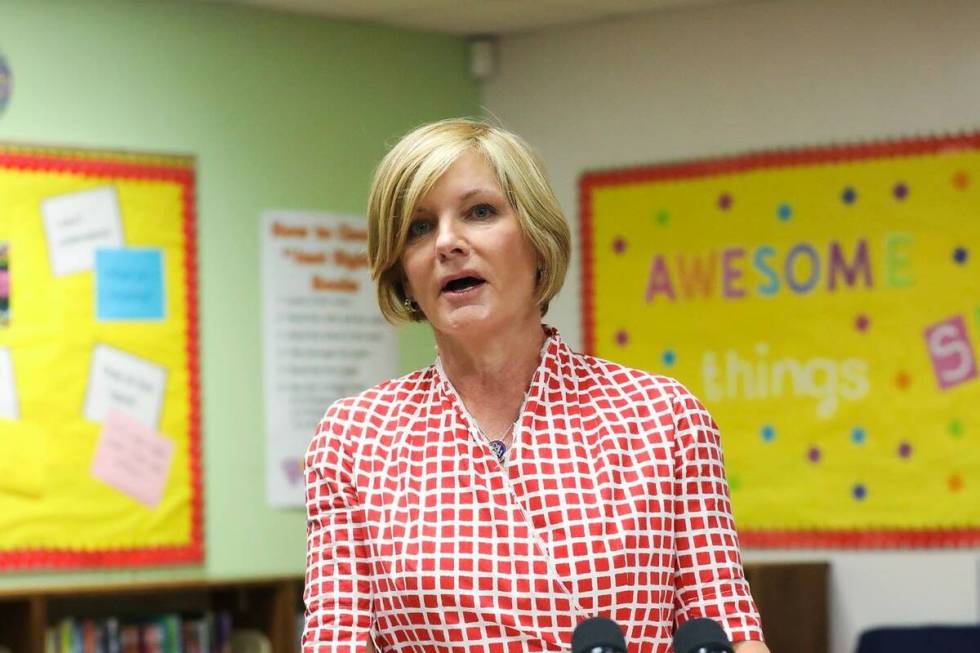

Susie Lee late on reporting stock trades to House committee

WASHINGTON — Nevada Democratic Rep. Susie Lee was one of nearly two dozen lawmakers who failed to meet statutory deadlines to report stock trades, but she did disclose most of the transactions within a grace period allowed by the House Ethics Committee, according to a published report Friday.

Lee was late reporting roughly 200 trades since 2020, worth between $267,000 and $3.3 million, according to a story by Business Insider, a financial news website.

The Stop Trading on Congressional Knowledge Act, commonly known as the STOCK Act, mandates lawmakers report trades within 45 days of the transaction. Lee did not meet that deadline.

But House ethics guidelines allow another 30-day grace period to report a trade and avoid a $200 filing fee, which “is distinct from a fine or penalty for legal violation of this requirement.”

She could face fees on at least two transactions that were reported after the grace period.

The transactions were from a joint account between Lee and her husband, Dan. The two announced in May they were divorcing.

Lee has contacted the Ethics Committee to ensure full compliance and disclosure, said Zoe Sheppard, a spokeswoman, in a statement to the Review-Journal.

“All of these trades were executed by a third party money manager with no input from the congresswoman,” Sheppard said. “Once she was made aware of the transactions, Congresswoman Lee worked with a financial advisor and the House Ethics Committee to file (the) transactions.”

The news report based on congressional records found that nearly two dozen current and former lawmakers in the House and Senate, from both political parties, were late in reporting deadlines established in the STOCK Act, passed by Congress in 2012.

No other lawmakers from Nevada were identified in the financial website report.

According to House Ethics Committee guidelines, filings within the grace period are sound and do not violate the STOCK Act or Ethics Committee rules. Only failure to file, or knowingly filing a false statement, can trigger civil or criminal penalties.

Still, the financial controversy is not the first for Lee, who came under scrutiny in 2020 when she sought an expansion of Paycheck Protection Program loans to include small businesses with income from gaming.

That expansion was backed by the entire Nevada congressional delegation.

It also allowed Full House Resorts, headed by Lee’s husband, to secure two loans totaling $5.6 million to pay employees at casinos in Colorado and Indiana during the coronavirus pandemic.

The loans to the publicly-traded company were disclosed in a conference call with investment analysts.

Lee faced sharp criticism from ethics groups and Republicans during the 2020 campaign, but she denied any wrongdoing. The bipartisan House Ethics Committee took no action on the matter during the 116th Congress.

She was re-elected to a second term in the House last November.

A Lee family trust also came under scrutiny for favorable trades made just before the COVID-19 pandemic hit. The trades were made by a third-party investor and were not directed by Lee. Although members of Congress received an unclassified briefing about COVID, Lee’s office said the congresswoman did not attend that briefing.

Contact Gary Martin at gmartin@reviewjournal.com. Follow @garymartindc on Twitter.