Report says housing bust has silver lining: affordability

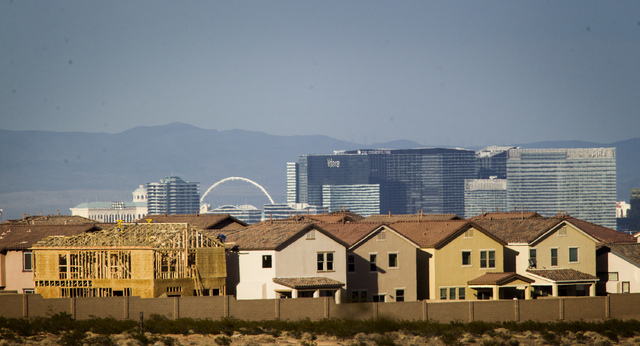

A new report points to a silver lining in Southern Nevada’s housing bust.

The study, released on Thursday from real estate website Trulia, shows the vast majority of local homes for sale in Las Vegas are affordable to the typical household, thanks to the city’s recession-era price crash. And that housing accessibility could prove important to the city’s economic future.

“Housing affordability affects economic competitiveness. Housing costs are an important part of doing business,” said Jed Kolko, Trulia’s chief economist. “Taxes get a lot of attention, but often, the difference in housing costs matters a lot more to whether businesses and people move, and to where.”

Las Vegas has a pretty big pricing difference to exploit these days. Based on a median local income of $49,546, 72 percent of local homes listed for sale are within reach of the typical household. A family earning the median could afford as much as $241,000 worth of house and still keep its payment below 31 percent of income, Trulia’s report said.

These days, $241,000 goes fairly far here. At that price on Thursday, the Multiple Listing Service showed a 2,437-square-foot, three-bedroom home on nearly a quarter of an acre in Summerlin, near Sun City and Lake Mead boulevards. There was also a 3,075-square-foot, four-bedroom home on half an acre in the southwest, near Robindale Road and Decatur Boulevard.

The report found that Las Vegas housing is more accessible than housing in other regional markets. In Salt Lake City, 65 percent of homes for sale were within reach. In Phoenix, 68 percent of listings were affordable. And just 49 percent of homes were available to the typical household in Riverside-San Bernardino, Calif.

“Las Vegas is much more affordable than other cities in the West, and that means we become an attractive destination for people who are retiring,” said Steve Brown, director of UNLV’s Center for Business and Economic Research. “We also provide affordable housing for people who are working.”

Local homes are also far more affordable than they were at their 2006 pricing peak, when $200,000 might have netted a two-bedroom condominium with no garage in an average neighborhood, said Tanya Murray, a Realtor with Realty Executives of Nevada.

“Our affordability level had really gotten off track at that point,” Murray said.

Trulia doesn’t have numbers on affordability in the bubble. But the median home value maxed out at $315,000 in 2006, according to the Greater Las Vegas Association of Realtors. The median household income was higher, too, at $54,334. And interest rates were costlier, at about 6 percent, compared with 4.5 percent today, Kolko added.

Any improvement in affordability is important, though, particularly for quality of life. In pricey markets, people have to double up on housing with family or roommates. They also settle for less space, or a longer commute from a suburban area with affordable housing, Kolko said.

High housing prices can also curb economic growth: Where homes cost a lot, commercial real estate tends to be pricey, too, and that can curb business expansion, Kolko said.

The latest stats do wave a few yellow flags for Las Vegas, though.

First, the share of local homes available to the median earner was down from 82 percent in 2012. Kolko called it a significant decline, due partly to higher interest rates, which were at 3.5 percent a year ago, and to higher prices. The median local home price hit a low of $118,000 in January 2012, but reached $180,000 in September, according to the Realtors association.

What’s more, beyond income you’ll find accessibility hurdles that other markets may not have, experts said. Include discouraged and underemployed workers, and Nevada’s jobless rate is still 19 percent. That’s a large core of locals who couldn’t buy even if they wanted to. The state also has above-average numbers of consumers with credit blemishes including foreclosures, short sales and bankruptcies.

So don’t expect the city’s overall affordability to translate into a buying surge, Brown said.

There’s even mixed news from Southern Nevada’s most important feeder market for new residents and tourists. Affordability plunged in California in the last year, with available listings falling 15 percentage points or more in Los Angeles, San Diego and Orange and Ventura counties. That could force more households out of California. Some of them may come to Nevada, Kolko said, but others may move even farther away, which could hurt weekend visitation. Plus, where home prices spike, people have less discretionary income for travel.

Murray said she expects affordability levels to stabilize as local price gains slow in coming months. Some sellers are reducing prices, and buyers are “pulling back a bit” rather than panicking over buying now, she said.

“We’re moving into a stabilization pattern right now, most definitely,” she said.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com. Follow @J_Robison1 on Twitter.