Who’s living there? Owner-occupied houses decline in Clark County

Before she bought a new home in 2004, Debra Michaud couldn't understand why a sales agent kept assuring her "only 20 percent" of neighboring houses would be sold to investors with no plans to live there.

After all, she had not asked about out-of-town landlords or even considered what they might mean for her new neighborhood.

But Michaud soon realized that many homes were sold to nonresident owners after all and quickly leased to tenants who, she said, didn't care for their homes, congregated in the street day and night, attracted criminals, and intimidated other residents. Crime has become such a concern that no-parking red zones line every inch of curb in her subdivision, speed bumps were installed and "No Loitering, Police Enforced" signs are posted in all public areas.

"We had the police here all the time. There was gang activity and a lot of break-ins. It was a scary place to live. This street was so bad that neighbors wouldn't come here to trick or treat," Michaud said.

Her neighborhood lies near Commerce Street and Centennial Parkway in the northern outskirts of North Las Vegas.

Michaud, who owns a window-cleaning business with her husband, purchased the home at a time when real estate values were skyrocketing and investors thought Southern Nevada real estate looked more prosperous than other investments.

Now Michaud, her neighbors and hundreds of others who bought in those days live in neighborhoods where 40 percent or more of the homes do not belong to the occupants.

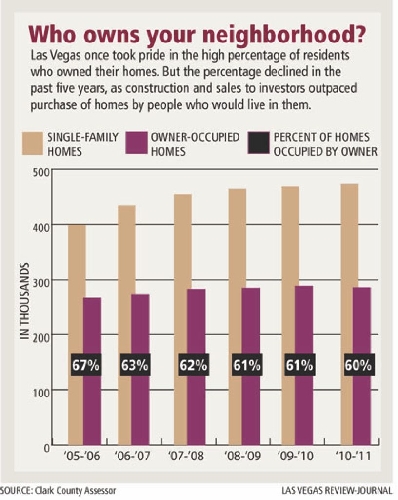

The percentage of single-family, owner-occupied homes in Clark County has been shrinking, an analysis of property records shows. Five years ago, 67 percent of single-family homes were owner-occupied. Presently, 60 percent of the 473,390 single-family homes in Clark County are owner-occupied.

The percentages are substantially lower than the cheerful home ownership ratios usually cited by community boosters, and they started declining before the current recession.

The number of owner-occupied homes grew but was outpaced by the growth of homes owned by others. The number of single-family homes in the county has increased 73,939 since 2005. But only 19,435 -- 26 percent of the additional homes -- were occupied by their owners.

The Review-Journal did not extract data for condominiums, mobile home parks or any other type of real estate.

Public officials and others are quick to point to Las Vegas' foreclosure and unemployment rates, the worst or near worst in the nation, to explain the decline in home ownership.

But the data suggest that explanation is insufficient because the rate of owner-occupancy took a sharp drop from 2005 to 2006, before the economy plummeted. Since then, the drop has continued about a percentage point a year.

Lewis Spellman, finance professor at the University of Texas, Austin and co-author of "The Impact of Rental Properties on the Value of Single-Family Residences" in 1991, said prospective homeowners will purchase current rentals if the local economy improves.

If they don't, values will drop in neighborhoods with a large or growing percentage of single-family homes that are not occupied by owners. Eventually the area will become a burden to the municipality that must service it, Spellman said.

"The market will absorb your excess housing supply back into home ownership if, indeed, the economic base continues to grow," Spellman said. "If the economic base doesn't come back, that excess supply of homes will continue to deteriorate values for (all) the homes," whether owner-occupied or not.

Lisa Mayo-DeRiso, co-founder of the Northwest Residents for Responsible Growth, a political action committee devoted to quality-of-life issues in northwest Las Vegas, said a "transient nature" contributes to the community's dismal scores in national ratings on education, social services, activities for children and other quality-of-life matters.

"When you talk to people at the school district, they are always talking about the 'transient nature of the classroom,' " Mayo-DeRiso said. "It affects the education system, our health system, and it has a trickle down effect if you have a lot of these types of residents (tenants). We are not saying they are not welcome in our community, but if you look at the model for building quality communities, people who own their home have a long-term interest in their neighborhoods and in their communities."

A CLOSER LOOK

A comparison of the percentage of owner-occupied, single-family homes in Southern Nevada shows the changes between 2005 and today:

■ In North Las Vegas, 59 percent in 2005, 53 percent today of 58,209 single-family homes. The number of single-family homes increased 15,449 since 2005. Of that, 5,955, or 39 percent, are owner-occupied.

■ In Henderson, 74 percent in 2005, 68 percent today of 78,541 single-family homes. The number of single-family homes increased 11,829 since 2005. Of that, 4,596, or 39 percent, are owner-occupied.

