Nevada gaming revenues down 13.7 percent in February

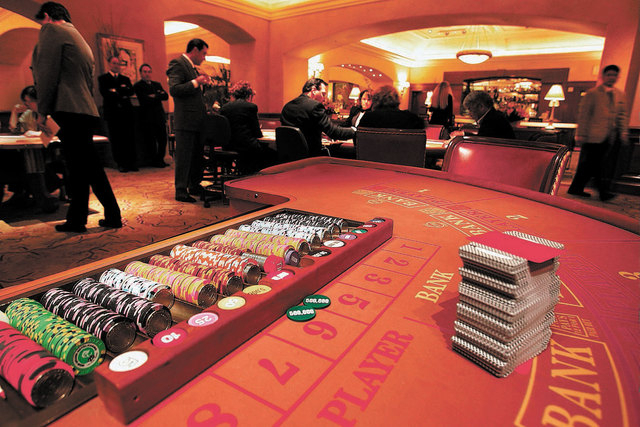

Nevada casinos went into February facing a comparison to the state’s largest gaming revenue month in almost five years and a baccarat revenue month that was an all-time record.

So the state’s 13.7 percent gaming revenue decline wasn’t too much of a surprise.

High-end baccarat players, lured to Las Vegas by the Chinese New Year holiday, had a run of good luck at the tables.

The Gaming Control Board said Friday that February results also included $824,000 from online poker, marking the first time the state has broken out the revenue figures. There are three online poker sites accepting real-money wagers from gamblers playing inside state borders.

“It’s in its infancy,” Control Board senior research analyst Michael Lawton said of the state’s online poker business. “We’ll see what happens.”

In the 10 months since the first website went live, online poker has contributed $8.5 million in gaming revenue.

Statewide, gaming revenue was $926 million compared with $1.073 billion in February 2013. On the Strip, gaming revenue was $555.7 million, a 20.2 percent decline compared with $696.1 million in 2013.

Baccarat play was the contributing factor in the decline.

Casinos collected $158 million from baccarat, a decline of 40 percent compared to the all-time record of $263.8 million in February 2013. The amount wagered on baccarat was $1.3 billion, a decline of 19.1 percent. The hold percentage — the percentage amount casinos won versus what players collected — was 12.3 percent, compared with 16.6 percent last year.

Revenue figures also declined in all other table games.

“To make matters worse, the core gaming segment held unlucky once again,” Susquehanna gaming analyst Rachael Rothman said.

Macquarie Securities gaming analyst Chad Beynon said the first two months could foreshadow a tough first quarter for several casino companies, including Wynn Resorts Ltd., Las Vegas Sands Corp. and MGM Resorts International.

“While Strip revenues fell significantly for February, the majority of the downfall came on the baccarat tables, which are concentrated at half a dozen Strip locations,” Beynon said.

Stifel Nicolaus Capital Markets gaming analyst Steven Weiczynski said despite the declining gaming revenue, visitation remained strong, which is a figure most investors focus on.

“To that end, we remain upbeat on the Strip’s prospects over the balance of 2014,” Weiczynski said. “We believe incremental group and convention trips should not only benefit higher-tier properties, but trickle down to mid- and lower-tier assets as higher-quality occupancy becomes scarcer.”

Clark County as a whole saw gaming revenue decline 15.2 percent. Laughlin, down 5 percent, and the Boulder strip, off 9 percent, had the only down months of the county’s reporting areas. Downtown casinos and North Las Vegas saw gaming revenue increase 3 percent each.

February was the second straight monthly decrease, following January’s 2.76 percent decline.

The month included $19.67 million in revenue casinos collected from Super Bowl wagering, a previously reported record.

“All in all, it was a good revenue month,” Lawton said. “But it was just a tough comparison.”

Washoe County gaming revenue, which includes Reno, declined 1.4 percent while North Lake Tahoe suffered the largest decline with a drop of more than 22 percent.

Nevada collected $58.9 million in gaming taxes through March 25, based on February’s revenue, a decline of 4.63 percent. For the first nine months of the fiscal year, gaming tax collections were off less than 1 percent.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.