Expansion makes McCarran airport more efficient for global travel

When it inaugurated its Las Vegas-Duesseldorf, Germany, flights on May 10, airberlin was late for its own party.

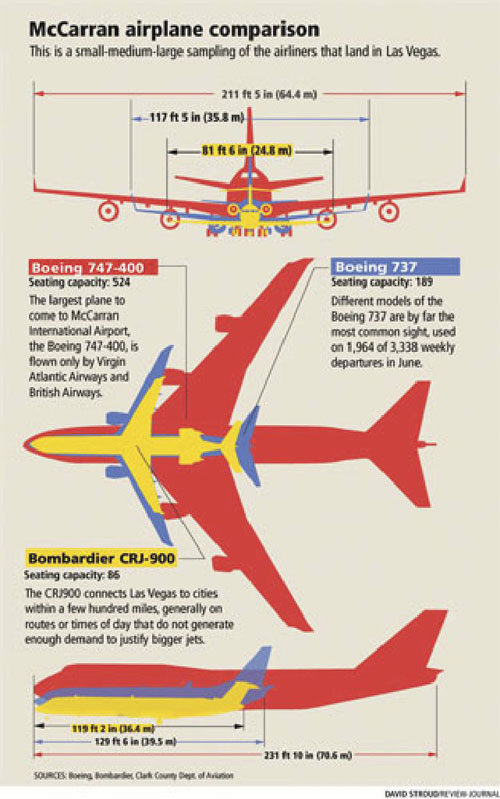

The plane reached McCarran International Airport's Terminal 2 right on time at 4:15 p.m., but two Boeing 747 jumbo jets had docked at other gates minutes earlier. By the time airberlin VIPs cleared customs and immigration, they were about an hour behind schedule for the speeches and publicity photos.

That ceremony encapsulated the problem Terminal 3 is designed to fix, replacing a Terminal 2 built two decades ago primarily for charter flights.

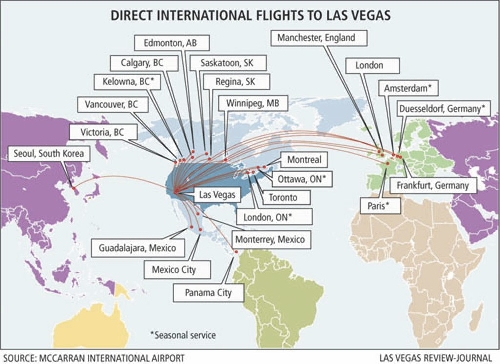

As Las Vegas grew into a world-class resort destination, with 181 flights a week in April to foreign destinations, the cramped and obsolete international terminal became a world-class choke point.

When pitching foreign airlines to include Las Vegas in their route systems, said Randall Walker, director of the Clark County Department of Aviation, "it didn't help when we made our case that we had to limit our arrivals to three an hour. With Terminal 3, each gate becomes much more efficient."

But will that be enough to lure more direct international flights to McCarran?

"You're not going to get Air France suddenly decide to fly from Paris to Las Vegas because of a new terminal," said airline consultant Jack Keady of Playa del Rey, Calif.

INTERNATIONAL TRAFFIC KEEPS GROWING

Seven of the T3's 14 gates are configured for international travel, segregated from other gates in the terminal with jetways that can funnel people straight to a larger U.S. Customs and Border Protection processing area.

Able to handle planes simultaneously at all seven gates, McCarran will increase capacity from 800 passengers an hour to 2,000, although Customs won't say how many agents it will have on hand or project wait times.

Four of the jetways can match up with two cabin doors at once, allowing faster unloading of long-range wide bodies such as the 747. One gate can handle the double-deck, 555-seat Airbus A380, although it would not be an easy fit, and no one expects the world's largest passenger plane to be placed on a Las Vegas route.

T3's size and timing are important. It comes online as the Las Vegas Convention and Visitors Authority strives to grow foreign tourists from 18 percent of all visitors in 2010 to 30 percent by the end of the decade.

McCarran's international traffic has continued to grow, up 38 percent since 2007 to 2.6 million passengers last year, even as the combined total of domestic and foreign travelers fell 13 percent. Canada's WestJet, which operates like a domestic airline because almost all of its passengers go through customs and passport checks at their home airports, accounted for three-fourths of the gain. Las Vegas business leaders hope T3 will stimulate more growth.

"The more efficient nature of Terminal 3 could lead to more international routes," Union Gaming Group principal Bill Lerner wrote in an April report.

Aviation experts are less optimistic.

"The first thing airlines look at is demand: can they sell 200, 250 seats per plane," said Keady, a former American Airlines marketing director. "The second is price, whether they can get it up to profitable levels. Then come operational considerations, including the building."

T3, he added, "might move the needle a little bit, but not a dramatic swing."

Further, competition has heated up. Atlanta recently opened a $1.4 billion international terminal. Los Angeles International Airport is spending $2 billion to renovate Tom Bradley Terminal, adding six more international gates. Vancouver, B.C., has mapped out an international expansion plan.

With or without new facilities, other cities have scored victories. Japan Airlines announced earlier this year it will launch nonstops from Tokyo to San Jose and San Diego, using its new Boeing 787 Dreamliners. Earlier, rival All Nippon Airways added Tokyo-to-Seattle to its schedule.

TWO PRIMARY CHALLENGES REMAIN

When wooing international carriers, Las Vegas must clear two critical hurdles that T3 cannot shorten:

■ Locals don't start international trips from here:

When he speaks to community groups, Walker often includes a use-it-or-lose-it pitch. On average, only 12 percent of all international travelers leaving Las Vegas are from Las Vegas. If locals don't buy more tickets, airlines could move on.

"I'm amazed how many people don't realize that British Airways has nonstop flights to London Heathrow and connections to pretty much anywhere in the world," he said.

■ Many T-shirts, few suits:

Raw passenger numbers are important, but airlines also look for yield, or what people will pay for a seat. There are lots of tourists willing to pay low fares but demand is anemic when it comes to business- or first-class seats that sell for thousands of dollars on an international flight. It's no coincidence that neither McCarran's largest domestic carrier, Southwest, nor international leader WestJet have first-class sections.

Damon Hylton, an airline consultant for the convention authority, said this weighed heavily in persuading Panama's Copa Airlines to come to Las Vegas.

"It was a tough sell," said Hylton, a vice president of Seabury APG. "They had a hard time believing in the potential for (connecting flights to) South America on the yield side."

What helped turn Copa around, he added, was British Airways' decision last year to upgrade its daily service to a 747 with four classes, including first.

"Airlines don't serve airports. They don't serve terminals," airline consultant Michael DiGirolamo said. "They serve markets."

Contact reporter Tim O'Reiley at toreiley@review journal.com or 702-387-5290.

Terminal 3 Guide