July home prices drop since year ago

With foreclosures and short sales dominating the market, Las Vegas median home prices fell to $122,000 in July, down 9.6 percent from a year ago, the Greater Las Vegas Association of Realtors reported Tuesday.

Monthly statistics show more homes are being sold at lower prices compared with the same month a year ago.

Realtors sold 3,164 single-family homes in July, a 7.3 percent increase from last year. That follows 3,629 sales in June.

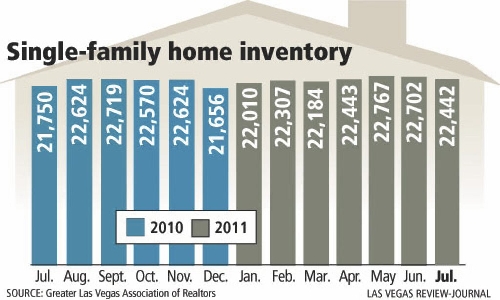

Inventory continued to creep up to 22,442 homes listed in July, 3.2 percent more than a year ago, with 4,533 new listings during the month. The number of available units without pending or contingent offers rose 8.4 percent to 10,975, the Realtors group reported.

Paul Bell, president of the association, said the monthly decrease in sales is similar to what he saw last summer. As for declining prices, that's a reflection of investors and cash buyers purchasing homes at bargain prices, he said.

About one-third of July sales were for less than $100,000, and half of the foreclosed homes have been selling for less than $100,000, he noted.

"It's just a function of properties that are in poor condition," Bell said Tuesday. "They require a lot of investment, so there's hidden value in homes we've yet to see."

There will be a pricing shift in the next year to 18 months as more dilapidated properties are cleared out of the inventory, he said. Those homes will come back on the market fully updated and will fetch top dollar, Bell said.

He said he saw a home in his own Spanish Oaks neighborhood purchased for $83,000, refurbished and turned around for $170,000 cash.

Overall, sales activity remains strong. More than 144,000 properties have been sold through the Multiple Listing Service since January 2008, including about 117,000 single-family homes.

There were 873 condo and townhome sales in July, a 9.1 percent increase from a year ago, while the median price decreased 13.2 percent, to $59,000.

Realtors reported that 52 percent of homes sold in July were purchased with cash, typically by investors who rehabilitate the homes and "flip" them for a quick profit or hold them for long-term rental. Cash purchases have been running about 50 percent for most of the year.

Bank-owned homes accounted for 50.2 percent of existing home sales in July, up from 47.2 percent in June. Another 20.2 percent were short sales, or lender-approved sales for less than the principal mortgage balance. That's down from a peak of 34 percent in June 2010.

David Brownell of Keller Williams Realty identified several interesting trends in that area in July. Inventory decreased for the sixth consecutive month.

He said 13,465 properties are for sale, down significantly from 15,373 at the beginning of the year. Some are under contract, awaiting seller signatures, so they're not truly on the market, Brownell said.

Real estate-owned, or bank-owned, properties are steadily becoming a bigger component of the market. REO pendings are up 41 percent from last year. REO closings are at 50 percent and would be much higher if not for investors buying at auction.

The 812 short-sale closings in July was the lowest number since February 2010. Brownell found the number to be surprisingly low, given that banks seem to be getting better at processing short sales.

Bank of America, for example, has decided to allow "substitute" buyers, no longer requiring the short-sale process to completely start over should the first offer fall through.

Still, success rates for short sales remain low -- about 8 percent to 12 percent, certainly no higher than 20 percent -- and that must change going forward, Brownell said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.