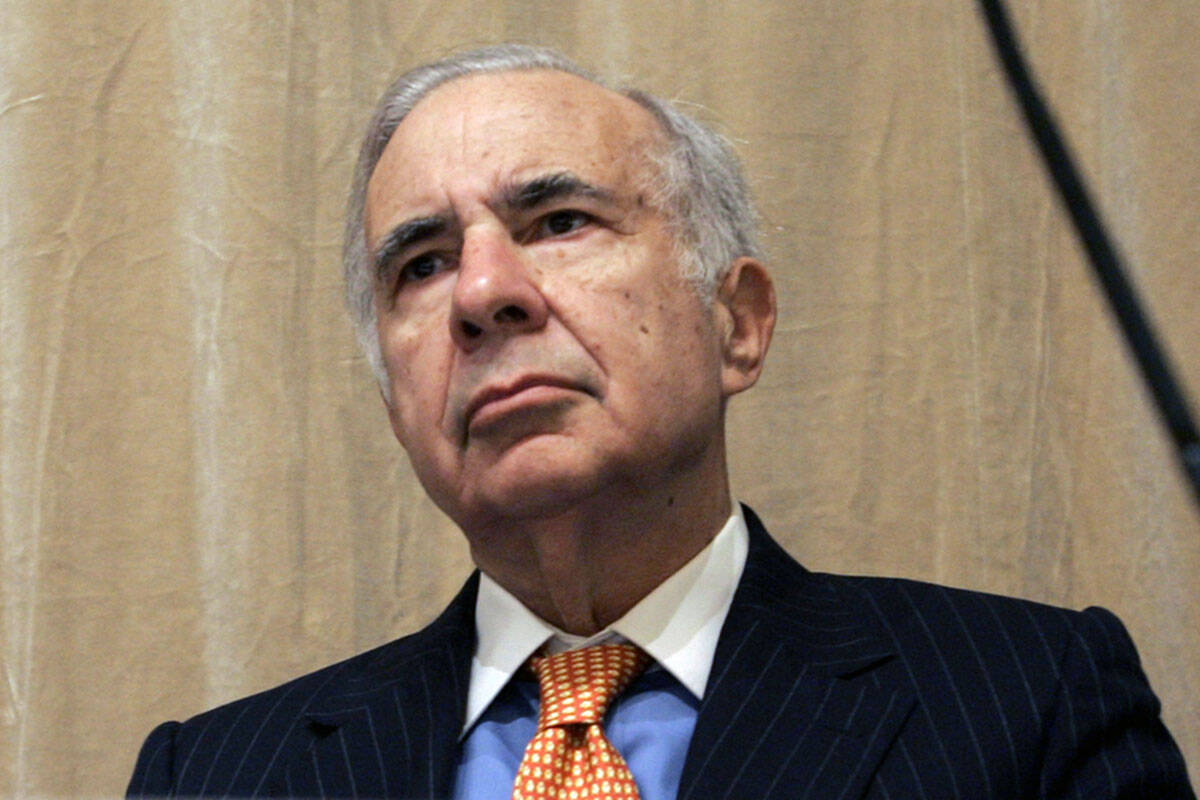

Southwest Gas calls Carl Icahn tender offer ‘opportunistic’

Southwest Gas Holdings pushed back against an extended offer from activist investor Carl Icahn to buy remaining shares of the company, calling the offer an unwelcome attempt to acquire it, the Las Vegas-based utility service said.

The rejection, announced Friday, follows Icahn’s bid to buy any outstanding company shares for $75 per share. It’s part of an ongoing feud and proxy fight between the gas company and the billionaire investor with a history of aggressive investing and takeover tactics.

Southwest Gas’ board of directors previously rejected Icahn’s tender offer, which the company described as “unsolicited, inadequate, structurally coercive, highly conditional and illusory,” according to the Friday news release from the gas company. The board continues to recommend stockholders don’t tender any of their shares.

Southwest Gas said financial and legal reviews of the offer determined it was not in the best interest of Southwest stockholders and that it undervalues the company.

“Tendering into Mr. Icahn’s Offer would only encourage an opportunistic attempt to acquire Southwest Gas at an inadequate price and contingent upon a long list of ambiguous conditions, some of which Mr. Icahn has made no move to fulfill,” according to the company’s statement.

On Oct. 5, Icahn shared an open letter to Southwest Gas noting that he was a “large shareholder” and criticizing the company for its pending efforts to buy Dominion Energy Questar Pipeline, LLC for more than $1.5 billion. Icahn said he owns a 4.9 percent stake of the company, according to the Wall Street Journal.

Later in October, Icahn announced that he intended to wage a proxy fight to replace the company’s entire board and buy up remaining shares for $75 a share.

Southwest Gas defended the decision to buy the Questar, noting the 2,160 miles of interstate gas pipelines in the Rocky Mountains would provide “extremely attractive energy transition opportunities” via renewable natural gas, hydrogen and carbon dioxide transportation, per the gas company’s board.

Shares of Southwest Gas Holdings, traded at $SWX on the New York Stock Exchange, opened Monday at $71.04 per share and closed 1.52 percent below at $70.20 per share. The company’s response to the tender offer was released on a stock market holiday.

McKenna Ross is a corps member with Report for America, a national service program that places journalists into local newsrooms. Contact her at mross@reviewjournal.com. Follow @mckenna_ross_ on Twitter.