Prosecutors say Henderson constable kept salaries meant for employees

Henderson Constable Earl Mitchell inflated employer tax contributions, underpaid his employees and sought money for expenses he never paid, allowing him to steal about $83,000 since 2015, authorities said in a court filing.

In a 46-page court document, prosecutors detailed for the first time how Mitchell manipulated the county’s voucher system to increase his income after the county took away his authority in 2015 to spend constable’s fees without oversight. A grand jury indicted Mitchell last week on four theft charges and one count of fraudulent appropriation of property by a public officer after a Las Vegas Review-Journal story sparked a police investigation.

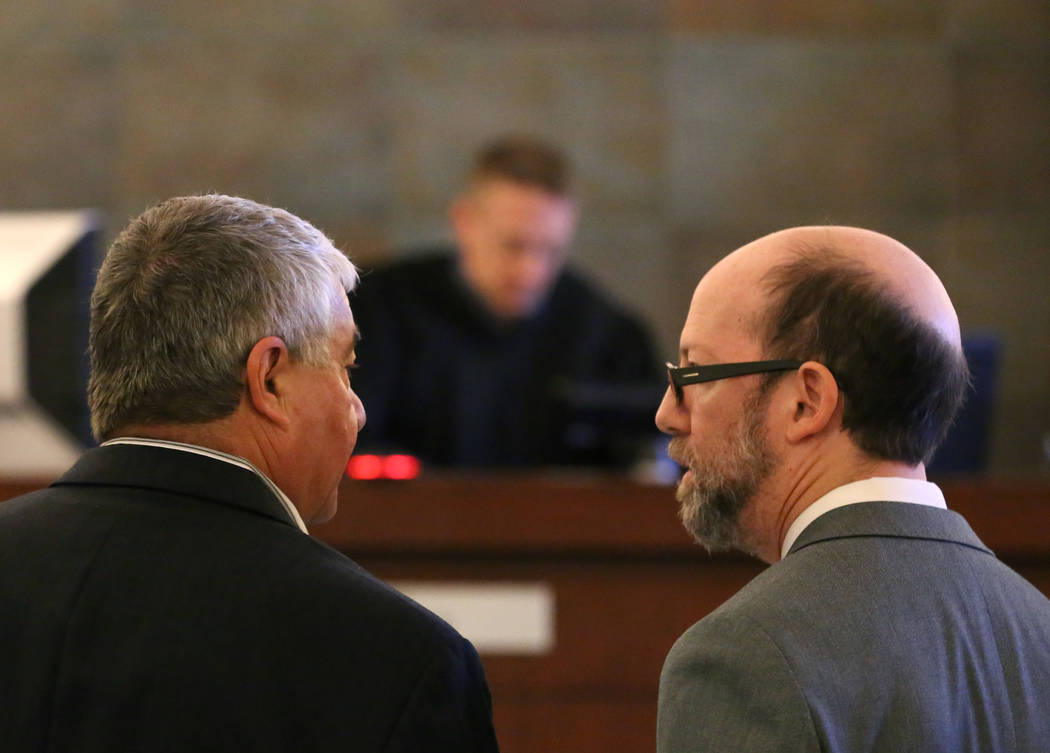

District Court Judge Joe Hardy Jr. released Mitchell on a $6,000 cash bond on Thursday, giving him three days to post the money.

After the county imposed financial controls on the constable funds, Mitchell took steps to hide the spending by removing his deputy’s access to the bank accounts, prosecutors said in court records.

“By doing this, Mitchell ensured that no other employee of the (Constable’s office) had authority to obtain copies of financial records for this account directly from the bank,” prosecutors wrote. “This effectively removed, or minimized, the possibility of oversight of the account usage or discovery of the cash withdrawal activity, the use of the debit card at bars and restaurants or the payment of checks directly to Constable Mitchell from the account.”

But Mitchell’s attorney Dayvid Figler said Mitchell should never have been indicted.

