Las Vegas land prices up more than double from recession

As construction gains steam across the Las Vegas Valley, a base ingredient for projects keeps getting pricier: a plot of dirt.

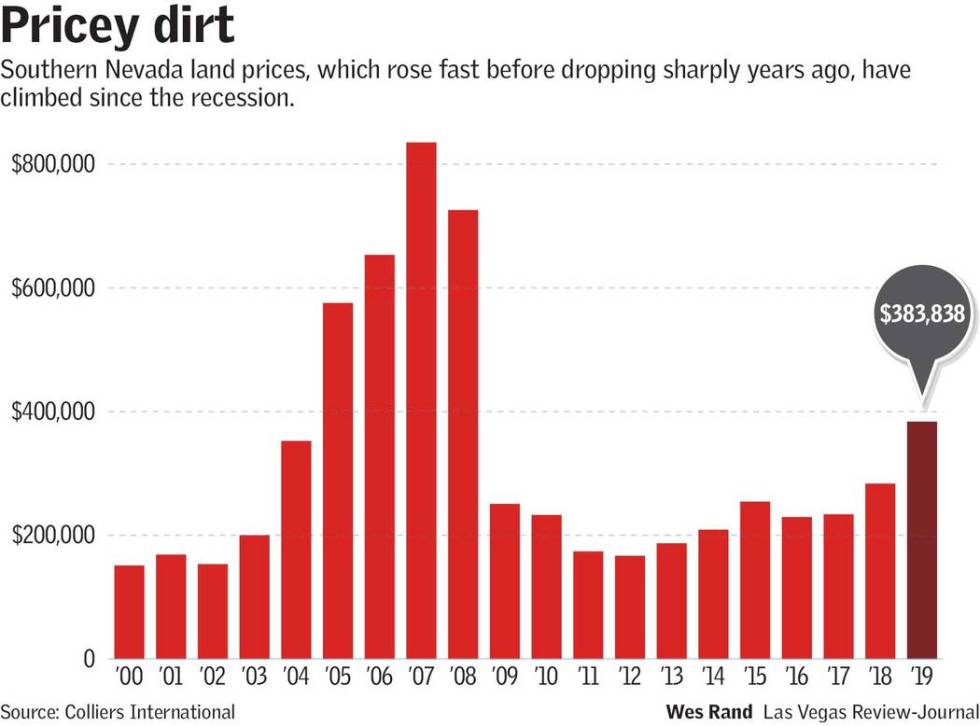

Investors paid a median of about $383,840 per acre last year for Southern Nevada land, up more than double from the depths of the Great Recession, according to figures from John Stater, Las Vegas research manager at brokerage Colliers International.

It’s no surprise. Amid an improved economy, developers have packed the valley with apartment complexes, housing tracts, warehouses and other projects in recent years — meaning more demand, and higher prices, for desert tracts.

Of course, Las Vegas’ real estate market is a volatile one, prone to hot and cold streaks, and land prices have followed a familiar path. They soared during the wild mid-2000s bubble, plunged during the recession and have since clawed their way back, rising at various speeds over the past several years.

They also remain nowhere near their peak from the bubble years, when Las Vegas’ white-hot construction market dwarfed the current building spree.

With easy money fueling a boom for all kinds of projects, from suburban subdivisions to megaresorts, people used to joke that Nevada’s state bird should be the crane.

Amid heated demand for land, and no shortage of flippers, buyers paid a median price of around $835,180 per acre in 2007, more than double last year’s level, Colliers’ data show.

The gap is even wider when you adjust for inflation, as the bubble-era peak is more than $1 million per acre in today’s dollars.

Still, the rising prices are a key reason why homebuilders, for instance, are putting up more condo and townhouse projects: As land gets more expensive, they’re cramming in more units to fetch desired profits.

Outside of housing, one area of the valley with a rising tally of land deals the past few years is the Strip, the heart of Las Vegas’ economy.

Construction largely ground to a halt when the economy crashed, leaving partially built projects littered around the valley. Coming out of the crisis, even as development picked up in the suburbs, investors largely ignored vacant parcels on or near casino-packed Las Vegas Boulevard and along quieter stretches of the street closer to the M Resort.

Prices were too high, and, in many cases, parcels were too big, real estate pros said.

The corridor isn’t packed with ground-up construction, but development has picked up, and vacant plots have been selling.

Among the deals: Wynn Resorts acquired about 38 acres of land next to Fashion Show mall for $336 million, a Southern California family picked up nearly 60 acres of mostly empty real estate just east of the Strip for $130 million, and investors last month bought a vacant 5.25-acre plot near the south edge of the Strip for $21 million, with plans for a luxury hotel-casino called Dream Las Vegas.

Land could always be cheaper — like almost anything, it’s only worth what someone will pay for it. But discounts come at a price.

The last time dirt was dirt cheap in Las Vegas, the economy was a mess, and practically no one was building anything anyway.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.