Home resales surge in month

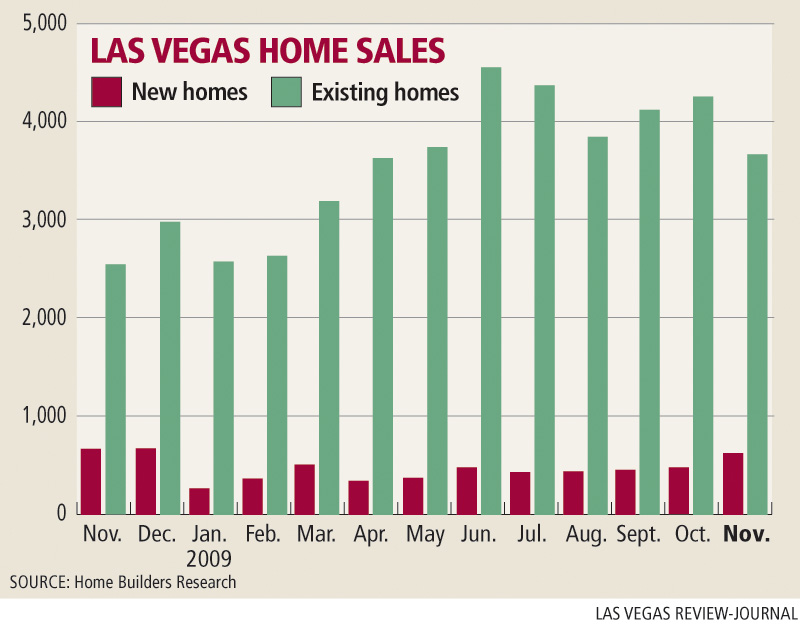

Spurred by low prices and extension of the federal tax credit, existing-home sales in Las Vegas increased 50.8 percent to 3,952 in November, Las Vegas-based Sales- Traq reported Tuesday.

It ended a seven-month streak of sales topping 4,000, but still shows strong demand for home purchases heading into the traditionally slow holiday period.

The median resale price of $125,000 is down 27.5 percent from the same month a year ago. However, it's a $2,000 bump from the previous month and has been hovering around $125,000 since April.

The new-home segment continues to struggle, though November's 598 escrow closings were the highest monthly total for the year, a decrease of 1.3 percent from a year ago. Median price tumbled 19.4 percent to $198,466, the first time it's been below $200,000 since 2003, SalesTraq reported.

The housing research firm showed 10,459 listings for sale, less than half of the available inventory from a year ago and a 2.6-month supply at the current sales pace.

November home sales rose nationally by 7.4 percent from October and are at the highest level in nearly three years, the National Association of Realtors reported. Sales were bolstered by the $8,000 first-time homebuyer tax credit, which was extended for the first four months of 2010 and expanded to grant a $6,500 credit to move-up buyers.

Existing-home sales rose to a seasonally adjusted annual rate of 6.54 million units in November from 6.09 million in October. Sales rose 44 percent from the 4.54-million-unit pace in November 2008.

Locally, the avalanche of foreclosures predicted for Las Vegas has failed to materialize.

November's 1,477 foreclosures represent a 27 percent decrease from a year ago, the fifth month of the year with declining year-over-year numbers, according to SalesTraq.

"In our view, Las Vegas may be entering a new real estate era," consultant Steve Bottfeld of Marketing Solutions said. "Whether you call it the end of the beginning or the beginning of the end, there is no question that the residential market is in a transition from what it was to what it will become."

Housing analyst Dennis Smith of Home Builders Research counted 604 new-home sales and 3,696 existing-home sales in November, a 6.1 percent decrease and 46.8 percent increase, respectively, from the same month a year ago.

Median new-home prices dropped to $199,928, compared with $205,500 the previous month, while existing-home prices increased $1,000 to $126,000.

"Bottom line is this indicates a very flat recovery," Smith said. "There (have) been good months and bad months. Good isn't anything that goes up $1,000. That's flat."

Smith said new-home sales could increase in the first quarter as buyers look to take advantage of the tax credit on move-up homes. Democrats in Washington, D.C., have suggested there will not be an extension of the credit past April, so it's a safe projection that home sales will be softer in the second half of 2010, he said.

"The tax credit ... it's parallel to what's going on with CityCenter. They don't know if it's going to be bad or good for the economy," Smith said. "We know what it did for home sales and we have to assume it'll work again, but I don't want to stand here and wave a flag that says next year will be better than this year. A good year will be if we beat the numbers for 2009."

Smith counted 285 homebuilding permits in November, bringing the yearly total to 3,495, a 41 percent decrease from a year ago. It's doubtful that permit activity will reach 4,000 for the year, he said.

Some analysts predict Las Vegas home prices will drop another 10 percent to 25 percent as more foreclosures flood the market.

Realtor Steve Hawks of Platinum Real Estate said there are more than 100,000 distressed homes in Las Vegas, including 70,000 already in some stage of foreclosure. He's heard reports of 25,000 to 45,000 people who've been living in their homes for a year to 18 months without making a mortgage payment and have yet to receive a notice of default.

"The dam is either going to burst or overflow," Hawks said. "Either way, the homes cannot be held back forever. But 2010 will not be the year of the flood. It will most likely be very similar to 2009."

Banks may release 10 percent more foreclosed properties than this year, he said. Short sales, or homes sold for less than the mortgage balance, could triple or quadruple the number from 2009.

Holding back inventory saves banks from taking huge write-downs, Hawks said. Accounting procedures were changed to let banks keep losses off their books. A bank that has a $300,000 loan on a home that's only worth $100,000 doesn't take the loss until the home is actually sold.

If the bank holds the property at an average cost of $500 a month, it will cost about $30,000 over five years. If it sells the home now, the bank takes a $200,000 loss.

"That means they have to raise $200,000 in capital. It's in the bank's best interest to hold off as long as possible," Hawks said. "That's why we will not see a flood of bank-owned homes anytime soon. It will only be a trickle. The trickle of bank-owned homes being put on the market is far less than the mortgages going into default. Therefore the shadow inventory will continue to rise."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491. The Detroit Free Press contributed to this report.