Icahn escalates feud with bid to buy Southwest Gas shares

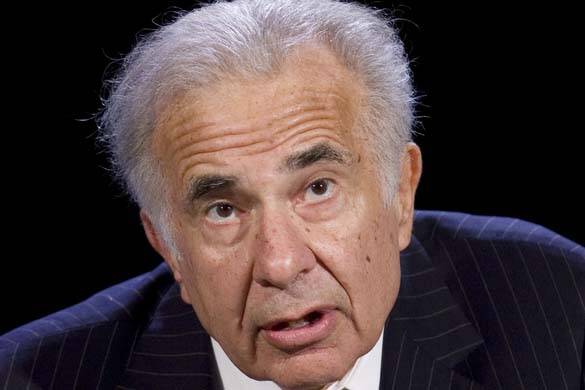

Activist investor Carl Icahn has made an unsolicited offer to buy all outstanding shares of Southwest Gas Holdings, the utility company announced Wednesday.

Icahn’s bid to buy any outstanding company shares for $75 per share escalates an ongoing feud between the Las Vegas-based gas company and the billionaire investor who’s earned a reputation as a corporate raider through his decades of aggressive investing and takeover tactics.

Southwest Gas’ board of directors will review the offer and decide what will be “in the best interest of Southwest Gas Holdings stockholders,” the company announced.

The board of directors will release its position on the offer to stockholders within 10 days.

The company advised Southwest Gas stockholders against taking any action until the board completes its offer evaluation. The offer expires Dec. 27 but could be extended an additional 60 days.

On Oct. 5, Icahn shared an open letter to Southwest Gas noting that he was a “large shareholder” and criticizing the company for its pending efforts to buy Dominion Energy Questar Pipeline, LLC for more than $1.5 billion.

Icahn accused Southwest Gas management of making “a number of egregious errors at the expense of shareholders” and that he was “extremely disappointed” with management over the past few years.

“However, the purchase of Questar you are currently being rumored to make at the price you are willing to pay will make all past errors pale in comparison,” he wrote in his letter.

Questar Pipelines consists of 2,160 miles of interstate gas pipelines in the Rocky Mountains transporting and storing gas across Utah, Wyoming and Colorado, according to Southwest Gas.

Southwest Gas responded with its own letter on Oct. 13 defending its decision to buy Questar, which it described as a “compelling, high-return suite of assets with unique strength and stability.” The company board argued the pipeline would provide “extremely attractive energy transition opportunities” via renewable natural gas, hydrogen and carbon dioxide transportation.

A spokesman for Southwest Gas didn’t respond to a request for comment.

The board implemented a short-term stockholder rights plan on Oct. 10 that “protect(s) stockholder interests by reducing the likelihood that any person or group could gain control of Southwest Gas Holdings without appropriately compensating Southwest Gas Holdings’ stockholders for control,” a company release said.

Icahn announced on Oct. 14 that he intended to wage a hostile proxy fight to replace the company’s entire board and buy up remaining shares for $75 a share. Southwest Gas planned to raise $1 billion for the Questar acquisition by selling stock at $65 a share, he noted in one of his open letters this month.

In an opinion piece posted Saturday by CNBC, Ken Squire, founder and president of activist investing research center 13D Monitor, called Icahn’s move “old school, creative activism.”

“His strategy creates quite the quandary for management,” Squire said in the piece.

Southwest Gas’ board will have to recommend for or against Icahn’s offer, Squire said, “and it is hard for them to say $75 is not a fair price when the company is a seller at $65.”

The Southwest Gas board, he said, wouldn’t want to cede control to Icahn, meaning Icahn would likely rely on the proxy fight. Whether Icahn’s proxy fight is successful depends on how many shareholders take his side, Squire wrote,.

Shares of Southwest Gas Holdings, traded as $SWX on the New York Stock Exchange, opened Wednesday at $69.37 and closed down 77 cents at $68.60.

Contact Mike Shoro at mshoro@reviewjournal.com. Follow @mike_shoro on Twitter.