“Any allegation with regard to how things were done just goes to a bookkeeping issue or a sloppy bookkeeping issue,” he said after Thursday’s hearing. “It is not theft. It is not misappropriation of public funds.”

Newspaper investigation

Mitchell stopped diverting money after the Review-Journal published a story in March showing that he wrote himself thousands in checks and withdrew county money at casinos and video poker bars, prosecutors wrote.

He provided heavily redacted bank statements to the Review-Journal after county and personal attorneys told him the records were subject to public disclosure but that he could black out personal expenses. Police subpoenaed the unredacted bank statements, seized records at his home and office and documents from Mitchell’s accountant.

Mitchell then met with his accountant in an attempt to document business reasons for the expenditures detailed in the newspaper.

“(A)fter the media articles about Mitchell, he came to (the accountant’s) home (office) with several boxes of paperwork and asked her to go through it to match receipts with expenditures from the (Henderson Township) account,” the court filing said. The accountant “told him that he would have to do that task himself.”

Other taxes

Police found that since 2015, Mitchell wrote himself 90 checks totalling $107,322, and made about $72,000 in debit card transactions. Investigators are still studying the spending to determine which expenses were personal or related to business. He also made 198 ATM withdrawals totalling $56,629 — most of which were at locations that raise questions about how he spent the money.

“Many of the cash withdrawals occurred at bars and casinos,” prosecutors wrote, listing 13 different drinking and gambling venues in Clark County and Reno.

Mitchell was able to do that because he inflated spending for taxes and salaries in vouchers sent to the county to pay his employees, court records say. He also filed expenses for employees, but kept the money himself, documents show.

“Mitchell told (the accountant) to add an additional amount to the Employer Tax Contributions section and told her that this was for some other ‘taxes’ he had to pay,” the filing said.

Mitchell owes the Internal Revenue Service and other creditors more than $170,000, liens filed with the Clark County Clerk show. But police did not say if those “other taxes” went to pay off his personal debt.

Investigators determined that Mitchell also used the account’s debit card to fill up his personal vehicles while also reimbursing himself for mileage expenses.

“By claiming both mileage and then using county provided funds to pay for gas and maintenance costs, Mitchell would be ‘double dipping’ these expenses,” the filing said.

“Not happy”

In 2015, the county cracked down on Mitchell and the North Las Vegas constable after questions surfaced about how much they were paying themselves. The subsequent rules required the constables to send all the fees they collected to the county and request cash to pay their staff and office expenses.

Authorities trained Mitchell on the new procedures, but “felt that Mitchell accepted, but was not happy, about the fact he now had to follow this new procedure to get his office and operating expenses paid,” prosecutors wrote. Despite Mitchell’s attitude, the county only audited the office after the Review-Journal story ran, finding many of the same questionable transactions that were detailed in the article.

Figler, the attorney for Mitchell, told the Review-Journal that Mitchell was elected to run the office and had the right to use the money as he saw fit.

“While the enterprise fund scheme altered the flow of the fees, it does not change the constitutional and statutory rights of the constable and the constable’s office,” he wrote in an emailed statement after Mitchell’s indictment last week.

Contact Arthur Kane at akane@reviewjournal.com or 702-383-0286. Follow @ArthurMKane on Twitter.

Timeline

Court filings show when Mitchell withdrew cash from county funds.

Aug. 19, 2015: Three cash withdrawals at Hammer's Bar and Grill, totaling 347.50.

Oct. 26, 2015: Three cash withdrawals at Hammer's Bar and Grill totaling $607.50.

Dec. 21, 2015: Two cash withdrawals at Shakespeare's Pub totaling $408.

Jan. 4, 2016: Two cash withdrawals at Shakespeare's Pub and additional withdrawals at The Players Club, 7-Eleven and The 052 Bar, totaling $1,316.45.

April 18, 2016: Four cash withdrawals at Terrible's Casino totaling $812.