Bargain prices help lift home sales in April

WASHINGTON -- Buyers who were brave enough to dive into the market for a bargain-priced house helped provide a modest boost to sales last month.

Sales of inexpensive foreclosures and other distressed low-end properties have even sparked bidding wars in places like Las Vegas, Phoenix and Miami. But the market for high-end properties is at a virtual standstill, mainly because it remains difficult to get a mortgage for expensive homes.

"We're looking at a dual market right now," said Sherry Chris, chief executive of Better Homes and Gardens Real Estate.

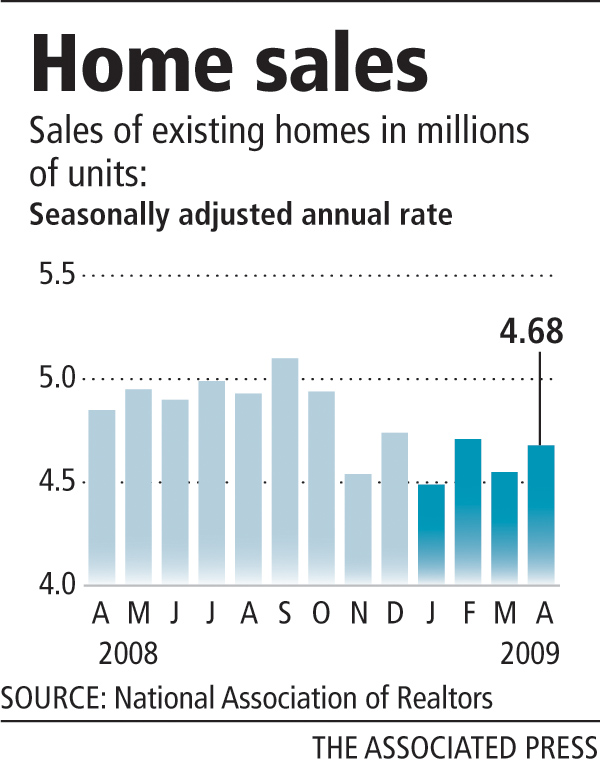

The National Association of Realtors said Wednesday that home sales rose 2.9 percent to an annual rate of 4.68 million in April from a downwardly revised pace of 4.55 million in March. Sales were 4.6 percent below April last year, without adjusting for seasonal factors.

Las Vegas-based Home Builders Research reported 3,652 sales of existing homes in April, a 62.5 percent increase from a year ago. For the year to date, resale transactions are up 69 percent in Las Vegas at 12,014 and could end up close to 40,000 by year's end, housing analyst Dennis Smith said.

Compared with January, the lowest point in the housing recession, April sales were up nearly 4 percent nationwide. But compared with the peak in September 2005, sales are still down 35 percent.

And they have not kept pace with foreclosures, which continue to pile up at an alarming pace. Those properties helped drag down the median sales price to $170,200.

In Las Vegas, one of the nation's foreclosure hot spots, the median resale price was $130,000 in April.

Smith of Home Builders Research said the supply of real estate-owned, or bank-owned, homes in Las Vegas is now limited. He expects to see banks releasing more REO homes for sale soon.

Will there be enough demand to absorb the expected increase in inventory of REO homes? Smith said it's too early to say.

"Until we know how many properties are going to be released into the marketplace, it is impossible to forecast how long it will take to absorb them," he said.

There is demand from out-of-town investors and buyers looking to take advantage of low prices, he said. However, there are also an estimated 30,000 empty homes in Las Vegas.

"That sounds like a lot of inventory," Smith said.

In Phoenix, Floyd Scott, broker-owner of Century 21 Arizona-Foothills, said roughly 70 percent of sales in his area are from distressed buyers. But that can't last forever, he said, noting that "we're running out of inventory."

Nationally, however, the number of unsold homes on the market at the end of April rose almost 9 percent from a month earlier to nearly 4 million. That's a 10-month supply at the current sales pace, and was particularly troubling to economists.

The rise in unsold homes "suggests foreclosure activity may be adding homes to the market faster than sales are removing them," wrote David Resler, chief economist with Nomura Securities.

Another big problem is the lack of activity at the housing market's higher-end. Lenders have tightened standards dramatically, especially for so-called "jumbo" loans above $730,000 that cannot be purchased by Fannie Mae or Freddie Mac, the government-controlled mortgage companies.

The Realtors group is pushing for the Federal Reserve to start buying those loans. It also wants higher loan limits enacted last year to apply to the whole country, not just expensive areas like California and New York.

In San Francisco, properties listed for $1 million and above are languishing on the market.

"That's where we're really feeling the pinch," said Ben Coleman, owner of Century 21 Hartford Properties.

Jumbo loans made up only 5 percent of the mortgage market in the first quarter of this year, down from 17 percent two years ago, trade publication Inside Mortgage Finance reports.

Rates for 30-year jumbo loans are averaging around 6.3 percent, compared with around 5 percent for nonjumbo loans, according to data publisher HSH Associates.

Since banks generally hold jumbo loans on their books, it's not surprising that they are keeping lending standards tight, noted Keith Gumbinger, a senior vice president with HSH Associates, who said, "It's not a risk-free investment."

Review-Journal writer Hubble Smith contributed to this report.