Housing inventory increase expected

A wave of foreclosures is expected to hit Las Vegas as banks lift a voluntary moratorium that was extended from March to the end of May, though nobody has an accurate estimate of how many bank-owned homes will be added to an already bulging inventory.

The total number of homes for sale in Las Vegas declined to 16,202 in April, compared with 21,338 in the same month a year ago, Las Vegas-based SalesTraq reported.

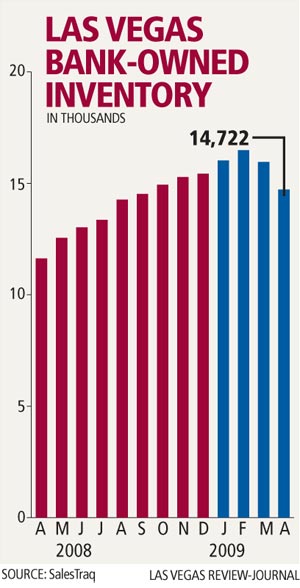

Real estate-owned, or bank-owned inventory stood at 14,722, up from 11,628 a year ago, but down from the previous two months.

Housing analyst Larry Murphy of SalesTraq said he's heard there could be an inventory of unreleased bank-owned homes ranging from 20,000 to 30,000. It's an impossible number for anyone to "get their arms around," he said.

"This thing is like a cloud of mystery out there. We can all hypothesize," Murphy said.

Bank-owned inventory came down in March and April, and Murphy said he's waiting to see May's data to draw any conclusions.

The country is still in the "middle innings" of the bursting of the great housing bubble, said Whitney Tilson, principal of New York investment firm T2 Partners. He recently published a 75-page report that said there's more pain to come.

It takes an average of 15 months from the first missed mortgage payment to a trustee sale of the home, usually by auction, he said. The subprime loans that defaulted in early 2007 led to the wave of foreclosures in 2008.

"We predicted in early 2008 that it would get so bad that it would require large-scale government intervention, which has occurred, and we're not finished yet," Tilson said.

Given that other types of loans with longer reset dates are now starting to default at catastrophic rates, the "sober implications" are for foreclosures and auctions to extend into 2009 and beyond, driving home prices down further, he said.

More than $200 billion in option ARMs are still outstanding, including $29 billion that will reset by the end of this year and another $67 billion that will reset in 2010, according to Washington, D.C.-based Zuckerman Spaeder. The average borrower's mortgage payment of $1,672 will increase by $1,053.

Alexis McGee of Sacramento, Calif.-based Foreclosures.com said there's a "phantom" inventory of repossessed properties not showing up for sale on the Multiple Listing Service. Only about 30 percent of them are listed on the market, McGee said.

Foreclosures.com counted 18,505 real estate-owned homes in Clark County through April, compared with 7,251 a year ago. Preforeclosures rose to 33,917 in the first four months, up from 20,363 a year ago.

The foreclosure inventory in Las Vegas has dried up for now, Earl Crouse of Better Homes Realty said. He expects it to stay that way until the fourth quarter.

Banks are "stepping up" to comply with the Obama administration's guidelines to keep people in their homes, Crouse said. Some banks are renting homes back to previous owners.

"They know they're stabilizing the market by pulling back (on bank-owned inventory) and getting multiple cash offers for anything $125,000 to $200,000," he said. "Banks are going to lose anyway, but it's less they're going to lose."

Tim Kelly Kiernan of ReMax Brodkin Group said the current foreclosure inventory is "being picked over pretty good" with lots of cash deals. Lenders are being more flexible in negotiations, he said.

His research indicates that banks are indeed holding back hundreds of thousands of properties nationwide. There were nearly 500 notices of default filed in Las Vegas on June 8, he said.

"That is just one day, so if we just do the math, more foreclosures are coming and fast," Kiernan said. "Unless the Obama administration does something to stop this, home values will continue to fall."

Murphy of SalesTraq said he agrees with most of the conclusions in T2 Partners' report from a national standpoint.

However, Las Vegas has been on the leading edge of everything that's happened in the housing market, from skyrocketing appreciation and home sales to the subprime mortgage crisis and foreclosure problems.

"I think things happening nationally are six months behind what's happening in Las Vegas and Sacramento," Murphy said. "I think we've already gone through most of the pain in Las Vegas."

Both Las Vegas and Sacramento have reported significant increases in resales over the past 12 months. Prices are still slipping, but not as much. The Greater Las Vegas Association of Realtors showed a 1.8 percent decline in the median price for May, or about $1,700, compared with monthly declines of $10,000 in previous months.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.