Tax hikes of 2009 take $1 billion bite

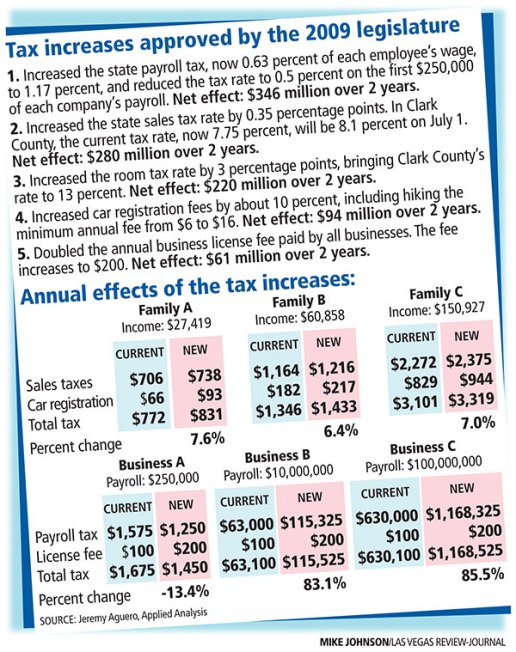

CARSON CITY — Larger Nevada businesses paying nearly twice as much in payroll taxes. Typical Nevada families forking over 6.4 percent more in sales taxes and car registration fees.

For some, that will be the legacy of the 2009 Legislature, which raised taxes by $1 billion over the next two years at a time when unemployment rose to 10.6 percent and the state economy struggled through a recession.

Counting the $220 million increase in room taxes approved in March, legislators ended up taking exactly $1.001 billion from citizens and putting it in state government programs. If equally distributed among all 2,783,000 Nevadans, the sum would amount to $180 more in taxes each of the two years.

"I don’t see it that way," said Jan Gilbert, a lobbyist for the Progressive Leadership Alliance of Nevada. "It is taking $1 billion and putting it in schools, higher education and health care. I have no objection to that."

Gilbert predicted most people won’t feel any effects from the tax increases. People are not shopping as much, so she doubted they will notice the 0.35 percentage point increase in the sales tax rate.

When the new rate takes effect July 1, Clark County’s sales tax will climb to 8.1 percent, up from 7.75 percent.

"This reminds me of 2003 (when taxes were increased by $833 million,)" Gilbert said. "People were saying, ‘The sky is falling. The sky is falling.’ I don’t think the public even noticed. The public isn’t going to notice these taxes either."

Carole Vilardo, president of the Nevada Taxpayers Association, and Mary Lau, executive director of the Retail Association of Nevada, both said it is too early to tell whether the tax increases will lead to closed businesses and higher unemployment.

Lau heard grumblings from a few businesses that the tax hike might affect their ability to stay open. But no business, as far as she knew, said conclusively that it will close because of the higher taxes.

The Gibbons administration is convinced the increases will anger residents.

"How about a man making $19,000 a year?" asked Daniel Burns, Gov. Jim Gibbons’ communications director. "The sales tax increase means something to him. Go into any store when someone buys clothes for school kids and see if that 0.35 percent makes any difference to them. It is chipping away at their money."

According to Jeremy Aguero of Applied Analysis in Las Vegas, a typical Clark County household with a $60,858 annual income will pay 6.4 percent more each year in sales taxes and car registration fees. The $87 rise in taxes will bring that family’s annual tax bite in those two categories to $1,433.

Business taxes and fees also will climb, starting with the doubling of the $100 annual business license fee. The payroll tax nearly doubles from 0.63 percent to 1.17 percent, with a 0.5 percent limit on the first $250,000 of a company’s payroll.

Aguero, who conducted his analysis for lawmakers, calculated that a business with a $10 million annual payroll — the size of a supermarket — will pay 83 percent more in payroll and business license taxes, increasing its state tax bill in these categories from $63,100 to $115,525.

It’s unclear how the increases in business taxes might be passed on to consumers in the form of, for instance, higher grocery prices.

Meanwhile, a large casino with a $750 million payroll would see its payroll and license taxes rise 85.7 percent — to $8,773,525 year from the current $4,725,100.

In the floor debate on the payroll tax, Assembly Speaker Barbara Buckley, D-Las Vegas, said the limit on the first $250,000 in payroll meant 74 percent of Nevada’s companies — generally those with four or five or fewer employees — would pay less in payroll taxes.

But Vilardo, widely considered as the state’s premier tax authority, said 30 percent of all taxable sales in Nevada are paid by businesses. Whatever reductions small businesses receive through lower payroll taxes likely will be canceled out by the sales tax increase, she said.

Lau conceded that an $87 per family annual increase in sales taxes and car registration fees doesn’t seem like much.

"But it puts a hesitation on people’s decisions on whether to shop," she said. "It is psychological."

Although most business owners need to call their accountant to find out how the tax increases will affect their businesses, Lau said, the idea that their taxes might be doubling is an "emotional shock" that might make them think twice about expanding or giving salary raises.

A Las Vegas Review-Journal poll last month found residents opposed higher payroll tax by a 3-to-1 margin, largely because they see a connection between higher taxes and keeping their jobs.

"I keep up with what is going on," Michelle Parker said as she changed her baby’s diapers in a Carson City park. "The tax increases won’t hurt me. But I don’t want to hurt business. I want people to keep their jobs."

"I’m a business major," added her friend, Sami Gonzales. "The tax increases won’t hurt me either, but they will hurt business. Businesses are going under all over the place."

Based on comments Sunday in the Legislature, it is clear some Democrats — all of whom supported the tax increase — worry about whether those votes will hurt their re-election chances.

At one point, Buckley corrected Assemblyman Kelvin Atkinson, D-North Las Vegas, after he referred to Assembly Minority Leader Heidi Gansert, R-Reno, as the "majority leader."

"I must have been thinking ahead," Atkinson quipped.

Contact Captial Bureau reporter Ed Vogel at evogel@reviewjournal.com or 775-687-3900.