Down, down, down

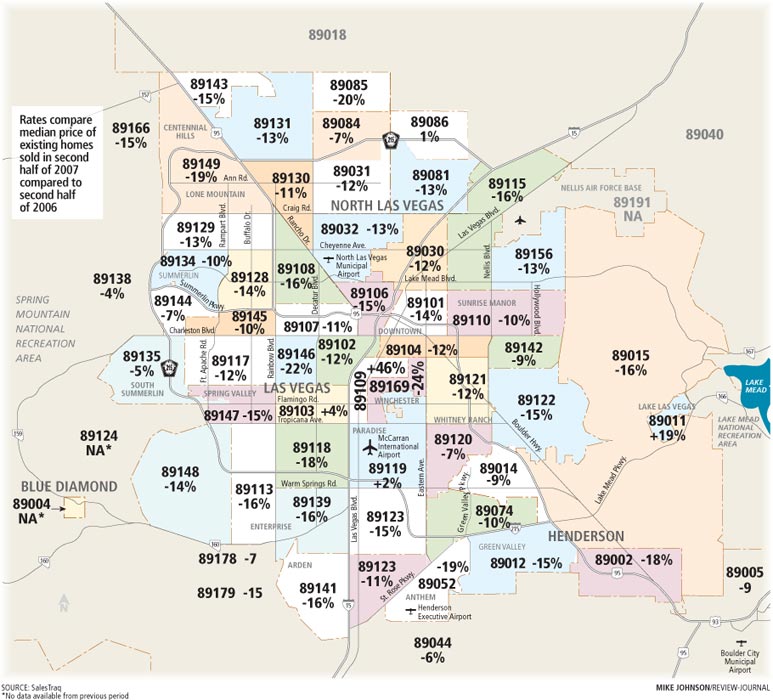

All but five of 61 ZIP codes in the Las Vegas Valley showed depreciating home values in 2007, no surprise in a housing market that leads the nation in foreclosures and appears to be caught in the "subprime tsunami" that crushed the lending industry early last year.

The biggest drop came in ZIP code 89169, where median home prices slipped 24 percent from $275,000 in the second half of 2006 to $210,000 in the second half of 2007, housing analyst Larry Murphy of Las Vegas-based SalesTraq reported.

He noted that 89169, in the Winchester area of Las Vegas, is among five ZIP codes that underwent boundary changes last year, so the numbers could be skewed by a different mix of housing product. The high-end Turnberry Place luxury towers are in that area.

Also hit hard were ZIP codes 89146, down 22 percent to $222,450, and 89085, down 20 percent to $336,150.

All percentages are based on median sales prices in each ZIP code over time.

"Do not assume that because your home is in a particular ZIP code that it appreciated or depreciated the same as the median value," Murphy said.

It's important to remember that ZIP codes were created to deliver mail, not to compare home prices, he said. They change with population density. It would be better to compare prices by product type such as single-family homes, apartment conversions, midrise and high-rise condos.

"I've said before that there's nothing sacred about the ZIP code appreciation map," Murphy said. "We just do it that way because it's convenient and interesting."

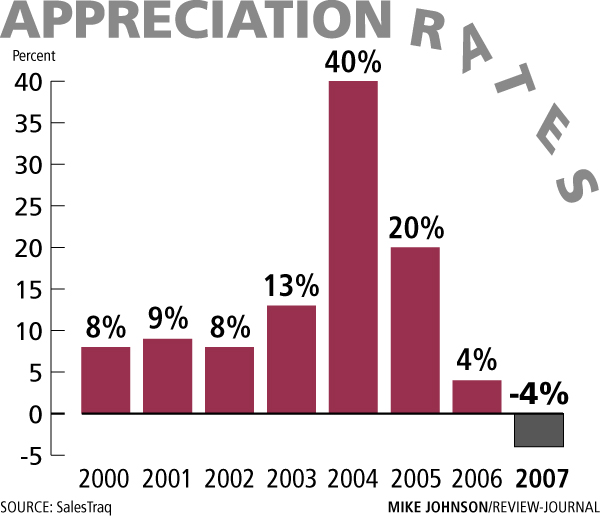

Overall, the median price of an existing home in Las Vegas decreased 4.3 percent to $275,907 based on 23,956 sales in 2007, according to SalesTraq. People were expecting it to be much worse, Murphy said.

For December, the price is down 11.2 percent from a year ago at $253,000.

Murphy said significantly higher sales volume in the first half of 2007 was "masking the downward trend" in prices during the second half of the year, so he used a weighted average for the entire year.

"You have to go in and look at how many homes sold at what price," he said. "You can't assume that all months are created equal. So in a declining market, it's going to look like prices didn't go down as much as the trend would indicate."

Tony Silva of TRG The Realty Group said: "For me, it's no shock of what's happening. I told everybody and nobody would believe it. Prices are still going down. Look at the figures. The figures don't lie. It's going to come back, but people have to realize they're not going to get the prices they want for their house. Prices are going to be back where they were before this surge started in '04."

Las Vegas led the nation with consecutive quarters of 40 percent and 50 percent appreciation in 2004, then posted a 20 percent gain in 2005 before leveling off at 4 percent in 2006.

