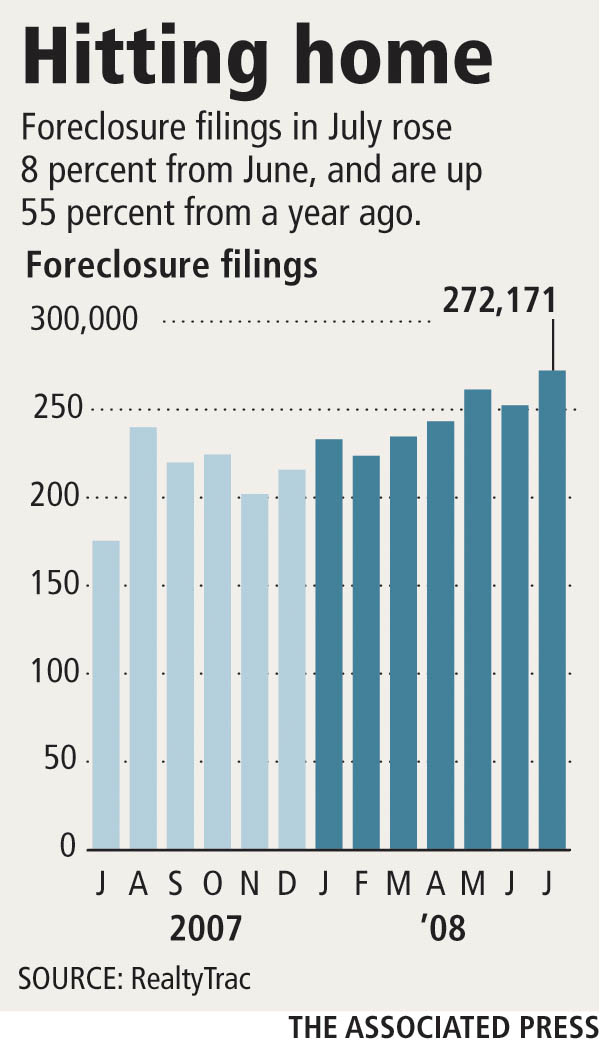

U.S. foreclosure filings surge 55 percent

WASHINGTON -- The number of homeowners stung by the dramatic decline in the U.S. housing market jumped last month as foreclosure filings grew by more than 50 percent compared with the same month a year ago, according to data being released today.

Nevada, California, Florida, Arizona, Ohio, Georgia and Michigan had the highest foreclosure rates. Foreclosure filings increased from a year earlier in all but eight states.

In the RealtyTrac report, the Cape Coral-Fort Myers area in Florida was the metro area with the highest rate of foreclosure, followed by three California cities: Merced, Stockton, and Modesto. Las Vegas ranked fifth.

Nationwide, more than 272,000 homes received at least one foreclosure-related notice in July, up 55 percent from about 175,000 in the same month last year and up 8 percent from June, RealtyTrac said.

Irvine, Calif.-based RealtyTrac monitors default notices, auction sale notices and bank repossessions. More than 77,000 properties were repossessed by lenders nationwide in July, the company said.

The combination of weak housing sales, falling home values, tighter mortgage lending criteria and a slowing U.S. economy has left financially strapped homeowners with few options to avoid foreclosure. Many can't find buyers or owe more than their home is worth and can't refinance into an affordable loan.

As foreclosures soar, banks and mortgage investors are also facing a pileup of foreclosed properties on their books and are cutting prices dramatically.

RealtyTrac noted that it had more than 750,000 foreclosed homes in its database of properties for sale, equal to about 17 percent of the 4.5 million U.S. homes that were up for sale in June.

To speed disposition of the 54,000 foreclosed properties it owns, Fannie Mae is opening offices in California and Florida and is considering selling those properties in bulk to investors.

"I do not think this is a time to be holding onto (foreclosed properties) hoping for a better day," CEO Daniel Mudd said last week.

It remains to be seen how much the government's intervention will stem the housing crisis. President Bush last month signed sweeping housing legislation that aims to prevent foreclosures by allowing homeowners to swap their mortgages for more affordable loans, but only if their lender agrees to take a loss on the initial loan.

The bill is projected to help about 400,000 households.

The number of foreclosures "could start to stabilize as early as the first quarter of next year if the government program gains any traction," said Rick Sharga, RealtyTrac's vice president for marketing. "That's really the unknowable right now."

Even with government help, nearly 2.8 million U.S. households will either face foreclosure, turn over their homes to their lender or sell the properties for less than their mortgage's value by the end of next year, predicts Moody's Economy.com.