And 11.7 percent of sales were bank-owned foreclosure sales, down from 12 percent a month earlier.

Local home prices peaked at a median of $315,000 in June 2006, and fell to a low of $118,000 in January 2012. Prices have risen in all but one month since March 2012.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512. Follow @J_Robison1 on Twitter.