Las Vegas home prices could fall further

Las Vegas homeowners are getting a tentative answer to the question: "How much lower can housing prices go?"

And the answer appears to be, "Lower still."

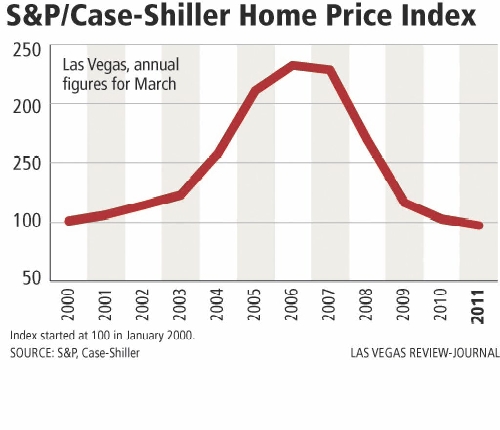

Standard & Poor's National Case-Shiller Home Price Index on Tuesday showed home prices hitting a new recession low for Las Vegas and the nation.

The average price of a Las Vegas area house slipped 1.1 percent from February to March. That represents a decline of 5.3 percent from a year ago.

"I'm not surprised," said Dennis Smith, president of Home Builders Research.

"Are the (home) prices still soft?" Smith asked. "Yes. Do we think they are going to continue to be soft? Yes. For how long? It could be for years."

Las Vegas home prices have now fallen below their January 2000 level, according to Case-Shiller.

The national figure fell 4.2 percent in the first three months of the year and dropped 5.1 percent over the level a year ago. Case-Shiller is an index that started at 100 in January 2000.

"This month's report is marked by the confirmation of a double-dip in home prices across much of the nation," David Blitzer, index committee chairman at S&P Indices, said in a statement.

Blitzer said home prices rebounded slightly in 2009 and 2010 mainly because of the first-time home buyers tax credit.

But since December, home prices have slipped in many areas, Blitzer said. In March, Las Vegas and 11 other cities "fell to their lowest levels as measured by the current housing cycle," he said.

DIFFERING VIEWS

Still, Paul Bell, president of the Greater Las Vegas Association of Realtors, said Case-Shiller data are 90 days old and said he sees a brighter outlook based on more current and reliable multiple listing service statistics that the association compiles.

The typical $125,000, one-story house with three bedrooms and two baths is selling quickly. "If you want that type of product, you better buy it now," Bell said. "These things are selling faster than pancakes at IHOP."

Even $1 million-plus single-family homes are starting to come back although slower than the average home, he said.

But Tim Kelly Kiernan, a certified distressed property expert with ReMax Extreme, took a different perspective. Case-Shiller has been "pretty much on the mark" with its home price index, he said.

"I advise my sellers that unless they really have to sell, don't sell," Kiernan said. Nationwide, roughly 92 percent of homeowners say it's a bad time to sell their home, according to the latest Thomson Reuters/University of Michigan index of consumer sentiment.

But Kiernan agreed with Bell that the time is right for long-term buyers.

"The prices are the lowest in many years, but don't expect any (home price) appreciation anytime soon," he said.

STABILIZATION EXPECTED

Jeff Thredgold, economist for Nevada State Bank, said home prices might fall a little more, but mortgage rates are within one-half point of their lowest level in 50 years, about 4.6 percent on 30-year, fixed rate products.

A homebuyer could buy at a lower price if he waits but wind up paying a higher interest rate on his mortgage, Thredgold said. "I suspect (home prices) will probably dip a little lower over the next couple of months, but most of the pain is behind us."

"By the later part of the year, I think you will see some stabilization in home prices, and some markets may see some improvement, but it's going to be slow and painful," Thredgold said.

One obstacle to a rebound in prices: a delay in processing foreclosures. Homes in foreclosure sell at a 20 percent discount on average, which can hurt prices in the neighborhood. But many foreclosure sales have been delayed while federal regulators, state attorneys general and banks review how those foreclosures were carried out over the past two years.

Once those homes are eventually foreclosed upon, they will cause prices to fall even further. Those declines are "etched in stone," said Patrick Newport, U.S. economist at IHS Global Insight.

Thredgold pointed out that the Nevada housing bust was born in the boom of the early 21st century.

Home prices in Nevada, California, Arizona and Florida doubled between 2003 and 2007, Thredgold said.

"Obviously, areas like Las Vegas and Phoenix and various parts of Florida are down more than (other areas) because they were up higher," he said.

During the housing boom days, lenders made a flood of subprime mortgages to buyers with below-standard credit. Many of these borrowers couldn't pay the monthly mortgage bill after teaser rates ended. Defaults spread to prime homeowners with better credit when they lost their jobs.

The massive number of foreclosures drove down home values for others, and some of them decided to walk away and make a strategic default, causing home prices to decrease even more.

Resale home prices plunged 12.5 percent over the past year to $112,000 from $128,000 in April, according to Home Builders Research. New Home prices dropped 6.6 percent to $186,900 from almost $200,000 in the same period.

However, sale of foreclosed houses, many of which are extensively damaged and looted, are skewing the averages, said Forrest Barbee, corporate broker at Prudential Americana Group.

Traditional sales by homeowners with equity are doing better, he said. Statistics he compiled for Equity Title of Nevada indicated that homeowners with equity sold 937 houses for a $200,000 average during May.

Areas near employment centers and in master-planned communities, such as Summerlin, are doing well, Bell said. North Las Vegas is overbuilt, but the new Veterans Administration hospital is attracting health care professionals and retired military veterans, he said.

"Jobs are everything," Barbee said.

Thredgold predicted even the jobs market will improve before housing, however. "Housing is contributing nothing to the recovery," he said.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420. The Associated Press contributed to this report.