Lennar ranked No. 1 top seller in valley

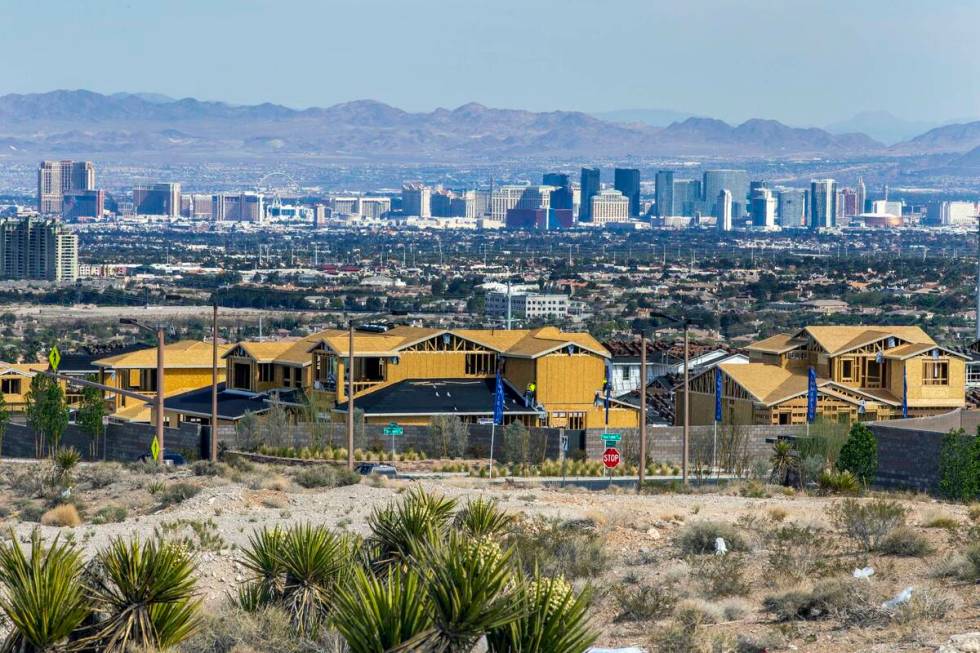

Lennar leaped to the top spot in the builder rankings as overall net sales recorded their second highest total during the first quarter since 2018, as the northwest valley led the way in new-home sales and prices continue to set records.

There were 3,478 net sales (sales minus cancellations) in January through March, trailing only the 4,113 recorded in the first quarter of 2021, according to Home Builders Research President Andrew Smith. The 2021 January to March total was an anomaly since the first quarter totals were 3,185 in 2018, 2,584 in 2019 and 3,113 in 2020.

“Builders will tell you the numbers can be higher but they’re restraining themselves because they can’t meet demand on production,” Smith said. “It’s more of a point of how strong things were at the beginning of last year and not something bad brewing in the market right now. With the decreases, it’s almost strictly a factor of not being able to keep up with demand with lot replacement. A lot of builders don’t have the lots on the books to replace what’s been selling out over the last two-plus years.”

For more than a year, however, builders have been assembling parcels at in-fill areas and even knocking down older homes, Smith said during his annual webinar to the homebuilding industry.

“It doesn’t seem like a big deal, but it’s something we didn’t see in Las Vegas until now,” Smith said. “The land acquisition department is finding ways to assemble pieces next to each other with different owners and making it work because there are not a lot of options.”

Sales should pick up if permits are an indication. Smith reported there were 4,153 permits issued to builders in the first quarter, the most of any quarter since the pandemic began in 2020. There were 3,776 issued during the fourth quarter of 2021 and 3,931 in the first quarter of 2021.

For closings, a lagging indicator, there were 2,693 during the first quarter, down 2 percent from the first quarter of 2021.

The northwest valley, which traditionally trails the rest of Las Vegas in sales, took the lead in the first quarter with 885 net sales, surpassing the 841 in the first quarter of 2021.

Sunstone, a new master plan of Lennar, Shea Homes and Woodside Homes in the northwest valley, had 71 sales. There were none in the first quarter of 2021.

“The reason is Sunstone,” Smith said of the northwest valley taking the top spot and that strength will continue. “You have the new areas of Summerlin north of Charleston Boulevard and you have Skye Canyon moving forward and Skye Hills, a new master plan west of Providence. There’s some land opening up to production near the 215 Beltway and Ann Road with D.R. Horton, Richmond and other builders going in that area.”

Smith said there’s been a lot of land purchases north of Kyle Canyon Road. Tri Pointe Homes has about 80 acres and KB Home has about 30 acres.

The southwest valley, which had the No. 1 spot a year ago with 1,037 sales, fell to 789 this year.

North Las Vegas, which had 1,000 a year ago, fell to 634 during the first quarter of 2022.

Henderson, which had 878 a year ago, fell to 712 this year.

The south valley had 191 sales, up from 106 a year ago. More builders are expected to open in-fill pieces there in the future, Smith said.

Mesquite sales rose to 128, up from 76 in 2021.

“Until the past few months, it’s been strictly Del Webb out there, but now you have Beazer and Richmond American,” Smith said.

The east valley had 82 sales, up from 67 a year ago. Pahrump sales declined from 84 a year ago to 21 in 2022.

Smith said Pahrump will increase with projects from D.R. Horton, Richmond American and Taylor Morrison.

“I’m not seeing anything going yet in the outlying areas, but I know with affordability concerns, there’s definitely interest and people looking,” Smith said of other potential areas in Southern Nevada.