A big part of the downturn in 2007 prices can be attributed to foreclosures. Clark County has the top seven ZIP codes in the nation for foreclosed properties, led by 89031 in North Las Vegas with 741 total foreclosure filings, Irvine, Calif.-based RealtyTrac reports.

That number includes 368 default notices, 285 auction notices and 88 bank repossessions, or REOs.

Foreclosures accounted for 38 percent of all home sales in January, the Greater Las Vegas Association of Realtors reported.

"We continue to see the impact of short sales and bank-owned properties on our housing market," association President Patty Kelley said.

Murphy said it's the old "chicken or the egg" question as to whether foreclosures caused prices to drop or declining home values led to rising foreclosures. Home equity loans topped $1 trillion, according to the 2006 U.S. Census, more than double the amount in 2001.

"We don't have a mortgage crisis. We don't have an interest rate crisis. We have an equity crisis," Murphy said. "Why did people take money out of their home? Because they could. It's 2008 now and you know why people aren't taking money out of their home? Because they can't. That's why it's going to be rough sledding for 2008 and when we sit here a year from now, it ain't gonna be any prettier picture."

Some areas defied the odds. ZIP code 89109, with 178 sales in the second half of the year, showed 46 percent appreciation from $349,515 in 2006 to $510,000 in 2007. 89011, with 315 sales, was up 19 percent to $332,500. Both ZIP codes had boundary changes.

The Office of Federal Housing Enterprise Oversight reported 2.4 percent depreciation for Nevada home prices in the third quarter of 2007, the latest figures available from the Washington, D.C.-based agency.

Las Vegas-Paradise is ranked No. 241 of 287 metropolitan statistical areas in the office's home price index with a 2.51 percent drop for the year. For the past five years, Las Vegas is up 88.3 percent. Reno-Sparks is further down the list at No. 267 with a 6.23 percent one-year drop.

Andrew Leventis, the office's senior economist, said home prices "got ahead of themselves" in a significant part of the country, but not everywhere.

"Home price growth in your neck of the woods was far greater than income growth and interest rate declines would justify," Leventis said.

"Those mortgage rate declines were good for the housing market and drove demand and prices went up far more than were justified."

He said there are two types of states in the negative. Those that saw tremendous appreciation during the boom such as Nevada, Arizona, California and Florida are now giving some of it back. Others such as Michigan, Ohio and Indiana are seeing weakness as a result of economic sluggishness.

Declining home prices bring an upside. Francisco Jimenez was able to buy two condominiums for $105,000 and $111,000, well below the $185,000 median, at separate foreclosure auctions held in December at the Plaza and Lake Las Vegas.

He picked up a third condo at a Feb. 10 auction, paying $140,000 for a 1,200-square-foot unit with attached garage that previously sold for $243,000.

"This is like the stock market. Buy low and sell high," Jimenez said. "There is opportunity for lower-income people to buy, if they can't afford $250,000 for a home but they have a job and good credit. It's a good opportunity for anyone who has the money. I would buy another 10 if I had the money."

Jimenez has read about the 120,000 new jobs expected to be generated by Strip development over the next few years and believes home prices will be as high or higher by 2010 than they were in 2005 and 2006.

That's not going to happen until the market burns through an inventory of homes for sale that peaked at about 24,000 last year, roughly half of which are vacant.

"There's a tremendous amount of inventory overhang all over the country and Las Vegas is way up there," Leventis said.

Real estate appraiser and consultant Ronald James said it's getting tougher to make a true and accurate appraisal of homes in Las Vegas because "comparable" sales are outdated.

"I think you're going to find, with the larger inventory, you have a lack of sales, so that's one of the issues," he said. "You're going to end up using sales that are not recent. It certainly takes longer to make an appraisal. When there's an abundance of data, you have more tools to work with."

James said there's going to be depreciation when home builders are reducing prices and offering $50,000 in incentives. There are homes in new subdivisions, especially in the northwest, that cost less than what someone originally paid for the same home down the street a year or two ago, he said.

"The bottom line is you have to take more time for each job. Each subdivision is different. The more established subdivisions haven't had as much decline as the newer ones," James said.

Klif Andrews, vice president of development for Pardee Homes in Nevada, said builders discounted prices heavily in 2007, but it tailed off at the end of the year. Some of those price decreases may still show up because of delayed escrow closings, he said.

"I think new home prices will stabilize in 2008. Resales have got a ways to go," he said. "You can find new home prices lower than resales in some areas."

The issues facing mortgage lenders will have a huge impact on the housing market, Andrews said.

It's important that interest rates have come down and that FHA has raised loan limits with only 3 percent down payment, he said.

"That makes it easier for our buyers to borrow at better rates," he said.

Murphy said the only "home run" right now is Sun City Mesquite, which is "going like gangbusters."

Prices there are starting at $130 a square foot, about $50 less than Sun City Aliante in North Las Vegas.

"Del Webb has a reputation for knowing what they're doing," he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or (702) 383-0491.

Overall, the median price of an existing home in Las Vegas decreased 4.3 percent to $275,907 based on 23,956 sales in 2007, according to SalesTraq.