■ In unincorporated Clark County, where land-use matters are overseen by the Clark County Commission, 65 percent in 2005, 58 percent today of 183,473 single-family homes. The number of single-family homes increased 32,632 since 2005. Of that, 8,503, or 26 percent, are owner-occupied.

■ In Las Vegas, 67 percent in 2005, 61 percent today of 143,265 single-family homes. The number of single-family homes increased 12,311 since 2005. Unlike the other jurisdictions, the number of owner-occupied homes dropped from 88,388 to 87,770. Meanwhile, the number of nonowner-occupied homes increased 12,929.

Local government officials -- such as Clark County Commissioners Steve Sisolak, Larry Brown and others interviewed last month -- point to the rash of foreclosures and rising unemployment to explain the decrease in owner-occupancy.

"I wish there were more owner-occupied, single-family homes," Sisolak said after seeing the ratios for the first time. "Unfortunately, the economic climate has made it difficult for people to own their own homes."

However, figures from the assessor's office said that most homes foreclosed during the mortgage crisis have been resold, so houses "taken back by the bank" don't represent many of the nonowner-occupied.

Specifically, there were 76,180 foreclosures from January 2007 to March 2010, which included most of the foreclosure crisis period. But the lenders who took those houses back resold all but 6,187. Those are fewer than 2 percent of the homes in the county and therefore, by themselves, cannot explain a 7 percent drop in owner-occupancy.

Furthermore, the percentage of owner-occupancy took its biggest, one-year dip -- from 67 percent to 63 percent -- from July 2005 to July 2006, months before the subprime mortgage crisis began. In each of the ensuing four years, the percentage dipped one point or less.

WHAT LIES AHEAD?

With Southern Nevada's unemployment the highest in the nation, and with the newest crop of outside investors -- some from as far away as Guam and Israel -- paying cash for 40 percent to 50 percent of the foreclosed homes for sale, Debra Michaud is worried what the future holds for her neighborhood.

If an original investor who paid more than $200,000 for a home chose to lease to undesirable tenants a couple of years ago, she contemplates aloud, who will the new investor, who paid $100,000 or less for the same house, allow to occupy it?

"I am afraid it will happen again," Michaud said. "They don't care about the neighborhood because they don't live in their home. All they care about is getting their money."

Spellman, the professor from Texas, is more optimistic about Las Vegas' future. Baby boomers, who represent 30 percent of the country's population, are expected to start retiring in January. As they depart the work force in droves during the next 18 years, many will retire to Nevada because it doesn't have an income tax, Spellman said.

Planning and zoning officials from the cities of Henderson and North Las Vegas, as well as commissioners Sisolak and Brown, who represent two of the fastest growing areas in Southern Nevada, said there was nothing local officials could have done to increase the ratio of owner-occupied homes when developers were erecting hundreds of single-family homes per year.

County and city officials are prohibited from using zoning laws to restrict a landowner's legal right to develop his or her land, others said.

And while associations that represent homeowners and condominium owners can enact restrictions on rental properties, elected officials cannot compel a developer to limit sales to investors, they said.

"The increase in renters is not considered a function of bad (community) planning, and is more a function of the economy," Andy Powell, a Henderson planner and demographer, said. "We have to sit back and let the market correct itself."

Brown, a former Las Vegas city councilman from the northwest part of the city, said the foreclosure crisis has changed the nine-home, dead-end street where his family has lived since the early 1990s. The commissioner said he hopes the current low occupancy rate reflects an "interim period" and that more Las Vegans will own homes when the local economy rebounds.

"I don't think we are going to see a significant change in the next few years because of the inventory (of homes) out there," Brown said. "It can be frustrating for those who have established a neighborhood as their home."

But he adds that there remain plenty of great neighborhoods with high ratios of owner-occupancy and lasting relationships between longtime neighbors, such as the retirement community of Sun City Summerlin, Desert Shores and Los Prados in northwest Las Vegas.

On the other hand, Sisolak said, Southern Nevada has tripled in size overnight and it's been difficult for residents to establish the lasting relationships and shared activities among community members that many here grew up surrounded by in the Midwest and on the East Coast.

"For a community to grow and prosper you need a sense of community support," Sisolak said. "When you come here and someone (in the neighborhood) stays for two to three years, there is not that sense of community like there is with other communities where generation after generation has stayed there. ... You are more connected and committed to a community when you are a homeowner and you have a financial commitment."

Contact reporter Frank Geary at fgeary @reviewjournal.com or 702-383-0277.

Owner-occupied houses decrease in Las Vegas

RELATED STORIES

• Assessor's numbers used for analysis

• Ideally, you'll find owners at home