Median prices, affected by issues with the supply chain and rising labor and land costs, continued to escalate during the first quarter and set a record of $459,395 when factoring in closings of new homes and town homes in March. The median price was $396,994 at the end of 2020 and $372,361 to start 2019. The average price in March was $526,000.

Smith said over the last four years, the average square footage of available home plans has gone down by 20 percent, while the base asking price from May 2018 until now has gone up 21 percent. The square footage has gone from 2,700 in 2018 to 2,168 in March, he said. It was $195 a square foot in January 2021, but it’s $253 on average today, he said.

“It wasn’t until recently that the new home side started matching more in line with the median price with resales,” Smith said. “Over the last five years, the new-home median closing price has increased by 49 percent. From 2018 to 2021 it was fairly flat. We didn’t start to see an increase in the closing price until January 2021. During 2019 and 2020, the median new-home closing prices decreased by 1.5 percent, and since January 2021 it has increased by 25 percent. It wasn’t because prices were flat but a change from larger homes to smaller homes, more attached products and higher density to make the project pencil out for the builders.”

Builder rankings

1. Lennar recorded 625 sales during the first quarter, a 19 percent increase over its 525 in the first quarter of 2021. It was ranked second in the first quarter of 2021.

2. It was followed by the Pulte Group with 490 sales, a 3 percent gain over the 477 in 2021. It was third in 2021.

3. D.R. Horton, which was fifth in 2021, moved up to third place with 425 sales, 32 percent increase over the 322 in 2021.

4. The biggest change in the rankings came when KB Home, which was No. 1 a year ago, fell to fourth with 417 net sales, a 42 percent drop from the 720 in 2021.

5. Richmond American rounded out the top five with 297 sales, a 2 percent decline from the 304 in 2021.

The rest of the top 10 in order and their 2022 and 2021 totals included Beazer Homes, 195 sales (185 in 2021); Touchstone Living, 167 sales (186 in 2021); Tri Pointe Homes, 152 (252 in 2021); Century Communities, 148 (363 in 2021); and Taylor Morrison, 147 (188 in 2021).

Just outside the top 10 were Toll Brothers, 130 (191 in 2021); Woodside Homes, 79 (194 in 2021); Harmony Homes, 59 (84 in 2021); Stonybrook Homes, 46 (51 in 2021); Shea Homes, 41 (24 in 2021); Signature Homes, 19 (2 in 2021); Pinnacle Homes, 13 (22 in 2021); Warmington, 13 (none in 2021); Summit Homes, 8 (18 in 2021); and Paragon Life, 7 (5 in 2021).

A 15 percent decline in net sales from the first quarter of 2021 netted fewer sales in the master-planned communities. Summerlin recorded 317 net sales, a 41 percent decline from 571 in the first quarter of 2021.

Cadence in east Henderson came in second with 212 sales, a 16 percent decline from the 251 in 2021. D.R. Horton has picked up a large amount of land north of Galleria Drive that should be moving into production soon, Smith said.

Valley Vista in North Las Vegas was third with 204 sales, down 27 percent from 278 in 2021.

Skye Canyon ranked fourth with 198 sales, a 4 percent decline from 206 in 2021.

Inspirada was fifth with 197 sales, a 22 percent decline from 252 in 2021.

Skye Hills, a new development of Beazer Homes in northwest Las Vegas, recorded 110 sales. There were none in the first quarter of 2021.

Lake Las Vegas recorded 92 sales, a 37 percent drop from 147 in 2021.

“We have heavy builder activity relative to where we’ve been,” Smith said. “Century Communities has about 50 acres (in Lake Las Vegas). Tri Pointe Homes, Richmond American, Toll Brothers and Taylor Morrison (are active in the Henderson community). Blue Heron has multiple projects opening up. Del Webb has picked up more land for their project. There was an announcement about the custom area going in called the Island. The custom-home and production-home side is picking up.”

Lennar’s new community, Sunstone recorded 71 sales.

Anthem Mesquite had 66 sales, an 11 percent drop from 74 in 2021.

The Villages at Tule Springs in North Las Vegas had 51 sales, down 67 percent from 156 in 2021.

“The initial phase of that master plan is winding down south of the (Interstate) 215 and now the parcels north of the 215 are being mapped and sold off. D.R. Horton and Richmond American have holdings up there so look for that master plan to have increased numbers in the future because that’s a vast area that’s yet to start selling and in line to be next.”

Mountain Falls in Pahrump had 17 sales, down from 23 in 2021.

Anthem in Henderson had nine sales, up from four in 2021.

Sedona Ranch had one sale compared to 37 in 2021.

Mountain’s Edge had no sales after 28 a year ago.

Rhodes Ranch had none after eight a year ago.

Southern Highlands had none after 38 a year ago.

Summerlin had the highest median closing price in the first quarter at $694,833 compared to $567,319 a year ago, a 22.4 percent increase.

Lake Las Vegas was next at $563,567 compared to $679,414 a year ago, a decline of 17 percent.

“We’re seeing volume from traditional production builders with smaller products,” Smith said. “Del Webb has sold a lot of homes there, and even though it’s Lake Las Vegas, those are smaller homes geared to those 55 and older and not the price category as other projects happening earlier. With land buying, Lake Las Vegas is going to increase the number of homes built out there.”

Skye Canyon was $537,503, up from $429,473 a year ago, a 25 percent increase.

Inspirada had a median price of $486,181, up from $405,036, a 20 percent increase.

Cadence was next at $481,568, an 18.6 percent increase over $406,013 a year ago.

The Villages at Tule Springs had a $426,267 median price, up 20.6 percent from $353,412 in 2021.

Valley Vista recorded $396,990, up 19.2 percent from $332,990 in 2021.