Home market keeps slipping

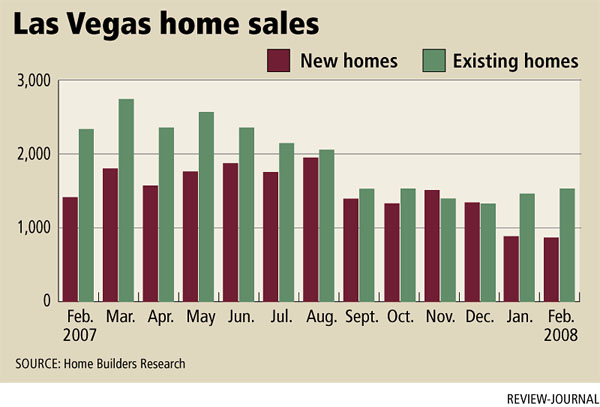

The numbers continued to worsen for the Las Vegas housing market in February as sales of new homes plunged nearly 40 percent to 867 and their median price dropped 11.8 percent to $283,315, Las Vegas-based research firm SalesTraq reported Tuesday.

Existing-home escrow closings fell 59.7 percent from a year ago to 901 and the median price is down 13.2 percent to $250,000.

Again, the number of foreclosures during the month exceeded the total for both new- and existing-home sales, SalesTraq President Larry Murphy noted. The 1,870 repossessed homes represent a 353 percent increase from 413 in the same month a year ago.

"We're still sliding along on the bottom here," Murphy said.

Two of three elements necessary for finding a real "bottom" are in place, he said. Inventory is declining and prices appear to be stabilizing. Sales, however, are not rising. That's the last piece of the puzzle that needs to be in place, Murphy said.

Home Builders Research President Dennis Smith counted 891 new home closings in February, bringing the total for the first two months to 1,764, down 49 percent from a year ago. The median price is off 10.5 percent at $283,000.

His resale figure for February was 1,529 for a two-month total of 3,017, a 37 percent decrease from last year. The median resale price of $235,000 is down 18.7 percent from February 2007.

Foreclosures account for about 40 percent of existing-home sales in Las Vegas and many are being sold at 35 percent to 50 percent below peak values of 2004, Smith said.

"Ouch," he said. "It's depressing and makes many (homeowners) very angry to hear, but that's the way it is."

Las Vegas has about 13,000 preforeclosure filings. Smith doesn't think the "foreclosure spigot" can be turned off quickly even with government assistance. Prices will remain low until the market rids itself of these distressed properties, he said.

"This is good news for those looking for a home," Smith said. "Not that they should all hunt down a foreclosed home. It's not as easy as it sounds. We have talked to many that have tried to play the foreclosure game and it can be very frustrating."

Both Home Builders Research and SalesTraq reported another down month for new home permits with 391 and 370, respectively. They're down about 70 percent from a year ago.

SalesTraq's Murphy found it interesting that Trump condominium-hotel had its "virgin" closing in February, Palms Place had 20 to 30 closings and Allure had 30 to 40. He expects to see more closings of high-rise units in March, perhaps 300 to 400 in addition to single-family new-home sales.

His concern is that the flurry of closings in the early months won't be sustained as fewer buyers are able to close escrow on condos that are selling for $1,000 per square foot, for example, at Trump.

"I've got a funny feeling in my gut that these guys are swallowing canal water here," Murphy said. "I'm going to give it six months after Trump has his first closing, by August. I'll bet by August that not more than 50 percent of those units have closed."

Irene Porter, executive director of the Greater Las Vegas Association of Realtors, said the good news is that inventory is moving and she's seeing a lot more sales activity. The Multiple Listing Service has stabilized at about 22,000 homes for sale.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.