Home sales inch up 3.3 percent in February

Home "flipping" has become a profitable venture again in Las Vegas now that median prices have retreated to 20-year lows.

Prices are bouncing around the bottom, a function of the type of home that's coming on the market, said Paul Bell, president of the Greater Las Vegas Association of Realtors. They're primarily smaller, three-bedroom homes purchased for under $100,000, he said.

What's missing from that number is the amount of restoration work that goes into making those homes leasable for the long term, the Realtor said.

Bell saw a single-story, 2,500-square-foot home in his Spanish Trail neighborhood go to an investor for $130,000 cash. It needed significant restoration, including foundation repair, but was turned around in 120 days and sold for $250,000 cash, he said.

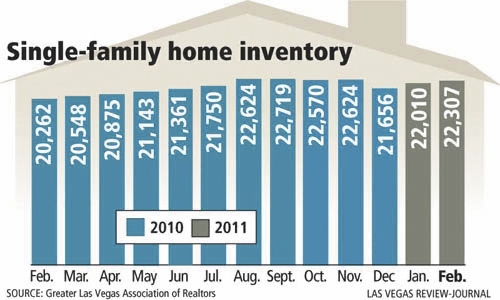

Home sales rebounded a bit in February from the previous month while inventory of homes for sale increased to 22,307, the Greater Las Vegas Association of Realtors reported Tuesday.

Realtors sold 2,591 single-family homes during the month, a 3.3 percent increase from the previous month and an 8.4 percent increase from February 2010. The median price was $128,000, down 5.7 percent from a year ago.

Most housing analysts predict a further decline in Las Vegas housing prices as foreclosures and short sales, or homes sold for less than the principal balance, continue to dominate the market.

As prices have fallen, the percentage of cash buyers has risen, peaking at 53.8 percent in February. That's probably the highest percentage in the country, Bell said.

Las Vegas will be a "testing ground" to see how high that number can go, he said.

"It's good because so many properties are ineligible for financing due to their condition," Bell said Tuesday. "We've been seeing investors buying them at trustee sales and restoring them for resale. They're helping address problems in blighted areas."

The steady stream of cash buyers shows how attractive Las Vegas is to people looking to invest in real estate, Bell said. He expects investors to continue paying cash for homes as long as lending standards remain tight, home prices remain at bargain levels and the inventory of bank-owned homes remains high.

There were 780 condominiums and townhomes sold in February, a 13.9 percent increase from a year ago. The median price fell 4.2 percent to $62,250.

David Brownell of Keller Williams Realty in Las Vegas noted that 85 percent of February's closings were priced under $200,000, and only 44 closings were priced over $500,000. He found 878 homes listed in Las Vegas for more than $500,000, or 20 months of inventory at the current sales rate.

"Ouch. This is a pretty good sign that the luxury home market may see further downward pressure on pricing," Brownell said.

Pending sales increased for the second straight month after eight months of decline, which could be the normal seasonal adjustment or it could be a sign of something greater to come, Brownell said.

The increase in sales from a year ago is also a good sign, particularly since there's no tax credit inflating those numbers, he said.

The median list price of available units on the Multiple Listing Service is $132,000 and the average price is $212,763, the Realtors association reported.

A separate report from Altos Research showed the median price in Las Vegas at $144,685, down 1.2 percent from the previous month and down 2.4 percent over the last three months. The Altos 10-city price composite decreased by 2 percent in February to $433,573. San Francisco and Washington, D.C., showed the steepest declines of 9.3 percent and 8.1 percent, respectively.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.